A holdup problem in contract arises when one party exploits its bargaining position after specific investments are made by the other party. For example, a supplier may invest in specialized machinery to produce custom parts for an automaker. Once the investment is sunk, the automaker might renegotiate contract terms to pay less, knowing the supplier cannot easily switch to another client. This problem leads to inefficiencies in economic transactions and discourages parties from making relationship-specific investments. Firms facing holdup risks often demand higher returns or avoid contracts requiring substantial upfront capital. Contracts in industries like manufacturing, technology development, and infrastructure frequently experience holdup challenges due to the need for specialized assets.

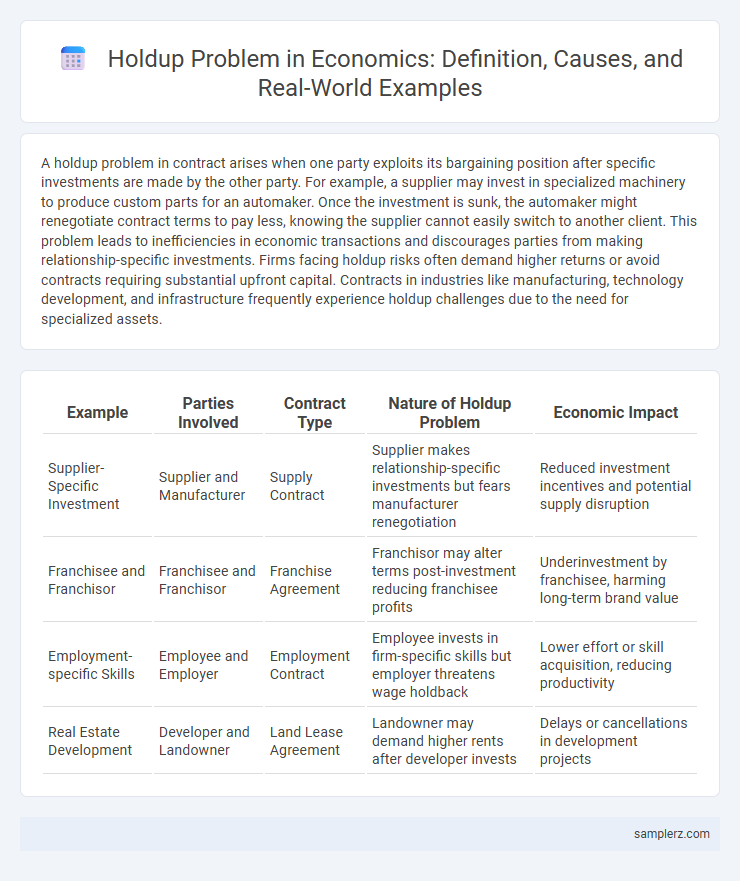

Table of Comparison

| Example | Parties Involved | Contract Type | Nature of Holdup Problem | Economic Impact |

|---|---|---|---|---|

| Supplier-Specific Investment | Supplier and Manufacturer | Supply Contract | Supplier makes relationship-specific investments but fears manufacturer renegotiation | Reduced investment incentives and potential supply disruption |

| Franchisee and Franchisor | Franchisee and Franchisor | Franchise Agreement | Franchisor may alter terms post-investment reducing franchisee profits | Underinvestment by franchisee, harming long-term brand value |

| Employment-specific Skills | Employee and Employer | Employment Contract | Employee invests in firm-specific skills but employer threatens wage holdback | Lower effort or skill acquisition, reducing productivity |

| Real Estate Development | Developer and Landowner | Land Lease Agreement | Landowner may demand higher rents after developer invests | Delays or cancellations in development projects |

Understanding the Holdup Problem in Economic Contracts

The holdup problem in economic contracts occurs when one party exploits transaction-specific investments made by the other party, leading to underinvestment and inefficiency. For example, a supplier may invest in specialized equipment tailored for a buyer's unique product, but the buyer can then renegotiate terms or delay payments, capturing most of the value created. Recognizing this risk, contracts often include safeguards like long-term agreements or renegotiation clauses to mitigate opportunistic behavior and ensure mutual cooperation.

