The Triffin dilemma arises when a country's currency serves as the global reserve currency, creating a conflict between domestic economic policy and international monetary stability. For instance, the U.S. dollar, as the primary reserve currency, must supply enough liquidity to meet global demand, leading to persistent trade deficits and increasing foreign debt. This imbalance can undermine confidence in the currency's value, affecting global economic stability. A classic example occurred during the Bretton Woods system, where the U.S. faced pressure to provide dollars to support global trade while maintaining gold convertibility. The resulting trade deficits eroded gold reserves and eventually led to the abandonment of the gold standard in 1971. The Triffin dilemma highlights the inherent tension in managing domestic currency supply while fulfilling international reserve currency roles.

Table of Comparison

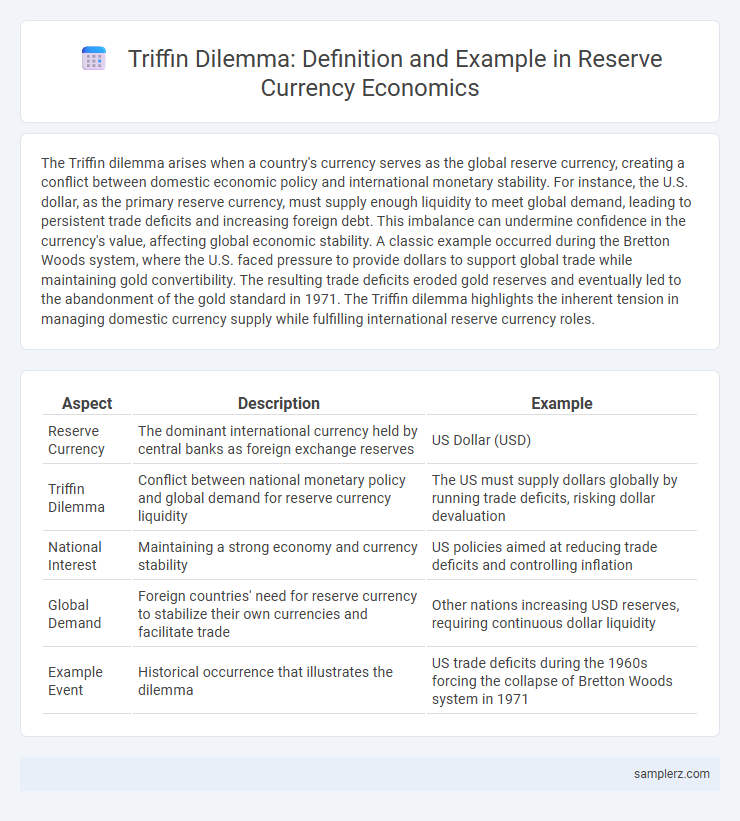

| Aspect | Description | Example |

|---|---|---|

| Reserve Currency | The dominant international currency held by central banks as foreign exchange reserves | US Dollar (USD) |

| Triffin Dilemma | Conflict between national monetary policy and global demand for reserve currency liquidity | The US must supply dollars globally by running trade deficits, risking dollar devaluation |

| National Interest | Maintaining a strong economy and currency stability | US policies aimed at reducing trade deficits and controlling inflation |

| Global Demand | Foreign countries' need for reserve currency to stabilize their own currencies and facilitate trade | Other nations increasing USD reserves, requiring continuous dollar liquidity |

| Example Event | Historical occurrence that illustrates the dilemma | US trade deficits during the 1960s forcing the collapse of Bretton Woods system in 1971 |

Introduction to the Triffin Dilemma in Reserve Currencies

The Triffin Dilemma highlights the conflict faced by countries issuing reserve currencies, where expanding domestic liquidity to meet global demand leads to balance of payments deficits and undermines confidence in the currency. The U.S. dollar, as the primary global reserve currency, exemplifies this paradox by requiring continuous current account deficits to supply the world with dollar liquidity while risking long-term currency stability. This inherent tension challenges the sustainability of reserve currencies and influences international monetary policies.

