The investment multiplier exemplifies how initial capital injection in an economy leads to a multiplied increase in overall economic output. For instance, when a government spends $1 million on infrastructure projects, the initial expenditure generates income for construction workers and suppliers. These recipients then spend their earnings on goods and services, stimulating further economic activity beyond the original investment amount. Data on the investment multiplier reveals that its magnitude depends on factors such as the marginal propensity to consume (MPC) and the existing economic environment. A high MPC means households spend most of their income, amplifying the multiplier effect. Economists use multipliers to predict the total impact of fiscal policies on gross domestic product (GDP) and employment levels, providing valuable insights for decision-making.

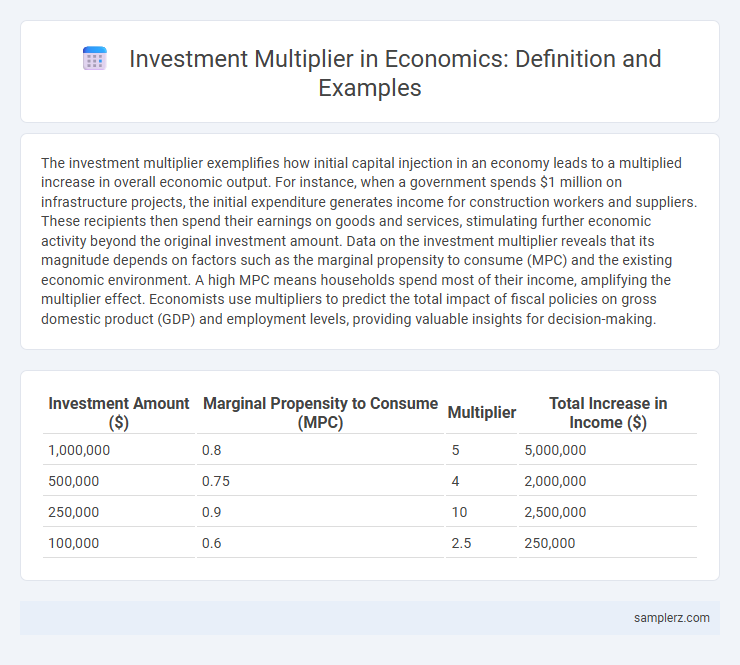

Table of Comparison

| Investment Amount ($) | Marginal Propensity to Consume (MPC) | Multiplier | Total Increase in Income ($) |

|---|---|---|---|

| 1,000,000 | 0.8 | 5 | 5,000,000 |

| 500,000 | 0.75 | 4 | 2,000,000 |

| 250,000 | 0.9 | 10 | 2,500,000 |

| 100,000 | 0.6 | 2.5 | 250,000 |

Understanding Investment Multipliers in Economics

Investment multipliers quantify the effect where an initial increase in investment triggers a larger overall increase in national income due to successive rounds of spending. For example, if the marginal propensity to consume (MPC) is 0.8, the investment multiplier is calculated as 1/(1-MPC), resulting in a multiplier of 5, meaning a $1 million investment can ultimately generate $5 million in total economic output. Understanding these multipliers helps policymakers evaluate the potential impact of fiscal stimulus on economic growth and employment.

The Concept of the Multiplier Effect in Investments

The multiplier effect in investments refers to the phenomenon where an initial injection of capital generates a more than proportional increase in overall economic output. For example, when a government invests $1 billion in infrastructure projects, it not only creates immediate jobs but also stimulates demand for materials, services, and consumer spending, potentially increasing total economic activity by $2 billion or more. This process illustrates how initial expenditures ripple through the economy, amplifying growth through increased income and consumption.

Real-World Examples of Investment Multipliers

When a government invests $1 billion in infrastructure projects, the real-world investment multiplier effect can boost economic output by up to $2.5 billion through job creation and increased consumer spending. In emerging markets, studies show that every dollar invested in renewable energy infrastructure generates approximately $1.5 to $3 in broader economic growth due to productivity improvements and new business opportunities. Historical data from the post-war United States reveals that investments in manufacturing facilities produced multipliers ranging from 1.7 to 2.2, significantly accelerating industrial development and income generation.

Case Study: Infrastructure Investment Multiplier

Infrastructure investment in transportation projects demonstrates a high multiplier effect, often generating $1.50 to $2.00 in economic output for every dollar spent due to increased productivity and job creation. Case studies in urban transit expansions show that the initial capital injection stimulates growth in related sectors such as construction, manufacturing, and services. This multiplier effect boosts GDP while enhancing long-term economic resilience through improved logistics and reduced operational costs.

The Role of Government Spending as an Investment Multiplier

Government spending acts as a powerful investment multiplier by injecting capital into infrastructure projects, which stimulates economic activity and generates multiple rounds of income for businesses and workers. For example, a $1 billion government investment in public transportation can result in increased demand for materials, labor, and services, leading to a total economic output exceeding the initial expenditure. This cyclical effect boosts GDP growth and employment rates, demonstrating the critical role of fiscal policy in economic expansion.

Private Sector Investments and Multiplier Impacts

Private sector investments significantly drive economic growth through multiplier effects by increasing aggregate demand, generating employment, and stimulating further business activities. For instance, a $1 million investment in manufacturing can create multiple rounds of spending, leading to an overall economic impact worth several million dollars. The multiplier impact varies by industry and region but commonly ranges between 1.5 to 3 times the initial investment, reflecting the ripple effect on supply chains and consumer consumption.

Multiplier Effect in Foreign Direct Investments (FDI)

Foreign Direct Investments (FDI) generate a significant multiplier effect by stimulating local economies through increased employment, infrastructure development, and technology transfer. For every dollar invested abroad, the host country often experiences multiple dollars in economic growth due to increased consumer spending and improved productivity. This cascading impact enhances GDP and fosters sustainable development in emerging markets.

Calculating the Investment Multiplier: Step-by-Step

The investment multiplier quantifies the effect of an initial capital injection on overall economic output, calculated by dividing the change in national income by the initial investment amount. To compute it, identify the marginal propensity to consume (MPC), then apply the formula: Multiplier = 1 / (1 - MPC). For instance, with an MPC of 0.8, the investment multiplier equals 5, indicating every dollar invested increases total income by five dollars.

Factors Influencing the Size of Investment Multipliers

Investment multipliers vary significantly based on factors such as the marginal propensity to consume (MPC), which determines how much of additional income is spent rather than saved. The openness of an economy influences the multiplier size, as higher import rates reduce domestic spending and weaken the multiplier effect. Fiscal policies, including taxation and government spending effectiveness, also play a critical role in amplifying or dampening the investment multiplier impact on economic growth.

Policy Implications of Investment Multipliers in Economic Growth

Investment multipliers significantly influence economic growth by amplifying the effects of initial capital expenditures on aggregate demand and employment levels. Policymakers can harness these multipliers by prioritizing public investments in infrastructure, education, and technology, which generate higher output returns and stimulate broader economic activity. Understanding sector-specific multiplier variations aids in designing targeted fiscal policies that maximize growth and promote sustainable development.

example of multiplier in investment Infographic

samplerz.com

samplerz.com