A Pigovian tax on carbon emissions is a government-imposed fee designed to reduce negative externalities caused by greenhouse gas output. This tax directly targets entities like factories, power plants, and vehicles that emit carbon dioxide, incentivizing them to lower their emissions. By internalizing the social cost of carbon, the tax encourages investment in cleaner technologies and renewable energy sources. Data shows that countries implementing carbon Pigovian taxes have experienced measurable declines in emissions over time. For example, Sweden's carbon tax, introduced in 1991, has contributed to a 26% drop in carbon emissions since its inception. This fiscal policy aligns economic activities with environmental costs, promoting sustainable economic growth while addressing climate change challenges.

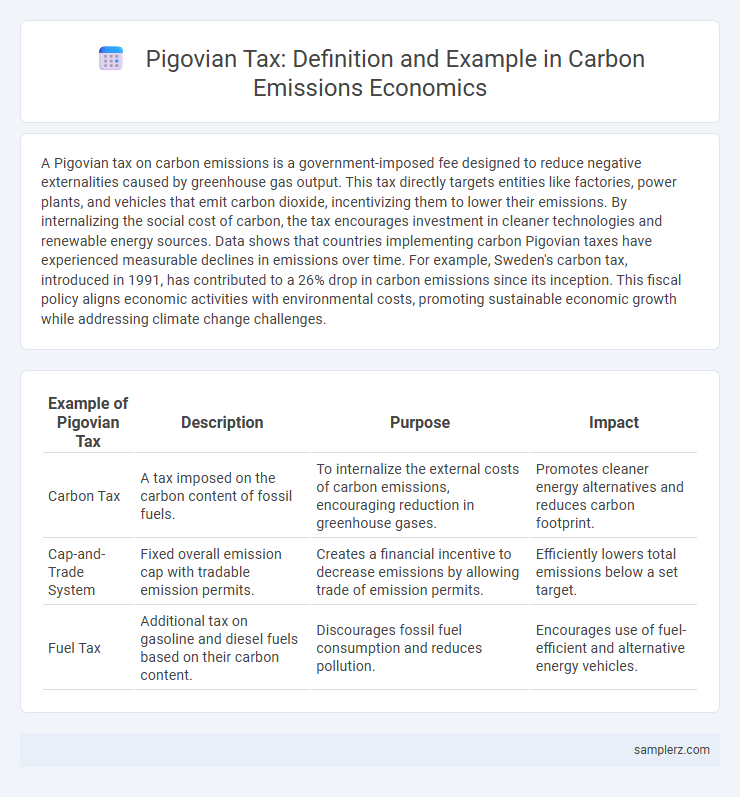

Table of Comparison

| Example of Pigovian Tax | Description | Purpose | Impact |

|---|---|---|---|

| Carbon Tax | A tax imposed on the carbon content of fossil fuels. | To internalize the external costs of carbon emissions, encouraging reduction in greenhouse gases. | Promotes cleaner energy alternatives and reduces carbon footprint. |

| Cap-and-Trade System | Fixed overall emission cap with tradable emission permits. | Creates a financial incentive to decrease emissions by allowing trade of emission permits. | Efficiently lowers total emissions below a set target. |

| Fuel Tax | Additional tax on gasoline and diesel fuels based on their carbon content. | Discourages fossil fuel consumption and reduces pollution. | Encourages use of fuel-efficient and alternative energy vehicles. |

Introduction to Pigovian Taxes in Carbon Emission Control

Pigovian taxes, designed to correct negative externalities, are applied to carbon emissions to internalize the social costs of pollution. By imposing a cost on each ton of carbon dioxide emitted, governments incentivize firms and consumers to reduce their carbon footprint. This market-based approach aligns economic incentives with environmental goals, promoting cleaner energy and sustainable practices.

Overview of Carbon Emission Challenges

Carbon emissions contribute significantly to global warming and air pollution, creating urgent environmental and economic challenges. Pigovian taxes on carbon emissions aim to internalize the external costs of pollution by imposing financial charges proportional to the emissions produced. This economic approach incentivizes businesses and consumers to reduce their carbon footprint, promoting cleaner technologies and sustainable practices.

