Carry trade in the currency market involves borrowing funds in a currency with a low interest rate and investing them in a currency with a higher interest rate to profit from the interest rate differential. For example, investors might borrow Japanese yen, which typically has low interest rates, and convert it into Australian dollars, where interest rates are higher. This strategy can generate significant returns when exchange rates remain stable or move favorably, but it carries risks if the low-interest currency appreciates sharply. A well-documented instance of carry trade occurred during the early 2000s when the US dollar was weaker compared to currencies like the New Zealand dollar or the Australian dollar. Investors borrowed in US dollars at relatively low rates and invested in these higher-yielding currencies to earn the spread. The global financial environment, including interest rate policies from central banks like the Federal Reserve and the Reserve Bank of Australia, heavily influenced the profitability and risks of such trades.

Table of Comparison

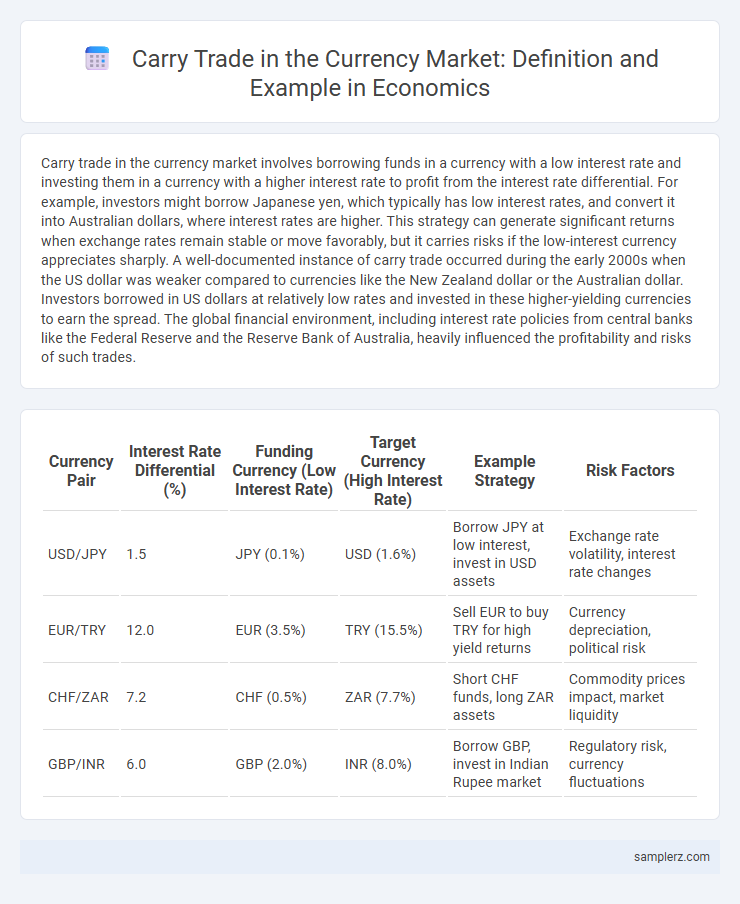

| Currency Pair | Interest Rate Differential (%) | Funding Currency (Low Interest Rate) | Target Currency (High Interest Rate) | Example Strategy | Risk Factors |

|---|---|---|---|---|---|

| USD/JPY | 1.5 | JPY (0.1%) | USD (1.6%) | Borrow JPY at low interest, invest in USD assets | Exchange rate volatility, interest rate changes |

| EUR/TRY | 12.0 | EUR (3.5%) | TRY (15.5%) | Sell EUR to buy TRY for high yield returns | Currency depreciation, political risk |

| CHF/ZAR | 7.2 | CHF (0.5%) | ZAR (7.7%) | Short CHF funds, long ZAR assets | Commodity prices impact, market liquidity |

| GBP/INR | 6.0 | GBP (2.0%) | INR (8.0%) | Borrow GBP, invest in Indian Rupee market | Regulatory risk, currency fluctuations |

Overview of Carry Trade in the Currency Market

The carry trade in the currency market involves borrowing funds in a currency with a low interest rate and investing them in a currency with a higher interest rate to capitalize on the interest rate differential. Prominent examples include borrowing Japanese yen, known for its historically low rates, and investing in currencies like the Australian dollar or New Zealand dollar, which offer higher yields. This strategy can generate substantial returns during stable economic conditions but carries risks tied to currency volatility and interest rate shifts.

