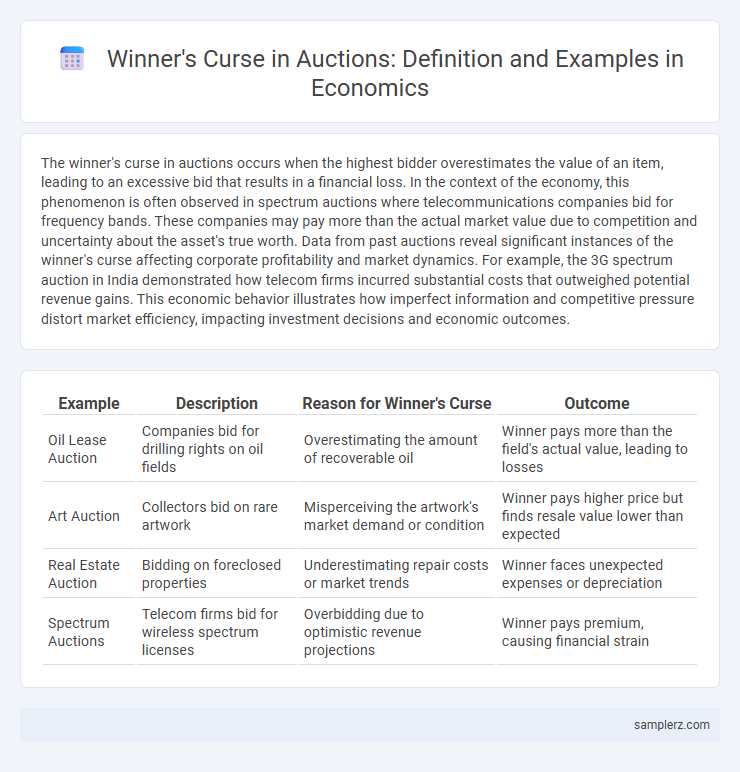

The winner's curse in auctions occurs when the highest bidder overestimates the value of an item, leading to an excessive bid that results in a financial loss. In the context of the economy, this phenomenon is often observed in spectrum auctions where telecommunications companies bid for frequency bands. These companies may pay more than the actual market value due to competition and uncertainty about the asset's true worth. Data from past auctions reveal significant instances of the winner's curse affecting corporate profitability and market dynamics. For example, the 3G spectrum auction in India demonstrated how telecom firms incurred substantial costs that outweighed potential revenue gains. This economic behavior illustrates how imperfect information and competitive pressure distort market efficiency, impacting investment decisions and economic outcomes.

Table of Comparison

| Example | Description | Reason for Winner's Curse | Outcome |

|---|---|---|---|

| Oil Lease Auction | Companies bid for drilling rights on oil fields | Overestimating the amount of recoverable oil | Winner pays more than the field's actual value, leading to losses |

| Art Auction | Collectors bid on rare artwork | Misperceiving the artwork's market demand or condition | Winner pays higher price but finds resale value lower than expected |

| Real Estate Auction | Bidding on foreclosed properties | Underestimating repair costs or market trends | Winner faces unexpected expenses or depreciation |

| Spectrum Auctions | Telecom firms bid for wireless spectrum licenses | Overbidding due to optimistic revenue projections | Winner pays premium, causing financial strain |

Understanding the Winner’s Curse in Auctions

The winner's curse in auctions occurs when the highest bidder overpays due to incomplete information or overestimation of an asset's value, leading to potential losses. This phenomenon is common in common value auctions where the item has a single true value unknown to bidders. Understanding this effect is crucial for bidders to avoid irrational exuberance and adopt strategies such as cautious bidding or thorough market research.

Classic Examples of Winner’s Curse in Real Estate Auctions

In real estate auctions, the winner's curse often occurs when bidders overestimate the value of properties, resulting in paying prices higher than market worth. Classic examples include competitive bidding on distressed properties or foreclosures, where emotional bidding drives prices beyond intrinsic value. This leads to financial losses for the winning bidder once hidden costs and necessary repairs are accounted for.

The Winner’s Curse in Spectrum License Auctions

Spectrum license auctions often illustrate the winner's curse when telecommunication companies overbid to secure valuable frequency bands, subsequently facing reduced profitability due to excessive payment relative to the license's actual market value. The intense competition for limited spectrum, combined with uncertainty about the true value and future regulatory changes, leads to aggressive bids that surpass rational valuations. This phenomenon is exemplified by the U.S. FCC auctions where several winners incurred financial losses after overestimating the revenue potential of the awarded licenses.

How Art Auctions Illustrate the Winner’s Curse

Art auctions often demonstrate the winner's curse when bidders overestimate the provenance or future value of a piece, leading to paying more than the intrinsic worth. This phenomenon is evident in cases where competitive bidding drives prices beyond expert appraisals or previous sale records. High-profile auctions featuring masterpieces by renowned artists like Picasso or Van Gogh frequently reveal how emotional attachment and speculative expectations cause buyers to suffer financial regret post-sale.

Oil and Gas Rights: A Case Study in Winner’s Curse

In the auction of oil and gas rights, the winner's curse often occurs when companies overbid for exploration licenses, underestimating the geological risks and overestimating potential reserves. This leads to inflated costs that exceed the projected profits from oil extraction, causing financial losses despite winning the bid. Historical data from offshore drilling auctions illustrates how such miscalculations result in long-term economic setbacks for the victorious firms.

IPO Auctions and the Impact of the Winner’s Curse

In IPO auctions, the winner's curse occurs when investors overpay for shares due to overly optimistic demand estimates, leading to subsequent losses as the stock price corrects to its true value. This phenomenon impacts market efficiency by discouraging aggressive bidding and causing undervaluation in future auctions. Empirical studies show that IPOs affected by the winner's curse often experience underperformance relative to initial pricing forecasts.

Winner’s Curse in Bidding for Government Contracts

In government contract auctions, the Winner's Curse occurs when the winning bidder significantly underestimates the true cost or overestimates the value of fulfilling the contract, leading to financial losses. This phenomenon is common in complex infrastructure or defense projects, where incomplete information and intense competition drive bidders to submit overly optimistic bids. Empirical studies show that firms winning these contracts often face cost overruns exceeding 20%, reflecting the impact of the Winner's Curse on public procurement efficiency.

Sports Franchise Auctions: Falling Prey to the Winner’s Curse

In sports franchise auctions, the winner's curse often manifests when bidders overestimate the team's future profitability, leading to overpayment that surpasses intrinsic value. Historical cases like the 1993 NFL franchise auction for the Carolina Panthers illustrate how aggressive bidding driven by competitive pressure can inflate prices beyond sustainable returns. Such miscalculations result in significant financial strain on the winning owners, undermining anticipated economic gains from team ownership.

Tech Startup Acquisitions and the Winner’s Curse Phenomenon

In tech startup acquisitions, the winner's curse occurs when the acquiring company overpays due to overly optimistic valuations in competitive bidding scenarios. This leads to inflated purchase prices that may not reflect the startup's true market potential or financial performance. High-profile cases like the Facebook acquisition of WhatsApp illustrate how aggressive bids can result in diminishing returns and strategic risks for acquirers.

Strategies to Avoid the Winner’s Curse in Auctions

Bidders can avoid the winner's curse in auctions by conducting thorough market research to accurately estimate the asset's value before bidding. Implementing strict bid limits based on independent valuations helps prevent overbidding driven by emotional excitement. Employing incremental bidding strategies and seeking advice from experienced auction consultants further mitigates the risk of overpaying.

example of winner’s curse in auction Infographic

samplerz.com

samplerz.com