Historical Background: Bretton Woods and the U.S. Dollar

The Triffin dilemma emerged from the Bretton Woods system established in 1944, where the U.S. dollar was pegged to gold and other currencies were fixed to the dollar, positioning the dollar as the global reserve currency. This system required the United States to supply dollars to the world, creating a conflict between domestic monetary policy and international demand for liquidity. The dilemma highlighted the inherent instability of relying on the U.S. dollar as the primary reserve currency, as persistent balance of payments deficits were needed to provide liquidity, eventually undermining confidence in the dollar's convertibility to gold.

How the Triffin Dilemma Manifests in Global Trade

The Triffin Dilemma manifests in global trade as countries relying on a reserve currency face increasing trade imbalances due to the issuing country's need to supply liquidity by running persistent deficits. This tension creates vulnerabilities, as the reserve currency issuer accumulates external debt while other nations depend on its currency for trade settlements and reserve assets. Consequently, the global financial system experiences instability, with fluctuations in currency value impacting international trade flows and economic growth worldwide.

Case Study: The U.S. Dollar’s Reserve Currency Role

The U.S. dollar's role as the world's primary reserve currency exemplifies the Triffin dilemma, as the United States must supply dollars to meet global demand, causing persistent trade deficits and increasing foreign liabilities. This dynamic challenges the sustainability of dollar dominance, given the tension between domestic economic policy objectives and international liquidity needs. The resulting imbalances highlight vulnerabilities in the global financial system reliant on a single national currency.

Impact of the Triffin Dilemma on Emerging Markets

The Triffin dilemma creates a conflict between domestic economic policy and global liquidity needs, leading to currency reserves imbalances that disproportionately affect emerging markets. These economies face increased volatility and vulnerability to external shocks as they rely heavily on the US dollar for trade and financial stability. Consequently, emerging markets often experience capital flow fluctuations, inflationary pressures, and constrained monetary policy autonomy due to the dominant role of the reserve currency.

The Euro as an Alternative Reserve Currency Example

The Euro presents a compelling alternative to the US dollar amid the Triffin dilemma, where the dominant reserve currency's country must balance domestic economic policy with global liquidity needs. Unlike the dollar, the Eurozone's shared fiscal responsibilities and diverse economic base reduce reliance on a single nation's debt issuance, mitigating the risks associated with persistent current account deficits. This diversification strengthens the Euro's position as a viable reserve currency, promoting stability in international financial markets.

Global Imbalances and the Triffin Dilemma

The Triffin dilemma highlights the inherent conflict between national interests and global economic stability when a country's currency serves as the dominant reserve currency, leading to persistent global imbalances. The United States, as the issuer of the primary global reserve currency--the U.S. dollar--faces pressure to run chronic current account deficits to supply liquidity, while these deficits undermine confidence in the currency's long-term value. This dynamic contributes to structural imbalances in international trade and capital flows, complicating efforts to maintain both domestic economic priorities and a stable international monetary system.

Policy Responses to the Triffin Dilemma

Policymakers addressing the Triffin dilemma in reserve currency systems often pursue strategies such as diversifying reserve assets to reduce dependency on a single currency and implementing coordinated international monetary policies to stabilize global liquidity. Central banks may also enhance swap lines and engage in multilateral agreements to manage liquidity shortages without exacerbating current account imbalances. These policy responses aim to balance the need for liquidity provision with the sustainability of reserve currency status while mitigating systemic risks in the global economy.

Lessons from Past and Present Reserve Currencies

The Triffin dilemma illustrates the inherent conflict between national interests and global monetary stability faced by reserve currencies like the US dollar and the British pound in the 20th century. Historical cases reveal that issuing a reserve currency requires balancing external demand for liquidity with maintaining domestic economic confidence, as overextension undermines currency value and global trust. Lessons from the British pound's decline and the ongoing challenges with the US dollar highlight the importance of diversifying reserve assets and implementing robust international monetary cooperation.

Future Outlook: Reforming the International Monetary System

The Triffin dilemma, exemplified by the U.S. dollar's role as the primary reserve currency, highlights inherent conflicts between national monetary policy and global liquidity demands. Future reform efforts emphasize diversifying reserve assets and enhancing multilateral coordination to reduce systemic risks and improve stability. Proposals include integrating digital currencies and strengthening institutions like the IMF to create a more resilient international monetary system.

example of Triffin dilemma in reserve currency Infographic

samplerz.com

samplerz.com