Classic Example: Yen Carry Trade Explained

The classic example of the yen carry trade involves borrowing low-interest Japanese yen to invest in higher-yielding currencies such as the Australian dollar or New Zealand dollar. Traders profit from the interest rate differential, capitalizing on Japan's near-zero interest rates while earning higher returns abroad. This strategy becomes especially attractive during periods of stable exchange rates and low volatility in the currency markets.

Case Study: AUD/JPY Carry Trade Dynamics

The AUD/JPY carry trade exemplifies the strategy where investors borrow in low-yield Japanese yen and invest in high-yield Australian dollars to capture interest rate differentials. This trade is particularly influenced by the Reserve Bank of Australia's interest rate policies and Japan's near-zero rates, creating a favorable environment for yield-seeking investors. Currency fluctuations and risk sentiment shifts, such as during market volatility, can significantly impact the profitability of the AUD/JPY carry trade.

Historical Carry Trade Booms and Busts

Historical carry trade booms and busts in the currency market often involve borrowing in low-interest-rate currencies like the Japanese yen and investing in high-yield currencies such as the Australian dollar. The Asian Financial Crisis of 1997 and the Global Financial Crisis of 2008 exemplify the sudden reversals when carry trade unwinds cause sharp currency depreciations and increased volatility. Central banks' interest rate policies and geopolitical events frequently trigger these volatile shifts, highlighting the risks inherent in carry trade strategies.

Emerging Market Currencies in Carry Trades

Emerging market currencies such as the Indonesian rupiah and the South African rand are often popular choices for carry trade strategies due to their relatively high interest rates compared to developed market currencies like the US dollar or Japanese yen. Investors borrow in low-yielding currencies and invest in assets denominated in higher-yielding emerging market currencies to capitalize on interest rate differentials and potential currency appreciation. However, carry trades involving emerging market currencies carry risks from exchange rate volatility and sudden shifts in global risk sentiment.

Interest Rate Differentials: Key Currency Pairs

The carry trade in the currency market exploits interest rate differentials between key currency pairs such as the Australian dollar (AUD) versus the Japanese yen (JPY) and the New Zealand dollar (NZD) against the Swiss franc (CHF). Investors borrow in low-yielding currencies like the JPY or CHF and invest in higher-yielding ones like the AUD or NZD to earn the interest rate spread. This strategy is highly sensitive to shifts in central bank policies by the Reserve Bank of Australia, Bank of Japan, and Swiss National Bank, which directly influence currency valuations.

Risks and Rewards in Currency Carry Trades

Currency carry trades involve borrowing in low-interest rate currencies like the Japanese yen and investing in higher-yielding currencies such as the Australian dollar, aiming to profit from the interest rate differential. Key risks include exchange rate volatility, which can erase gains if the funding currency appreciates sharply, and sudden shifts in global risk sentiment that trigger rapid unwinding of positions. Despite these risks, carry trades can offer substantial rewards through steady interest income and capital appreciation when market conditions remain favorable and central bank policies stay divergent.

Real-Life Hedge Fund Carry Trade Strategies

Real-life hedge fund carry trade strategies often involve borrowing funds in low-interest-rate currencies such as the Japanese yen and investing in higher-yield currencies like the Australian dollar or Brazilian real to capture the interest rate differential. These strategies capitalize on stable or appreciating target currencies to generate returns while managing risks through dynamic hedging and stop-loss mechanisms. Key examples include large funds exploiting divergences in central bank policies across G10 and emerging market currencies to enhance portfolio yield and diversify risk exposure.

Central Bank Policies Impacting Carry Trades

Central bank policies, such as interest rate differentials set by the Federal Reserve and the Bank of Japan, play a pivotal role in shaping carry trade dynamics by influencing borrowing costs and currency valuations. When the Fed raises rates while the Bank of Japan maintains low or negative interest rates, investors often borrow in yen to invest in higher-yielding dollar assets, amplifying carry trade activity. Changes in monetary policy signals from these central banks directly affect risk appetite and capital flows, thereby impacting the profitability and sustainability of carry trades in the global currency market.

Global Financial Crisis and Carry Trade Examples

During the Global Financial Crisis, investors engaged in carry trade by borrowing low-yielding Japanese yen to invest in high-yielding currencies such as the Australian dollar and the Brazilian real, seeking higher returns amid market volatility. This strategy amplified currency fluctuations, as rapid unwinding of carry trades led to sharp depreciation of emerging market currencies and heightened global financial instability. The crisis highlighted the risk inherent in carry trades, where sudden shifts in risk appetite cause significant losses and impact global currency markets.

example of carry trade in currency market Infographic

samplerz.com

samplerz.com