Shadow price in resource allocation represents the implicit value of an additional unit of a constrained resource. For instance, in a manufacturing plant producing electronics, if the available labor hours are capped, the shadow price indicates how much the profit would increase by adding one extra hour of labor. This metric helps managers prioritize resource distribution by highlighting which constraints have the most significant impact on overall output. In the agricultural sector, shadow price can be applied to water allocation during drought conditions. When water resources are limited, the shadow price reflects the economic benefit of one more unit of water for crop irrigation. Policymakers use this data to optimize resource allocation, ensuring that critical constraints are addressed to maximize yields and economic returns.

Table of Comparison

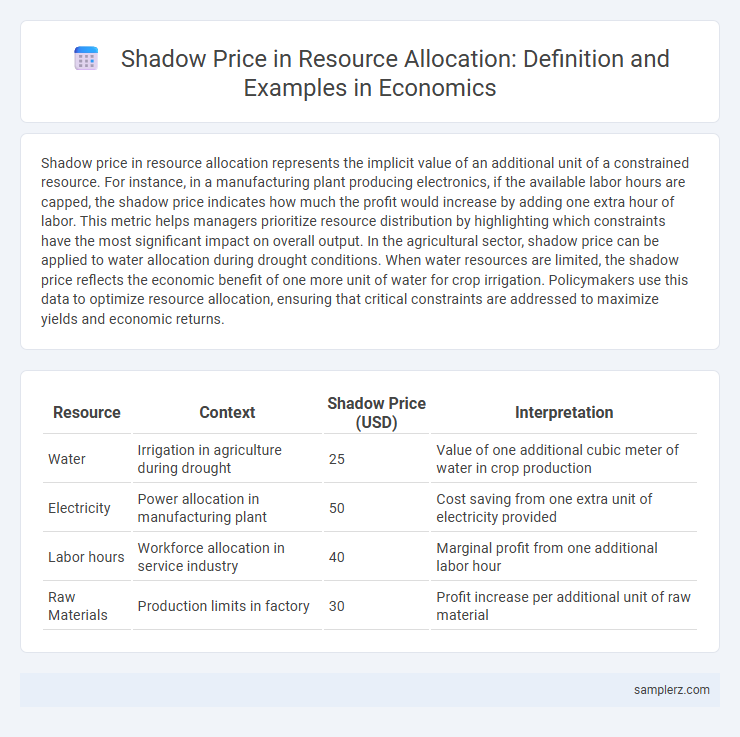

| Resource | Context | Shadow Price (USD) | Interpretation |

|---|---|---|---|

| Water | Irrigation in agriculture during drought | 25 | Value of one additional cubic meter of water in crop production |

| Electricity | Power allocation in manufacturing plant | 50 | Cost saving from one extra unit of electricity provided |

| Labor hours | Workforce allocation in service industry | 40 | Marginal profit from one additional labor hour |

| Raw Materials | Production limits in factory | 30 | Profit increase per additional unit of raw material |

Introduction to Shadow Price in Resource Allocation

Shadow price represents the marginal value of relaxing a constraint in resource allocation problems, reflecting the additional benefit gained from one more unit of a limited resource. In linear programming, shadow price quantifies how much the objective function, such as profit or cost, would improve with an incremental increase in resource availability. Understanding shadow prices enables managers to make informed decisions on resource adjustments to optimize production and maximize economic efficiency.

Shadow Price and Its Role in Efficient Resource Distribution

Shadow price represents the implicit value of a scarce resource in constrained optimization problems, reflecting the marginal benefit of relaxing a resource limitation by one unit. It plays a crucial role in efficient resource distribution by guiding decision-makers to allocate resources where the shadow price is highest, ensuring maximum economic efficiency. In practice, shadow prices help optimize production, budgeting, and investment decisions by quantifying the opportunity cost of resource constraints.

Real-World Examples of Shadow Pricing

Shadow pricing plays a critical role in resource allocation by assigning implicit values to non-market goods and constraints, such as environmental resources or labor regulations. For instance, the World Bank uses shadow prices to evaluate the social cost of carbon emissions in infrastructure projects, influencing investment decisions toward sustainable development. Similarly, water resource management in agriculture often employs shadow pricing to allocate scarce water supplies efficiently, reflecting the opportunity cost of water use amidst competing demands.

Shadow Price in Labor Allocation Scenarios

Shadow price in labor allocation scenarios reflects the marginal value of an additional unit of labor in production or project contexts, guiding optimal resource distribution. For instance, in manufacturing, assigning a shadow price to labor hours helps determine the economic benefit of reallocating workers to high-demand tasks, maximizing output efficiency. This metric assists managers in evaluating opportunity costs and making informed decisions on workforce deployment under constrained labor conditions.

Resource Constraints and Shadow Price Calculation

Shadow price represents the marginal value of relaxing a resource constraint in economic optimization problems, indicating how much the objective function improves per unit increase in the resource. For instance, in a production setting with a limited budget for raw materials, the shadow price quantifies the increase in profit achievable by acquiring one additional unit of the constrained material. Calculating shadow prices involves solving the dual of the linear programming problem, where the shadow price corresponds to the optimal dual variable associated with each binding resource constraint.

Shadow Price Application in Production Planning

Shadow price in production planning measures the marginal value of relaxing a resource constraint, guiding firms to optimize output levels and maximize profit. For instance, in manufacturing, the shadow price of machine hours indicates how much additional profit can be earned by acquiring one more hour of machine time. This application helps managers prioritize resource allocation, ensuring efficient use of limited inputs in product mix decisions.

Shadow Pricing for Limited Raw Material Utilization

Shadow pricing for limited raw material utilization assigns an implicit value to scarce inputs, guiding firms in optimizing resource allocation to maximize profit. For instance, in manufacturing, the shadow price of a constrained metal reflects the additional profit generated per extra unit of metal available, enabling decision-makers to prioritize production processes. This economic tool ensures efficient utilization of raw materials by quantifying opportunity costs, leading to better-informed investment and procurement strategies.

Shadow Price in Transportation and Logistics Optimization

Shadow price in transportation and logistics optimization represents the monetary value of an additional unit of capacity or resource, such as an extra truckload or ton-mile, within a constrained network. For example, in a supply chain model, if increasing a specific route's capacity by one unit reduces total operational costs by $50, the shadow price is $50, indicating the maximum worth of that resource increment. This value guides decision-makers in resource allocation, highlighting where investments in additional capacity yield the most economic benefit.

Shadow Price Impact on Environmental Resource Management

Shadow price plays a crucial role in environmental resource management by assigning a monetary value to scarce natural resources, such as clean water or carbon emissions permits, which are not directly priced in markets. This valuation guides policymakers in allocating resources efficiently, encouraging sustainable practices, and internalizing environmental externalities to reflect true social costs. For instance, the shadow price of carbon emissions influences regulatory decisions and market-based mechanisms like cap-and-trade systems, promoting reduced pollution and conservation efforts.

Future Implications of Shadow Price in Economic Decision-Making

Shadow price represents the implicit value of a constrained resource in economic models, guiding optimal allocation decisions when market prices are unavailable. Its use in resource allocation helps predict the opportunity cost of limited goods, allowing policymakers to evaluate trade-offs in investment, production, and environmental conservation. Future applications of shadow pricing will enhance sustainable development strategies by quantifying the economic impact of scarce resources, influencing long-term fiscal and environmental policies.

example of Shadow price in resource allocation Infographic

samplerz.com

samplerz.com