Velocity of money supply measures how quickly money circulates within an economy over a specific period, indicating economic activity levels. For example, if the money supply in a country is $1 trillion and the total value of transactions is $5 trillion within a year, the velocity of money is 5. This high velocity suggests that each unit of currency is used frequently to purchase goods and services, reflecting a dynamic and active economy. Central banks closely monitor the velocity of money to understand spending habits and the effectiveness of monetary policy. A decline in velocity often signals reduced consumer and business spending, potentially leading to slower economic growth or recession. Changes in velocity impact inflation rates, influencing decisions on interest rates and money supply adjustments.

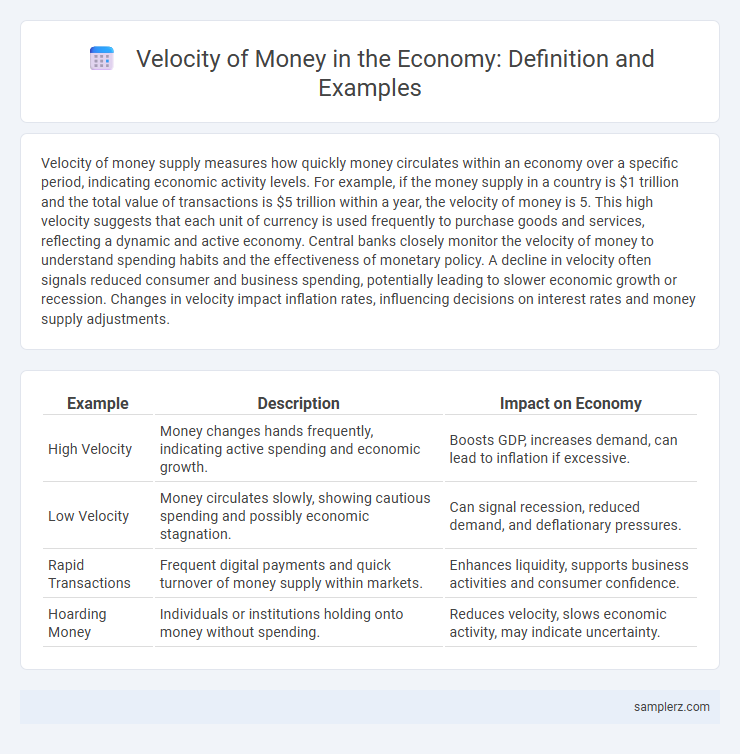

Table of Comparison

| Example | Description | Impact on Economy |

|---|---|---|

| High Velocity | Money changes hands frequently, indicating active spending and economic growth. | Boosts GDP, increases demand, can lead to inflation if excessive. |

| Low Velocity | Money circulates slowly, showing cautious spending and possibly economic stagnation. | Can signal recession, reduced demand, and deflationary pressures. |

| Rapid Transactions | Frequent digital payments and quick turnover of money supply within markets. | Enhances liquidity, supports business activities and consumer confidence. |

| Hoarding Money | Individuals or institutions holding onto money without spending. | Reduces velocity, slows economic activity, may indicate uncertainty. |

Understanding the Velocity of Money: A Key Economic Indicator

The velocity of money measures how quickly currency circulates within an economy, calculated by dividing nominal GDP by the money supply. A higher velocity indicates rapid spending and robust economic activity, while a lower velocity suggests slower transactions and potential economic stagnation. Tracking this indicator helps economists assess consumer confidence, inflationary pressures, and overall financial health.

Real-World Examples of Money Velocity in Action

In Japan during the 1990s, stagnant economic growth and deflation caused the velocity of money to decline sharply, demonstrating how low consumer spending and investment reduce the frequency of money circulation. Conversely, during the 2008 U.S. financial crisis, the velocity of money dropped as households and businesses increased savings to mitigate uncertainty, slowing overall economic activity despite increased monetary supply. Emerging markets like India have shown higher money velocity rates due to rapid economic growth and rising consumer demand, reflecting more active circulation of money in real transactions.

How Increased Money Velocity Stimulates Economic Growth

Increased money velocity accelerates the circulation of money within the economy, enhancing transactional efficiency and boosting aggregate demand. This rapid turnover of currency facilitates higher consumption and investment, leading to increased production and job creation. Empirical studies show that economies with elevated money velocity often experience accelerated GDP growth due to amplified spending and investment activities.

The Impact of Low Money Velocity on Recessionary Trends

Low money velocity, indicating slower circulation of money in the economy, exacerbates recessionary trends by reducing consumer spending and business investment. During periods of low velocity, even an increased money supply may fail to stimulate economic growth, as funds remain idle rather than fueling demand. This stagnation contributes to prolonged economic downturns and challenges monetary policy effectiveness.

Historical Case Studies: Velocity Changes During Financial Crises

During the 2008 financial crisis, the velocity of money sharply declined as consumers and businesses hoarded cash amid uncertainty, reducing spending and slowing economic activity. Historical data from the Great Depression also shows a significant drop in velocity, reflecting a loss of confidence in financial institutions and credit markets. These cases illustrate how financial crises cause velocity to fluctuate, impacting monetary policy effectiveness and economic recovery.

Digital Payments and Their Effect on Money Velocity

Digital payments significantly increase the velocity of money by enabling faster and more frequent transactions compared to traditional cash methods. Mobile wallets, contactless cards, and online banking reduce friction in the payment process, accelerating the circulation of funds within the economy. This rapid turnover enhances economic activity by improving liquidity and supporting real-time financial flows.

Central Bank Policies and the Movement of Money Supply

Central bank policies directly influence the velocity of money by adjusting interest rates and reserve requirements, which affect how quickly money circulates in the economy. When central banks implement quantitative easing, the increased money supply can initially reduce velocity as excess liquidity accumulates in banks rather than being spent. Conversely, tightening policies incentivize spending and investment, accelerating the turnover rate of money and stimulating economic activity.

Measuring the Velocity of Money: Tools and Challenges

Measuring the velocity of money involves calculating the ratio of nominal GDP to the money supply, typically using M1 or M2 aggregates. Tools such as the equation of exchange (MV=PY) help quantify how frequently money circulates within an economy, but challenges arise due to transaction variations, digital payments, and differing velocity across sectors. Accurate measurement is essential for policymakers to assess inflationary pressures and economic growth, yet data limitations and changing payment technologies complicate velocity's precise calculation.

The Relationship Between Inflation and Money Velocity

The velocity of money measures how quickly currency circulates within an economy, directly influencing inflation rates as faster money turnover tends to increase demand and push prices upward. In periods of rising inflation, velocity often accelerates because consumers and businesses spend money more rapidly to avoid future price increases. Central banks monitor this relationship closely to design policies that stabilize inflation by managing the money supply and its velocity.

Future Trends: Predicting Changes in Money Velocity

Emerging technologies like blockchain and digital currencies are poised to accelerate money velocity by enabling faster and more transparent transactions. Central banks' increasing adoption of real-time payment systems also contributes to a higher turnover rate of money supply. Predictive models incorporating AI suggest that these innovations will sustain elevated velocity levels, influencing inflation and economic growth dynamics.

example of velocity in money supply Infographic

samplerz.com

samplerz.com