Classic Examples of Holdup in Supply Chain Agreements

In supply chain agreements, a classic example of the holdup problem occurs when a supplier makes specific investments in customized equipment or processes tailored to a buyer's needs, allowing the buyer to renegotiate terms or demand price reductions post-investment. This opportunistic behavior exploits the supplier's sunk costs, creating inefficiencies and potential underinvestment in critical components. Such contractual vulnerabilities highlight the importance of designing agreements that mitigate the risk of asset-specific hold-ups through mechanisms like long-term contracts or credible commitment devices.

Holdup Scenarios in Joint Venture Contracts

In joint venture contracts, holdup problems often arise when one party exploits specific contractual dependencies to renegotiate terms after initial investments are made, causing inefficiencies and increased transaction costs. For example, a partner may withhold critical technology or resources, leveraging the other party's sunk costs to extract higher returns. Such scenarios undermine cooperative investments and necessitate carefully drafted contracts with clear dispute resolution mechanisms and safeguard clauses.

Real-World Holdup Case Studies in Business Negotiations

In business negotiations, the holdup problem often arises when one party makes relationship-specific investments and the other exploits this dependency to renegotiate contract terms. A notable example is the Boeing and Spirit AeroSystems case, where Spirit's heavy investment in producing fuselage sections led to renegotiation pressures after Boeing's order reductions. This case highlights the risk of asset-specific investments becoming leverage points, causing inefficiencies and distrust in long-term contracts.

Impact of Asset Specificity on Holdup Risks

Asset specificity significantly increases holdup risks by making investments highly tailored and non-transferable, which limits a party's bargaining power post-contract. For example, in supplier-manufacturer relationships where specialized machinery is required, the supplier may exploit the dependency by demanding higher prices after initial investments are sunk. This vulnerability often leads to inefficient renegotiations and underinvestment, undermining supply chain stability and overall economic efficiency.

Labor Contracts and the Employer-Employee Holdup Problem

Labor contracts often face the holdup problem when employers underinvest in employee training due to fear that workers may leverage specialized skills to demand higher wages. This misalignment results in inefficient investment in human capital and reduced productivity. Addressing this requires designing contracts with explicit provisions to balance risks and incentives between employers and employees.

Holdup Issues in Intellectual Property and Licensing Agreements

Holdup problems in intellectual property and licensing agreements occur when one party exploits the specific investments made by another, demanding renegotiation or additional compensation after the contract is signed. For example, a licensor may refuse to commercialize a patented technology without increased royalties, leveraging their control over the intellectual property to extract greater rents. These holdups can deter investment in innovation and complicate negotiations in technology transfer and collaborative R&D projects.

Strategies to Mitigate Holdup in Long-Term Contracts

To mitigate holdup problems in long-term contracts, parties often implement detailed contract clauses that specify performance standards and dispute resolution mechanisms. Investing in relationship-specific assets can be coupled with fostering trust and open communication channels to reduce opportunistic behavior. Employing renegotiation protocols and third-party enforcement further ensures commitment and minimizes potential hold-up risks.

Regulatory Responses to the Holdup Problem

Regulatory responses to the holdup problem in contracts often involve implementing standardized contract frameworks and enforcing clear dispute resolution mechanisms to minimize opportunistic behavior. Governments may introduce regulations that mandate transparency and predefined penalty clauses, reducing the risk of parties exploiting contract-specific investments. These measures aim to enhance trust and efficiency in economic transactions by mitigating the hold-up risks associated with specialized asset commitments.

Holdup Problem: Lessons from International Trade Contracts

The holdup problem in international trade contracts arises when one party exploits the other's specific investments by renegotiating terms after commitments are made, causing inefficiencies and increased transaction costs. For example, a supplier in a developing country may invest heavily in specialized machinery to fulfill a contract, only to face demands for lower prices or delayed payments from the buyer once production has started. This risk discourages upfront investments and complicates contract enforcement, highlighting the need for clear agreements and credible commitment mechanisms in global trade.

example of holdup problem in contract Infographic

samplerz.com

samplerz.com