Okun's law illustrates the inverse relationship between unemployment and economic growth, stating that for every 1% increase in the unemployment rate, a country's GDP decreases by approximately 2%. For example, if the unemployment rate rises from 5% to 6%, the GDP is expected to contract by around 2%, signaling reduced economic output. This empirical relationship helps policymakers estimate the output loss associated with changes in labor market conditions. In practical terms, during a recession, a rise in unemployment leads to diminished consumer spending, lowering aggregate demand and thus GDP. Data from the U.S. economy in the early 1980s demonstrates Okun's law, where a 1.5% increase in unemployment correlated with a 3% drop in GDP growth. Economists use this relationship to forecast economic performance and to design fiscal policies aimed at stabilizing employment and output levels.

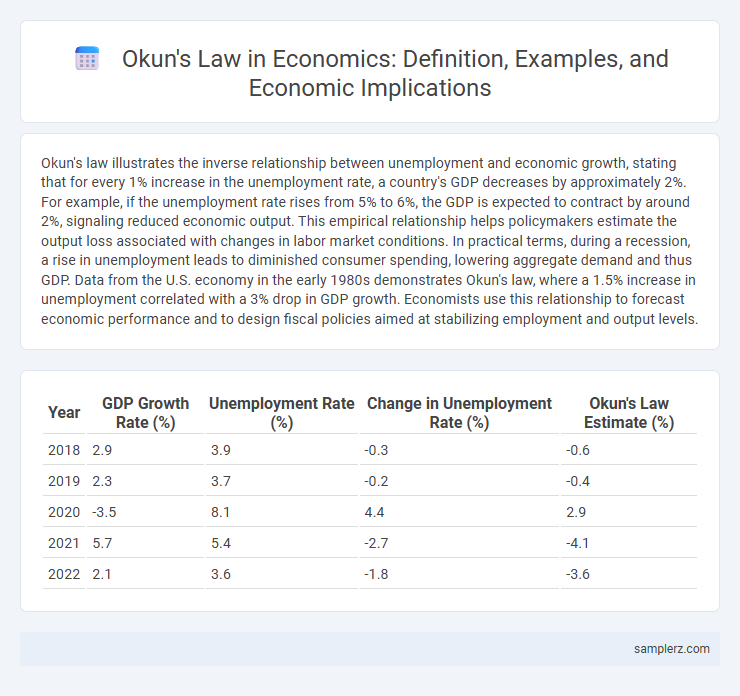

Table of Comparison

| Year | GDP Growth Rate (%) | Unemployment Rate (%) | Change in Unemployment Rate (%) | Okun's Law Estimate (%) |

|---|---|---|---|---|

| 2018 | 2.9 | 3.9 | -0.3 | -0.6 |

| 2019 | 2.3 | 3.7 | -0.2 | -0.4 |

| 2020 | -3.5 | 8.1 | 4.4 | 2.9 |

| 2021 | 5.7 | 5.4 | -2.7 | -4.1 |

| 2022 | 2.1 | 3.6 | -1.8 | -3.6 |

Understanding Okun’s Law: A Brief Overview

Okun's Law demonstrates the inverse relationship between unemployment rates and GDP growth, where a 1% decrease in unemployment typically results in a 2-3% increase in real GDP. This empirical rule helps economists predict economic performance during labor market fluctuations and guides policy decisions to stabilize growth. Understanding this correlation is crucial for analyzing how labor market dynamics influence macroeconomic output.

Historical Context: Origins of Okun’s Law

Okun's law, formulated by economist Arthur Okun in the early 1960s, established a quantitative relationship between unemployment rates and GDP growth, showing that a 1% decrease in unemployment typically correlates with a 2-3% increase in output. This empirical observation emerged from post-World War II economic data in the United States, reflecting how labor market dynamics directly influence economic performance. Okun's law remains a foundational concept in macroeconomic policy analysis, particularly in understanding the trade-offs between growth and employment.

