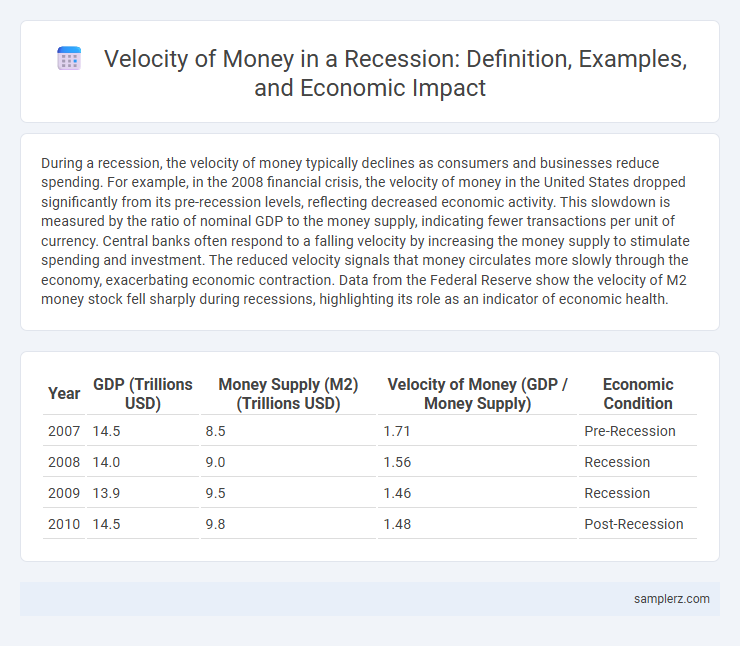

During a recession, the velocity of money typically declines as consumers and businesses reduce spending. For example, in the 2008 financial crisis, the velocity of money in the United States dropped significantly from its pre-recession levels, reflecting decreased economic activity. This slowdown is measured by the ratio of nominal GDP to the money supply, indicating fewer transactions per unit of currency. Central banks often respond to a falling velocity by increasing the money supply to stimulate spending and investment. The reduced velocity signals that money circulates more slowly through the economy, exacerbating economic contraction. Data from the Federal Reserve show the velocity of M2 money stock fell sharply during recessions, highlighting its role as an indicator of economic health.

Table of Comparison

| Year | GDP (Trillions USD) | Money Supply (M2) (Trillions USD) | Velocity of Money (GDP / Money Supply) | Economic Condition |

|---|---|---|---|---|

| 2007 | 14.5 | 8.5 | 1.71 | Pre-Recession |

| 2008 | 14.0 | 9.0 | 1.56 | Recession |

| 2009 | 13.9 | 9.5 | 1.46 | Recession |

| 2010 | 14.5 | 9.8 | 1.48 | Post-Recession |

Understanding the Velocity of Money During a Recession

During a recession, the velocity of money typically declines as consumers and businesses reduce spending and increase savings, leading to slower economic activity. For example, in the 2008 financial crisis, the velocity of money in the U.S. dropped sharply as uncertainty caused a drop in consumption and investment. Monitoring changes in the velocity of money helps economists understand shifts in demand and the effectiveness of monetary policy during economic downturns.

Real-World Examples of Money Velocity Declining in Downturns

During the 2008 financial crisis, the velocity of money in the United States sharply declined as consumers and businesses hoarded cash amid economic uncertainty. In Japan's "Lost Decade" of the 1990s, persistent deflation and stagnant demand led to a prolonged drop in money velocity, exacerbating the recessionary environment. Eurozone countries experienced a similar fall in money velocity during the COVID-19 pandemic, reflecting reduced spending and investment despite expansive monetary policies.

How Consumer Spending Impacts Money Circulation in Recession

During a recession, consumer spending typically declines significantly, causing a slowdown in the velocity of money as households prioritize saving over spending. Reduced consumer expenditures on goods and services lead to decreased business revenues, which in turn limits wages and investment, further stalling economic activity. The contraction in money circulation creates a feedback loop that suppresses overall demand, making economic recovery more challenging.

The Role of Banks in Slowing Money Velocity

During a recession, banks often tighten lending standards, which significantly reduces the velocity of money by limiting the flow of credit to consumers and businesses. Restricted bank lending diminishes spending and investment activities, causing money to circulate more slowly within the economy. As a result, the slowdown in credit availability plays a crucial role in decreasing money velocity and exacerbating economic contraction.

Case Study: Velocity of Money in the 2008 Global Financial Crisis

During the 2008 Global Financial Crisis, the velocity of money in the United States sharply declined as consumer spending and business investments contracted amidst widespread financial uncertainty. Federal Reserve data indicates that the velocity of M2 money stock dropped from approximately 1.8 in early 2008 to below 1.5 by 2009, reflecting reduced circulation of currency in the economy. This contraction in the velocity of money exacerbated economic stagnation and delayed recovery by limiting monetary policy effectiveness.

Government Stimulus and Its Effect on Money Flow in Recessions

Government stimulus during recessions increases the velocity of money by injecting funds directly into the economy, encouraging consumer spending and business investment. Enhanced liquidity from fiscal measures reduces hoarding and accelerates circulation, mitigating the recession's depth. Empirical data shows that stimulus checks and relief programs significantly boost transaction volumes, revitalizing economic activity despite prevailing downturn conditions.

Business Investment and Money Velocity in Economic Slumps

During economic slumps, the velocity of money typically declines as businesses reduce investment due to uncertainty and decreased demand. Business investment contracts sharply, leading to slower circulation of money within the economy, which further exacerbates recessionary pressures. This drop in money velocity highlights the critical role of business confidence in maintaining economic momentum during downturns.

Comparing Money Velocity in Different Recessions

During the 2008 financial crisis, the velocity of money dropped sharply as consumer spending and business investments contracted, reflecting decreased economic activity. In contrast, the 2020 COVID-19 recession saw a temporary spike in money velocity due to stimulus payments and increased digital transactions, before declining as lockdowns extended. Comparing these recessions highlights how changes in consumer behavior and monetary policy uniquely influence the circulation speed of money in economic downturns.

Central Bank Policies and the Stagnation of Money Movement

During a recession, the velocity of money typically declines as consumers and businesses hold onto cash rather than spending, leading to stagnation in economic activity. Central bank policies such as lowering interest rates and implementing quantitative easing aim to increase liquidity and encourage lending, but these measures may have limited impact if confidence remains low. The resulting slow movement of money exacerbates economic contraction and challenges efforts to stimulate growth.

Visualizing the Drop in Money Velocity with Economic Indicators

During a recession, the velocity of money sharply declines, as consumers and businesses reduce spending and increase savings amid economic uncertainty. Visualizing this drop often involves correlating velocity data with indicators such as rising unemployment rates and decreasing consumer confidence indexes. Graphs depicting the inverse relationship between velocity and these economic indicators provide clear insights into the slowdown of economic activity.

example of velocity of money in recession Infographic

samplerz.com

samplerz.com