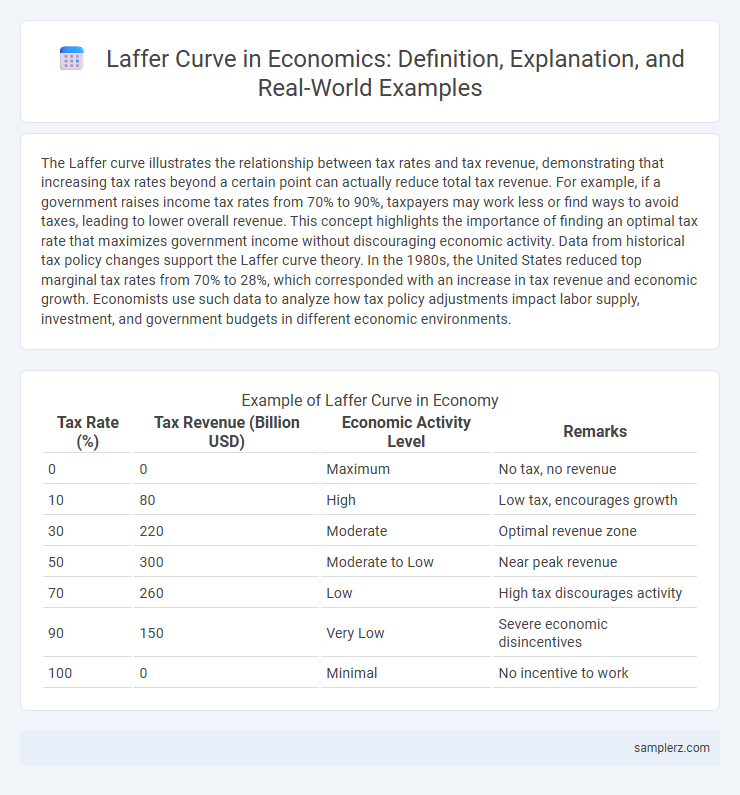

The Laffer curve illustrates the relationship between tax rates and tax revenue, demonstrating that increasing tax rates beyond a certain point can actually reduce total tax revenue. For example, if a government raises income tax rates from 70% to 90%, taxpayers may work less or find ways to avoid taxes, leading to lower overall revenue. This concept highlights the importance of finding an optimal tax rate that maximizes government income without discouraging economic activity. Data from historical tax policy changes support the Laffer curve theory. In the 1980s, the United States reduced top marginal tax rates from 70% to 28%, which corresponded with an increase in tax revenue and economic growth. Economists use such data to analyze how tax policy adjustments impact labor supply, investment, and government budgets in different economic environments.

Table of Comparison

| Tax Rate (%) | Tax Revenue (Billion USD) | Economic Activity Level | Remarks |

|---|---|---|---|

| 0 | 0 | Maximum | No tax, no revenue |

| 10 | 80 | High | Low tax, encourages growth |

| 30 | 220 | Moderate | Optimal revenue zone |

| 50 | 300 | Moderate to Low | Near peak revenue |

| 70 | 260 | Low | High tax discourages activity |

| 90 | 150 | Very Low | Severe economic disincentives |

| 100 | 0 | Minimal | No incentive to work |

Understanding the Laffer Curve: A Brief Overview

The Laffer Curve illustrates the relationship between tax rates and tax revenue, demonstrating that there is an optimal tax rate maximizing government revenue without discouraging economic activity. At low tax rates, increasing rates boosts revenue, but beyond a critical point, higher taxes reduce incentives to work or invest, causing total revenue to decline. This concept helps policymakers balance taxation and economic growth by avoiding excessive tax burdens that diminish overall fiscal income.

Historical Background of the Laffer Curve Theory

The Laffer Curve theory, popularized by economist Arthur Laffer in the 1970s, illustrates the relationship between tax rates and tax revenue, suggesting that increasing tax rates beyond a certain point can reduce total revenue. This concept gained prominence during the Reagan administration's tax reforms, influencing supply-side economics and fiscal policy debates. Historical data from the Great Depression and post-World War II tax cuts provide empirical contexts where variations in tax rates impacted government revenues in ways consistent with the Laffer Curve hypothesis.

