Ricardian equivalence is a concept in fiscal policy suggesting that government borrowing does not affect overall demand because individuals anticipate future taxes to repay the debt. An example occurs when a government funds a stimulus package through borrowing rather than immediate taxation. Consumers, expecting higher taxes later, save the extra disposable income instead of increasing consumption, neutralizing the intended stimulative effect. This concept hinges on the assumption that households are forward-looking and have perfect access to credit markets. For instance, if a government reduces taxes today by issuing debt, rational consumers increase their savings to pay for anticipated future tax increases. Empirical studies often analyze saving rates, consumption patterns, and fiscal deficits to assess the validity of Ricardian equivalence in specific economies.

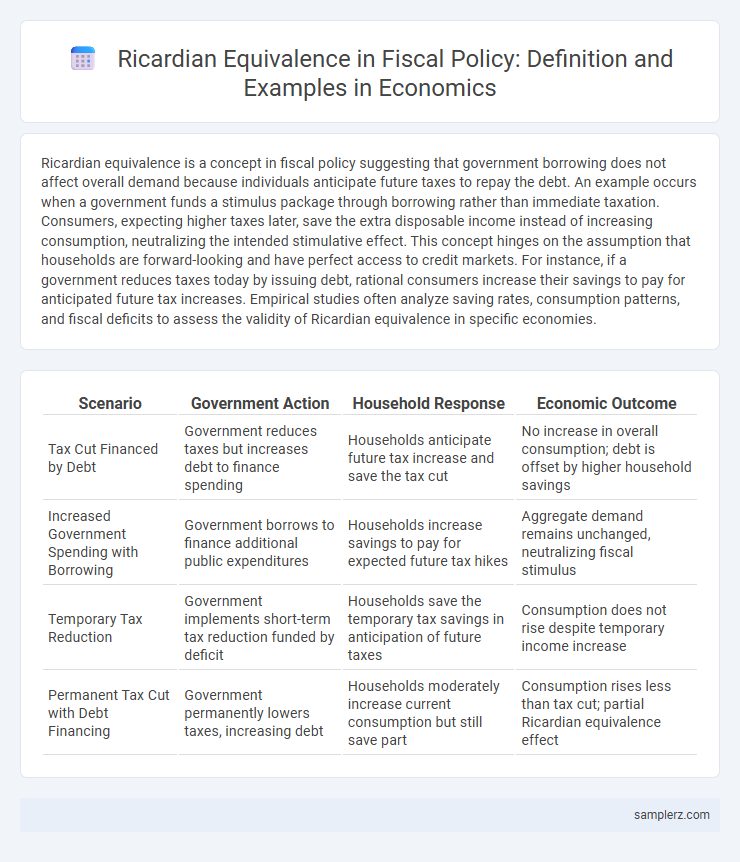

Table of Comparison

| Scenario | Government Action | Household Response | Economic Outcome |

|---|---|---|---|

| Tax Cut Financed by Debt | Government reduces taxes but increases debt to finance spending | Households anticipate future tax increase and save the tax cut | No increase in overall consumption; debt is offset by higher household savings |

| Increased Government Spending with Borrowing | Government borrows to finance additional public expenditures | Households increase savings to pay for expected future tax hikes | Aggregate demand remains unchanged, neutralizing fiscal stimulus |

| Temporary Tax Reduction | Government implements short-term tax reduction funded by deficit | Households save the temporary tax savings in anticipation of future taxes | Consumption does not rise despite temporary income increase |

| Permanent Tax Cut with Debt Financing | Government permanently lowers taxes, increasing debt | Households moderately increase current consumption but still save part | Consumption rises less than tax cut; partial Ricardian equivalence effect |

Understanding Ricardian Equivalence in Fiscal Policy

Ricardian equivalence posits that consumers anticipate future tax liabilities resulting from government debt, leading them to increase savings rather than spend additional disposable income from fiscal stimulus. For example, when a government implements a tax cut financed by borrowing, rational households offset this by saving more to pay for expected future taxes, neutralizing the policy's impact on aggregate demand. This theory challenges the effectiveness of deficit-financed fiscal expansion by highlighting the relationship between government borrowing, consumer expectations, and private savings behavior.

