Zimbabwe experienced one of the most extreme cases of hyperinflation in history during the late 2000s. At its peak in November 2008, Zimbabwe's inflation rate reached an estimated 79.6 billion percent month-on-month, devastating the economy and rendering the currency virtually worthless. The Reserve Bank of Zimbabwe resorted to issuing trillion-dollar notes, a stark indicator of the severity of the economic crisis. Venezuela also suffered from hyperinflation starting in 2016, driven by economic mismanagement and falling oil prices. Inflation rates soared beyond 1,000,000% by 2018, severely shrinking the purchasing power of the Venezuelan bolivar and causing widespread shortages of basic goods. The government introduced new currencies and implemented price controls, but these efforts failed to stabilize the economy or restore confidence in the financial system.

Table of Comparison

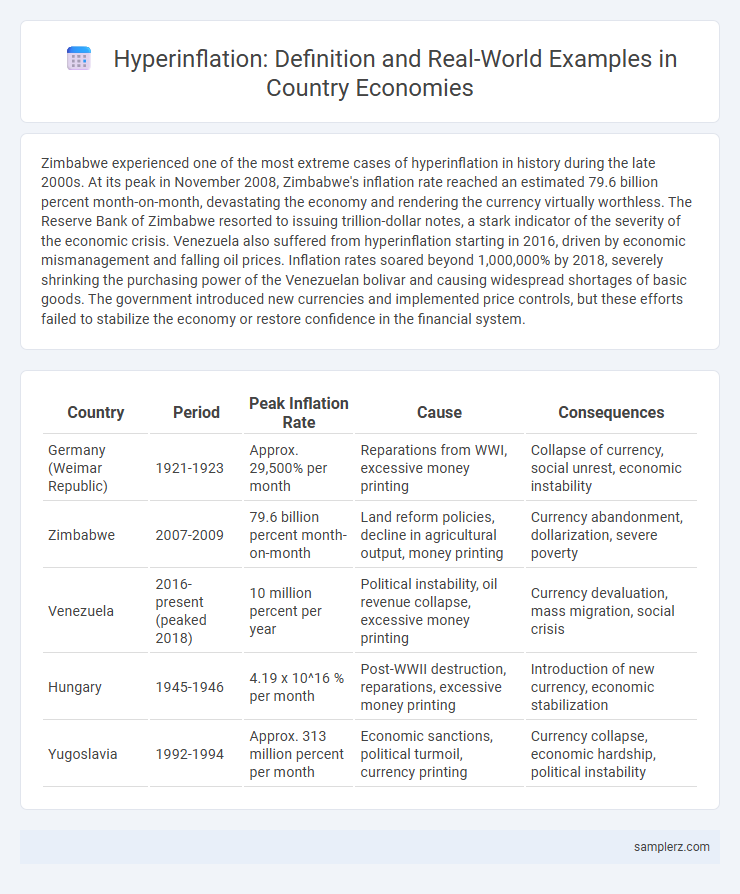

| Country | Period | Peak Inflation Rate | Cause | Consequences |

|---|---|---|---|---|

| Germany (Weimar Republic) | 1921-1923 | Approx. 29,500% per month | Reparations from WWI, excessive money printing | Collapse of currency, social unrest, economic instability |

| Zimbabwe | 2007-2009 | 79.6 billion percent month-on-month | Land reform policies, decline in agricultural output, money printing | Currency abandonment, dollarization, severe poverty |

| Venezuela | 2016-present (peaked 2018) | 10 million percent per year | Political instability, oil revenue collapse, excessive money printing | Currency devaluation, mass migration, social crisis |

| Hungary | 1945-1946 | 4.19 x 10^16 % per month | Post-WWII destruction, reparations, excessive money printing | Introduction of new currency, economic stabilization |

| Yugoslavia | 1992-1994 | Approx. 313 million percent per month | Economic sanctions, political turmoil, currency printing | Currency collapse, economic hardship, political instability |

Zimbabwe’s Hyperinflation Crisis: Lessons Learned

Zimbabwe experienced one of the most severe cases of hyperinflation in history during the late 2000s, with inflation rates reaching an astronomical 79.6 billion percent month-on-month in November 2008. This crisis stemmed from excessive money printing, loss of confidence in the Zimbabwean dollar, and economic mismanagement, leading to a collapse in both the currency and the broader economy. The resulting lessons emphasize the critical need for sound fiscal policies, monetary discipline, and credible central banking to prevent such economic catastrophes.