Real-World Examples of the Laffer Curve in Action

The Laffer Curve is exemplified in real-world taxation policies such as the 1980s U.S. tax cuts under President Reagan, where reducing marginal tax rates aimed to stimulate economic growth and increase overall tax revenue. Similarly, countries like Ireland have implemented lower corporate tax rates to attract multinational investments, boosting employment and tax income. These instances demonstrate how adjusting tax rates in the upward-sloping region of the Laffer Curve can potentially enhance government revenue without discouraging productivity.

The Laffer Curve and Tax Revenue Optimization

The Laffer Curve illustrates the relationship between tax rates and tax revenue, showing that there is an optimal tax rate maximising government income without discouraging economic activity. At low tax rates, increasing rates can boost revenue, but beyond a certain threshold, higher taxes lead to reduced incentives to work and invest, causing tax revenue to decline. This concept guides fiscal policy by balancing tax burden and economic growth to optimise tax revenue collection.

Case Study: The Reagan Tax Cuts and the Laffer Curve

The Reagan tax cuts of the 1980s serve as a prominent example of the Laffer Curve in action, where reductions in marginal tax rates aimed to stimulate economic growth and increase overall tax revenue. By lowering the top income tax rate from 70% to 28%, the policy sought to enhance incentives for work, investment, and entrepreneurship, resulting in a period of strong GDP growth and job creation. Despite initial deficits, the tax cuts contributed to a long-term expansion of the tax base, illustrating the complex relationship between tax rates and government revenue predicted by the Laffer Curve.

International Applications: The Laffer Curve in Europe

The Laffer Curve illustrates the relationship between tax rates and tax revenue, showing how excessively high taxes may reduce government income by discouraging economic activity. In Europe, countries like Ireland and the United Kingdom applied Laffer Curve principles during the 1980s and 1990s, cutting top marginal tax rates to stimulate investment, labor participation, and overall economic growth. Empirical data from these regions demonstrate increased tax revenues and GDP growth following tax reforms aligned with Laffer Curve predictions, highlighting its relevance in international fiscal policy design.

The Laffer Curve and Economic Growth Relationships

The Laffer Curve illustrates the relationship between tax rates and tax revenue, showing that beyond a certain point, higher taxes can reduce incentives for work and investment, slowing economic growth. Empirical studies indicate that optimal tax rates maximize revenue without stifling economic activity, emphasizing the balance between taxation and growth. Policymakers use the Laffer Curve to design tax systems that encourage entrepreneurship and productivity while maintaining sufficient public revenue.

Criticisms and Limitations of the Laffer Curve Model

The Laffer Curve, illustrating the relationship between tax rates and tax revenue, faces significant criticisms including its oversimplification of complex economic behaviors and varying empirical support across different economies. Critics argue the model assumes a uniform tax elasticity that ignores factors such as tax evasion, economic growth rates, and income distribution effects. Its limitation in practical policy application stems from the difficulty in accurately identifying the optimal tax rate that maximizes revenue without harming economic productivity.

The Laffer Curve in Modern Fiscal Policy Debates

The Laffer Curve illustrates the relationship between tax rates and tax revenue, showing that beyond a certain tax rate, increasing taxes can lead to decreased revenue due to reduced economic activity. Modern fiscal policy debates often reference the Laffer Curve to argue for optimal tax rates that maximize government revenue without discouraging investment and work. Empirical studies indicate that the revenue-maximizing tax rate varies by economy but typically lies between 50% and 70%, influencing contemporary tax reform discussions.

Key Takeaways: Lessons from Laffer Curve Examples

The Laffer Curve illustrates the relationship between tax rates and tax revenue, demonstrating that beyond a certain tax rate, higher taxes can lead to decreased government revenue due to reduced economic activity. Key takeaways include the importance of identifying the optimal tax rate that maximizes revenue without discouraging work, investment, or entrepreneurship. Case studies, such as tax cuts in the 1980s U.S. and recent corporate tax adjustments, highlight how poorly calibrated tax rates can either stifle growth or leave potential revenue untapped.

example of Laffer curve in economy Infographic

samplerz.com

samplerz.com