Rational inattention in economic choice occurs when individuals deliberately ignore some information due to cognitive constraints or costs associated with processing data. For example, consumers may overlook detailed price differences among brands when making purchasing decisions because the effort required to analyze every option exceeds the perceived benefit. This behavior highlights how limited attention impacts decision-making in markets, influencing demand patterns and pricing strategies. Firms also exhibit rational inattention by focusing on key economic indicators like gross domestic product (GDP) growth or inflation rates, while disregarding less impactful data. Investors often allocate resources based on headline financial news rather than exhaustive economic reports, optimizing their attention to maximize returns. This selective information processing shapes market dynamics and reflects the trade-off between the value of information and the cognitive effort needed to acquire it.

Table of Comparison

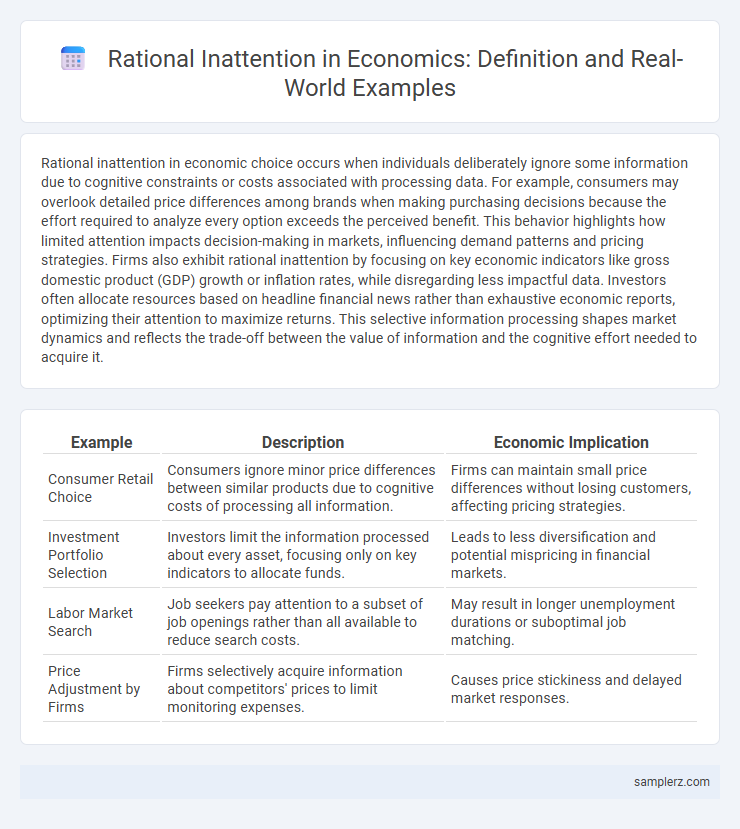

| Example | Description | Economic Implication |

|---|---|---|

| Consumer Retail Choice | Consumers ignore minor price differences between similar products due to cognitive costs of processing all information. | Firms can maintain small price differences without losing customers, affecting pricing strategies. |

| Investment Portfolio Selection | Investors limit the information processed about every asset, focusing only on key indicators to allocate funds. | Leads to less diversification and potential mispricing in financial markets. |

| Labor Market Search | Job seekers pay attention to a subset of job openings rather than all available to reduce search costs. | May result in longer unemployment durations or suboptimal job matching. |

| Price Adjustment by Firms | Firms selectively acquire information about competitors' prices to limit monitoring expenses. | Causes price stickiness and delayed market responses. |

Understanding Rational Inattention in Economic Decision-Making

Rational inattention in economic decision-making occurs when individuals selectively process information due to cognitive constraints and limited attention capacity. This phenomenon explains why consumers may overlook price changes or market signals, optimizing their choices based on a cost-benefit analysis of acquiring and processing information. Empirical studies show that rational inattention can lead to market inefficiencies, such as delayed reactions to policy shifts or suboptimal investment decisions.