Theory Behind Pigovian Taxes for Environmental Protection

Pigovian taxes on carbon emissions are designed to internalize the external costs associated with pollution, aligning private costs with social costs to reduce environmental harm. By imposing a fee per ton of CO2 emitted, these taxes create financial incentives for businesses and individuals to decrease their carbon footprint and invest in cleaner technologies. The theory behind Pigovian taxes emphasizes correcting market failures by pricing negative externalities, which leads to more efficient allocation of resources and promotes sustainable economic growth.

Real-World Examples of Carbon Pigovian Taxes

Sweden's carbon tax, implemented in 1991, exemplifies a successful Pigovian tax by charging approximately $137 per ton of CO2 emissions, significantly reducing fossil fuel consumption. British Columbia's carbon tax, set at CAD 50 per ton of CO2, has contributed to a measurable decline in greenhouse gas emissions while maintaining strong economic growth. Norway's carbon tax integrates emissions from various sectors, including petroleum, effectively incentivizing cleaner energy practices and supporting national climate goals.

Sweden’s Carbon Tax: A Global Model

Sweden's Carbon Tax, implemented in 1991, serves as a leading example of a Pigovian tax aimed at reducing carbon emissions by incentivizing cleaner energy use and discouraging fossil fuel consumption. The tax, initially set at approximately 250 SEK per ton of CO2, has progressively increased to over 1,200 SEK per ton, contributing to a 25% reduction in national emissions since its inception. This model demonstrates how a well-designed carbon tax can effectively align economic behavior with environmental goals while maintaining economic growth.

British Columbia’s Revenue-Neutral Carbon Tax

British Columbia's Revenue-Neutral Carbon Tax exemplifies a Pigovian tax designed to reduce carbon emissions by directly pricing the environmental externality. Implemented in 2008, the tax imposes a fee on fossil fuel consumption while returning all revenues to residents through reductions in personal income and corporate taxes, maintaining overall tax neutrality. This approach incentivizes low-carbon choices, driving measurable declines in provincial greenhouse gas emissions without increasing the net tax burden.

France’s Carbon Tax Policy and Outcomes

France's carbon tax, implemented as part of its commitment to reduce greenhouse gas emissions, imposes a fee on fossil fuel consumption based on carbon content, effectively internalizing the external costs of pollution. This Pigovian tax has led to measurable declines in carbon emissions from the energy and transportation sectors, while encouraging investment in renewable energy and energy efficiency technologies. Revenue generated from the tax supports climate adaptation programs and social equity measures, mitigating economic impacts on lower-income households.

Effects of Pigovian Taxes on Business and Consumer Behavior

Pigovian taxes on carbon emissions incentivize businesses to adopt cleaner technologies and reduce pollution by internalizing the social cost of carbon. These taxes increase production costs for carbon-intensive goods, prompting consumers to shift toward environmentally friendly alternatives, thus altering demand patterns. Over time, this leads to a market-driven reduction in carbon emissions as both producers and consumers respond to price signals favoring sustainability.

Economic Benefits and Drawbacks of Carbon Pigovian Taxes

Carbon Pigovian taxes internalize the negative externalities of carbon emissions by imposing a cost per ton of CO2, incentivizing firms to reduce pollution and fund renewable energy projects. These taxes enhance economic efficiency by correcting market failures, leading to improved public health and lower climate change-related damages, which translate into long-term cost savings. However, potential drawbacks include increased production costs, regressive impacts on low-income households, and risks of reduced international competitiveness without coordinated global policies.

Lessons Learned from International Pigovian Tax Implementation

International Pigovian tax implementation on carbon emissions reveals critical lessons in balancing economic growth with environmental sustainability. Countries like Sweden and British Columbia demonstrate that setting a clear price on carbon encourages innovation and reduces emissions without hindering competitiveness. Effective design features include revenue recycling for social equity and transparent regulatory frameworks, highlighting the importance of policy predictability in market behavior.

example of Pigovian tax in carbon emission Infographic

samplerz.com

samplerz.com