The Weimar Republic: Rise and Fall of the German Mark

The Weimar Republic experienced one of history's most severe hyperinflations between 1921 and 1923, with the German Mark losing almost all its value due to excessive printing to pay war reparations. At its peak, prices doubled every few days, making basic goods unaffordable and savings worthless, devastating the middle class and destabilizing the economy. This hyperinflation dramatically contributed to social unrest and paved the way for political changes in Germany.

Venezuela’s Recent Hyperinflation: Causes and Effects

Venezuela experienced one of the most severe cases of hyperinflation in recent history, with inflation rates exceeding 1,000,000% annually at its peak in 2018. Key causes include excessive money printing by the central bank, drastic drops in oil revenue, and economic mismanagement leading to a collapse in public confidence. The hyperinflation resulted in severe shortages of basic goods, plummeting real wages, increased poverty rates, and mass migration, deeply impacting the country's socioeconomic stability.

Hungary 1946: The World’s Worst Hyperinflation

Hungary experienced the world's worst hyperinflation in 1946, with prices doubling every 15 hours and the monthly inflation rate reaching an astronomical 41.9 quadrillion percent. The government issued the pengo currency, which rapidly lost value, forcing the introduction of the adopengo as a temporary measure before replacing it with the forint in August 1946. This hyperinflation severely disrupted Hungary's economy, wiping out savings and destabilizing financial institutions during the post-World War II recovery period.

Yugoslavia in the 1990s: A Case Study of Monetary Collapse

Yugoslavia experienced hyperinflation between 1992 and 1994, with monthly inflation rates reaching an unprecedented 313 million percent in January 1994. The collapse of the Yugoslav economy was driven by political instability, war, and the breakdown of central monetary policy, leading to the devaluation of the Yugoslav dinar. This monetary collapse devastated savings, disrupted trade, and necessitated currency reforms to stabilize the economy.

Greece’s Wartime Inflation: Economic Instability During WWII

Greece experienced severe hyperinflation during World War II, with prices skyrocketing due to occupation costs and the collapse of industrial output. The inflation rate reached unprecedented levels, peaking at several million percent annually, devastating savings and crippling the national economy. This wartime economic instability triggered currency devaluation and long-term financial challenges that hindered post-war recovery.

Nicaragua in the 1980s: Spiraling Prices and Economic Turbulence

Nicaragua experienced severe hyperinflation during the 1980s, with annual inflation rates soaring above 30,000%, driven by political instability and economic mismanagement. The rapid devaluation of the Cordoba caused widespread shortages of basic goods, eroding purchasing power and deepening poverty. This economic turbulence disrupted trade, investment, and social services, leaving long-lasting impacts on Nicaragua's financial system and overall development.

Argentina’s Hyperinflation Episode of the Late 1980s

Argentina's hyperinflation in the late 1980s saw inflation rates soaring beyond 3,000% annually, devastating the economy and eroding purchasing power. The crisis stemmed from excessive money printing, fiscal deficits, and loss of confidence in the currency, leading to rapid price increases and severe economic instability. Government intervention, including currency reforms and stabilization plans, eventually curbed hyperinflation but left lasting impacts on Argentina's financial system and public trust.

Peru’s Lost Decade: Hyperinflation and Economic Reform

Peru experienced hyperinflation during the late 1980s, with rates reaching over 7,000% in 1990, devastating the economy and causing widespread poverty. The crisis was driven by excessive public spending, devaluation of currency, and political instability under the Alan Garcia administration. Economic reforms initiated in the early 1990s, including fiscal discipline, currency stabilization, and structural adjustments, successfully curbed inflation and restored growth.

Lessons from Global Hyperinflation: Warning Signs and Prevention

Zimbabwe's hyperinflation peaked at an estimated 79.6 billion percent month-on-month in November 2008, highlighting the catastrophic impact of unchecked money printing and fiscal mismanagement on economic stability. Key warning signs included spiraling government debt, loss of confidence in the local currency, and massive supply chain disruptions. Effective prevention requires establishing credible monetary policies, maintaining fiscal discipline, and fostering transparent governance to restore trust and stabilize prices.

example of hyperinflation in country Infographic

samplerz.com

samplerz.com