Demand-pull inflation occurs when aggregate demand in an economy outpaces aggregate supply, leading to a general rise in prices. A common example is during a rapid economic expansion where consumer spending, business investments, and government expenditures increase simultaneously. This surge in demand causes shortages of goods and services, pushing prices upward as businesses respond to higher demand. Another example can be seen in booming housing markets, where increased consumer income and low-interest rates lead to greater demand for homes. The demand for housing exceeds supply, resulting in rising property prices and rental rates. Data from the U.S. Bureau of Labor Statistics often reflects such trends as demand-pull factors contribute to overall inflation rates.

Table of Comparison

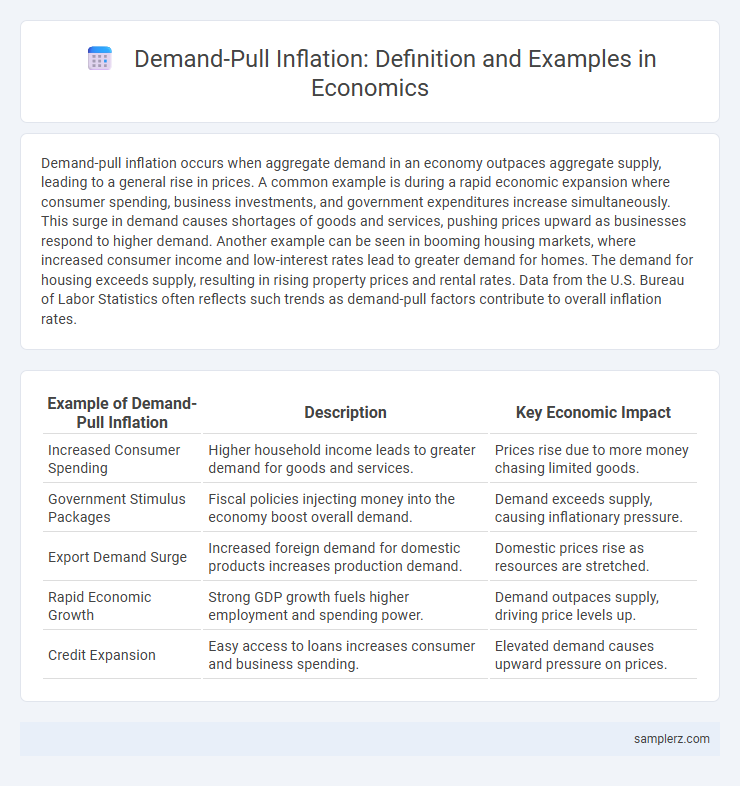

| Example of Demand-Pull Inflation | Description | Key Economic Impact |

|---|---|---|

| Increased Consumer Spending | Higher household income leads to greater demand for goods and services. | Prices rise due to more money chasing limited goods. |

| Government Stimulus Packages | Fiscal policies injecting money into the economy boost overall demand. | Demand exceeds supply, causing inflationary pressure. |

| Export Demand Surge | Increased foreign demand for domestic products increases production demand. | Domestic prices rise as resources are stretched. |

| Rapid Economic Growth | Strong GDP growth fuels higher employment and spending power. | Demand outpaces supply, driving price levels up. |

| Credit Expansion | Easy access to loans increases consumer and business spending. | Elevated demand causes upward pressure on prices. |

Understanding Demand-Pull Inflation: A Brief Overview

Demand-pull inflation occurs when aggregate demand in an economy exceeds aggregate supply, leading to upward pressure on prices. For example, a surge in consumer spending during economic growth periods can increase demand for goods and services beyond their available supply, causing prices to rise. This type of inflation highlights the relationship between strong demand, limited production capacity, and rising price levels in a growing economy.

Key Economic Sectors Impacted by Demand-Pull Inflation

Demand-pull inflation primarily impacts key economic sectors such as housing, consumer goods, and manufacturing, where increased consumer spending drives prices upward. In housing markets, rising demand for properties outpaces supply, leading to significant price hikes. Consumer goods and manufacturing sectors experience cost escalations due to higher production demand, resulting in broader inflationary pressures across the economy.

Classic Examples of Demand-Pull Inflation in History

Classic examples of demand-pull inflation include the post-World War II economic boom in the United States, where surging consumer demand outpaced supply, driving prices upward. The 1970s oil crisis also triggered demand-pull inflation as increased energy costs fueled widespread price increases amid robust demand. Rapid economic growth periods in emerging markets like China during the early 2000s exemplify how expanding consumer spending and investment can cause demand-pull inflation.

Consumer Demand and Its Role in Driving Inflation

Rising consumer demand for goods and services significantly contributes to demand-pull inflation by increasing overall spending beyond an economy's productive capacity. When consumers purchase more than businesses can supply, prices are pushed upward as companies respond to higher demand with limited inventory. This surge in consumer demand fuels inflationary pressures, emphasizing its critical role in accelerating price increases during economic expansions.

Government Spending as a Catalyst for Demand-Pull Inflation

Government spending on infrastructure projects increases aggregate demand by injecting capital directly into the economy, creating a surge in consumption and investment. This amplified demand outpaces supply capacity, leading to upward pressure on prices and triggering demand-pull inflation. Historical data from post-war stimulus programs consistently highlight government expenditure as a primary catalyst for inflationary pressures driven by demand.

Expansionary Monetary Policy and Demand-Pull Effects

Expansionary monetary policy increases money supply and lowers interest rates, boosting consumer and business spending, which raises aggregate demand. This heightened demand leads to demand-pull inflation as the economy's output nears full capacity, pushing prices upward. Key indicators include rising consumer expenditure, increased credit availability, and upward pressure on wages and raw material costs.

Housing Market Surges: A Model of Demand-Pull Inflation

Housing market surges illustrate demand-pull inflation when increased consumer demand for homes outpaces available supply, driving up prices rapidly. This imbalance between high demand and limited inventory pushes housing costs beyond typical growth rates, fueling inflationary pressures in the economy. Aggressive buyer competition and low-interest rates often exacerbate this effect, leading to sustained price inflation in the real estate sector.

Technology Booms and Inflationary Pressures

Technology booms often generate demand-pull inflation as rapid advancements increase consumer spending on innovative products and services, pushing aggregate demand beyond supply capacity. The surge in demand for cutting-edge technology components and skilled labor intensifies inflationary pressures within key sectors. This imbalance between soaring demand and limited supply triggers price increases, driving overall inflation rates upward during technology-driven economic expansions.

Globalization and Its Influence on Demand-Pull Inflation

Globalization intensifies demand-pull inflation by expanding consumer access to diverse goods and services, which increases aggregate demand across multiple economies. Enhanced global trade and interconnected supply chains boost income levels and consumption capacity, driving up demand faster than supply can adjust. This persistent imbalance amplifies price pressures, particularly in emerging markets integrated into the global economy.

Strategies to Mitigate Demand-Pull Inflation Effects

Implementing tight monetary policies, such as increasing interest rates, helps reduce consumer spending and curb demand-pull inflation. Governments can also use fiscal measures like cutting public expenditure or increasing taxes to decrease aggregate demand. Supply-side interventions, including boosting production capacity and improving supply chains, alleviate shortages that fuel demand-pull inflation.

example of demand-pull in inflation Infographic

samplerz.com

samplerz.com