Everyday Choices Shaped by Limited Attention

Consumers often exhibit rational inattention by prioritizing essential purchases like groceries or fuel over less urgent expenditures due to cognitive and time constraints. Limited attention leads individuals to simplify decision-making by focusing on key product attributes such as price or brand reputation while ignoring less salient information. This behavioral pattern reflects an optimization strategy where attention is allocated efficiently to maximize utility under information-processing costs.

Rational Inattention and Consumer Purchase Decisions

Rational inattention occurs when consumers deliberately limit the information they process due to cognitive costs, influencing their purchase decisions by focusing only on the most relevant product attributes. This selective attention leads to simplified decision-making heuristics, such as favoring well-known brands or ignoring minor price differences. Understanding rational inattention helps explain consumer behavior patterns, especially in markets with abundant product information and varying levels of complexity.

Investment Choices Under Information Overload

Investors exhibit rational inattention by selectively processing relevant financial data to optimize portfolio returns despite overwhelming market information. By allocating limited cognitive resources to critical indicators like interest rates and earnings reports, investors avoid costly decision errors caused by information overload. This strategic focus enhances investment performance while minimizing the cognitive burden associated with exhaustive data analysis.

Rational Inattention in Labor Market Participation

Rational inattention in labor market participation occurs when workers allocate limited cognitive resources to processing only the most relevant job information, leading to delayed or suboptimal employment decisions. Empirical studies show that individuals may ignore minor wage changes or job offers due to the high cost of acquiring and processing detailed labor market data. This behavior influences unemployment rates and labor supply elasticity by creating informational frictions that slow adjustment to new economic conditions.

Policy Responses to Attention Constraints in Economics

Policy responses to attention constraints in economics include simplifying tax codes to reduce cognitive load and implementing default options in retirement savings plans to guide decision-making. Behavioral nudges are designed to capture limited attention by highlighting critical information at decision points, improving economic outcomes. Empirical studies demonstrate that these interventions effectively mitigate the impact of rational inattention on consumer and investor choices.

Digital Platforms: Rational Inattention in Online Shopping

Consumers exhibit rational inattention on digital platforms by selectively focusing on a limited number of product attributes, such as price, ratings, or delivery time, to minimize cognitive overload during online shopping. This behavior results in suboptimal choices when important product details are overlooked due to limited attention capacity. E-commerce algorithms exploit rational inattention by simplifying information presentation, guiding user decisions toward promoted products or higher-margin items.

Behavioral Implications of Rational Inattention

Rational inattention explains consumer behavior by highlighting how individuals selectively allocate their limited attention when processing economic information, often ignoring subtle price changes to reduce cognitive costs. This selective focus leads to suboptimal decision-making patterns such as delayed responses to market signals or under-reacting to new data, impacting demand elasticity and market efficiency. Behavioral implications include increased market volatility and persistent price stickiness, as consumers prioritize salient information over comprehensive analysis.

Financial Choices: Balancing Risks with Limited Information

Investors often exhibit rational inattention by allocating their attention selectively among numerous financial options to balance risks without being overwhelmed by information overload. This behavior leads to focusing on major market indicators or key assets rather than exhaustive data, optimizing decision-making efficiency under cognitive constraints. Limited processing capacity compels financial agents to ignore certain details, which can influence portfolio diversification and risk management strategies.

Rational Inattention and Pricing Strategies in Markets

Rational inattention in pricing strategies arises when firms allocate limited cognitive resources to process market information, leading to suboptimal price adjustments despite fluctuating demand or cost conditions. This behavior often results in price stickiness, where firms maintain stable prices to avoid the costs associated with acquiring and analyzing detailed market data. Empirical studies in retail and financial markets demonstrate that bounded rationality and information-processing constraints significantly influence dynamic pricing decisions and market equilibrium outcomes.

example of rational inattention in choice Infographic

samplerz.com

samplerz.com