Real-World Examples of Ricardian Equivalence

Ricardian equivalence suggests that when a government finances spending through debt rather than immediate taxation, households anticipate future taxes and increase savings accordingly. A real-world example occurred during the U.S. tax cuts in the early 2000s, where despite increased government borrowing, consumer spending did not rise significantly as households adjusted savings expectations. Similarly, Japan's prolonged fiscal stimulus showed limited impact on consumption growth, reflecting Ricardian equivalence dynamics as citizens foresaw future tax burdens.

Ricardian Equivalence: Government Spending and Private Savings

Ricardian equivalence suggests that when a government increases spending financed by debt, individuals anticipate future tax increases and therefore increase their private savings to offset the expected tax burden. Empirical examples include the U.S. tax cuts of the early 2000s, where households reportedly saved a significant portion of their tax rebates instead of increasing consumption. This behavioral response challenges the effectiveness of deficit-financed fiscal stimulus in boosting aggregate demand.

Case Study: Tax Cuts and Household Saving Behavior

Ricardian equivalence suggests that when governments implement tax cuts, households anticipate future tax increases to pay off government debt, leading them to increase savings and offset the intended stimulative effects of fiscal policy. Empirical evidence from the 2001 U.S. tax cuts reveals that many households did not significantly increase consumption, instead boosting savings rates to prepare for expected future liabilities. This case study highlights the importance of considering forward-looking consumer behavior in designing effective fiscal policies.

Empirical Evidence Supporting Ricardian Equivalence

Empirical evidence supporting Ricardian equivalence includes studies analyzing long-term government bond issuances and their limited impact on consumer spending, indicating that households anticipate future taxes and adjust saving behavior accordingly. Research on U.S. fiscal policy during the 1980s shows that increased government deficits did not significantly boost aggregate demand, consistent with Ricardian predictions. Cross-country analyses also reveal that countries with higher public debt levels often exhibit stable private saving rates, reinforcing the theory's applicability in diverse economic contexts.

Fiscal Stimulus and the Ricardian Response

Fiscal stimulus initiatives, such as direct government spending or tax cuts, aim to boost aggregate demand by increasing disposable income and consumption. According to the Ricardian equivalence theory, rational consumers anticipate future tax liabilities resulting from increased government debt and therefore save the additional income instead of spending it. This Ricardian response can diminish the effectiveness of fiscal stimulus, as the intended rise in consumption is offset by higher private savings.

Ricardian Equivalence in Developed versus Emerging Economies

Ricardian equivalence suggests that government borrowing today leads individuals to increase savings, anticipating future tax hikes to repay debt, which can neutralize fiscal policy effects. In developed economies, high financial literacy and access to credit markets make Ricardian equivalence more pronounced, reducing the stimulative impact of deficit spending. Emerging economies often exhibit weaker Ricardian responses due to credit constraints, lower savings rates, and greater uncertainty, enabling fiscal policy to have a more significant short-term effect on aggregate demand.

Limitations and Criticisms of Ricardian Equivalence

Ricardian equivalence suggests that government borrowing does not affect overall demand because individuals anticipate future taxes and save accordingly, but empirical evidence reveals significant limitations in this theory. Households often face liquidity constraints and myopia, preventing them from fully adjusting their savings in response to government deficits. Furthermore, the assumption of perfect capital markets and rational expectations is criticized as unrealistic, limiting the practical applicability of Ricardian equivalence in fiscal policy analysis.

Policy Implications of Ricardian Equivalence in Modern Economies

Ricardian equivalence suggests that consumers anticipate future taxes resulting from government borrowing, leading them to increase savings and offset fiscal stimulus effects. This theory implies that deficit-financed tax cuts or government spending may have limited impact on aggregate demand in modern economies. Policymakers must consider that fiscal expansions might not boost economic growth as expected if individuals fully internalize government budget constraints.

Ricardian Equivalence during Economic Crises

During economic crises, Ricardian equivalence suggests that government attempts to stimulate demand through deficit spending may not increase overall consumption because households anticipate future tax increases to repay debt, leading them to increase savings instead. Empirical studies during the 2008 financial crisis show mixed evidence, with some households fully internalizing future liabilities while others do not, affecting the effectiveness of fiscal multipliers. The theory highlights the importance of consumer expectations and intertemporal budget constraints in shaping the impact of fiscal policy in recessionary environments.

example of Ricardian equivalence in fiscal policy Infographic

samplerz.com

samplerz.com