Okun’s Law in Modern Economic Analysis

Okun's Law illustrates the inverse relationship between unemployment rates and GDP growth, where a 1% increase in unemployment typically corresponds to a 2% decrease in a country's gross domestic product. Modern economic analysis employs Okun's coefficient to quantify this effect, using real-time labor market data and GDP fluctuations to forecast economic cycles. Policymakers utilize Okun's Law to design fiscal and monetary strategies aimed at stabilizing employment and promoting sustainable economic growth.

Real-World Application: Okun’s Law in the United States

Okun's Law illustrates the inverse relationship between unemployment rate changes and GDP growth in the United States, showing that a 1% increase in unemployment typically corresponds to a 2% decrease in real GDP. During the 2008 financial crisis, US unemployment surged from 5% to 10%, correlating with a sharp GDP contraction of about 4.3%. Policymakers use Okun's Law to estimate economic output gaps and guide fiscal stimulus measures aimed at reducing unemployment and boosting growth.

Global Perspectives: Examples from Other Economies

Okun's law illustrates the inverse relationship between unemployment rates and GDP growth in various economies, such as the United States where a 1% increase in unemployment typically leads to a 2% decrease in GDP. In Japan, variations in Okun's coefficient reflect unique labor market rigidities, showing less sensitivity of GDP to unemployment changes. Emerging markets like Brazil demonstrate fluctuating Okun's law parameters due to informal employment sectors and economic volatility, highlighting global economic diversity in labor-output dynamics.

Interpreting GDP and Unemployment Data Through Okun’s Law

Okun's law quantifies the inverse relationship between unemployment rates and GDP growth, asserting that a 1% decrease in unemployment typically results in a 2% to 3% increase in real GDP. For example, if unemployment drops from 6% to 5%, GDP is expected to rise by approximately 2% to 3%, reflecting increased labor utilization and productivity. Economists use this correlation to interpret economic performance, assess labor market health, and forecast GDP changes based on unemployment trends.

Factors Influencing Okun’s Coefficient Variations

Okun's coefficient varies due to changes in labor productivity, labor force participation, and technological advancements, which impact the relationship between unemployment and GDP growth. Structural shifts in industries and variations in labor market flexibility also influence how strongly unemployment rates correlate with output changes. Economic policies, such as fiscal stimulus or wage regulations, can modify the sensitivity of output to unemployment fluctuations, causing Okun's coefficient to differ across countries and time periods.

Case Study: Okun’s Law During Economic Recessions

During the 2008 global financial crisis, Okun's Law demonstrated a clear relationship between rising unemployment and declining GDP, with every 1% increase in unemployment correlating to approximately a 2% decrease in output. Empirical data from the U.S. economy confirmed that as the unemployment rate surged from 5% to 10%, GDP contracted significantly, illustrating the practical implications of Okun's coefficient. This case study highlights the predictive power of Okun's Law in quantifying economic losses during recessions and informing fiscal policy responses.

Criticisms and Limitations of Okun’s Law Examples

Okun's Law, illustrating the inverse relationship between unemployment and GDP growth, faces criticisms for its variability across different economic contexts and periods. Empirical examples show the coefficient linking unemployment changes to GDP growth is not constant, undermining its predictive accuracy during structural shifts or recessions. Limitations include its assumption of a stable labor market and output gap, which often fails in times of technological change or labor force fluctuations.

Future Outlook: Relevance of Okun’s Law in a Changing Economy

Okun's Law remains a critical tool for forecasting economic performance by linking unemployment rates to GDP growth, even as technological advancements and automation reshape labor markets. Changes in workforce composition and productivity trends may alter the traditional parameters of Okun's coefficient, necessitating updated models for accurate economic predictions. Policymakers and economists leverage real-time data analytics to adapt Okun's framework, ensuring its continued relevance in dynamic economic environments.

example of Okun’s law in economy Infographic

samplerz.com

samplerz.com