Open market operations involve the buying and selling of government securities by a central bank to regulate the money supply. For example, the Federal Reserve purchasing Treasury bonds injects liquidity into the banking system, lowering interest rates and encouraging borrowing. This process helps stimulate economic growth by increasing the availability of credit. Conversely, selling government securities in open market operations reduces the money supply, as banks use their reserves to buy bonds. This action raises interest rates, which can slow down inflation and cool an overheating economy. Central banks employ these operations regularly to maintain economic stability and control inflationary pressures.

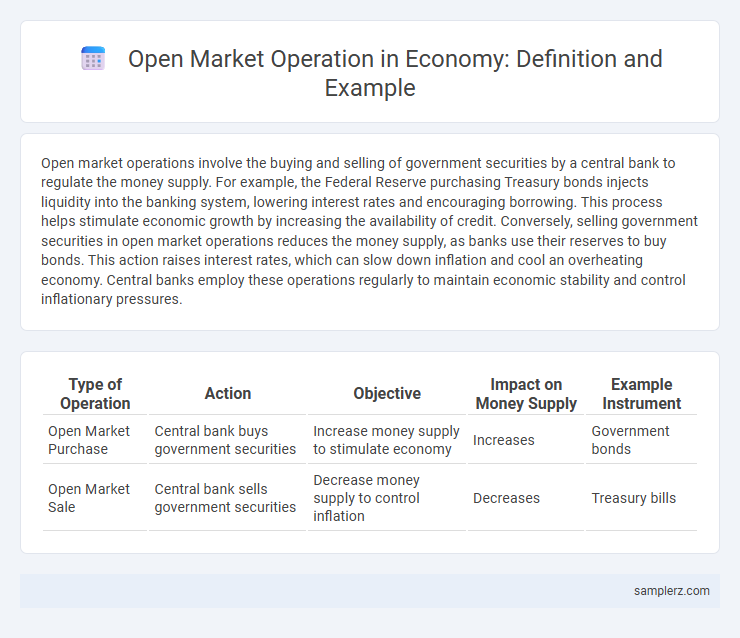

Table of Comparison

| Type of Operation | Action | Objective | Impact on Money Supply | Example Instrument |

|---|---|---|---|---|

| Open Market Purchase | Central bank buys government securities | Increase money supply to stimulate economy | Increases | Government bonds |

| Open Market Sale | Central bank sells government securities | Decrease money supply to control inflation | Decreases | Treasury bills |

Understanding Open Market Operations in Modern Economies

Open Market Operations (OMO) involve central banks buying or selling government securities to regulate money supply and influence interest rates. For instance, the Federal Reserve purchasing Treasury bonds injects liquidity into the banking system, lowering interest rates and stimulating economic activity. Such operations are crucial tools for managing inflation, controlling unemployment, and ensuring overall financial stability in modern economies.

Real-World Examples of Open Market Operations

The Federal Reserve's frequent purchase and sale of U.S. Treasury securities serve as a primary example of open market operations to control money supply and stabilize inflation. In 2020, the Fed significantly expanded its asset purchases to inject liquidity amid the COVID-19 pandemic, supporting economic recovery. Similarly, the European Central Bank's large-scale asset purchase programs illustrate open market operations aimed at boosting eurozone economic activity and managing interest rates.

Open Market Operations: Case Studies from Major Central Banks

The Federal Reserve's open market operations in 2008 involved large-scale asset purchases to stabilize financial markets during the global financial crisis, effectively lowering interest rates and increasing liquidity. The European Central Bank engaged in targeted longer-term refinancing operations (TLTROs) to support bank lending within the Eurozone, stimulating economic growth amid sluggish conditions. The Bank of Japan's persistent purchase of government bonds and exchange-traded funds under its quantitative easing program exemplifies aggressive use of open market operations to combat deflation and promote inflation targets.

The Role of the Federal Reserve in U.S. Open Market Operations

The Federal Reserve conducts open market operations primarily by buying and selling U.S. Treasury securities to regulate the money supply and influence short-term interest rates. These transactions affect the federal funds rate, which in turn impacts borrowing costs, consumer spending, and overall economic growth. Through precise management of these operations, the Fed aims to maintain price stability and achieve maximum employment.

European Central Bank's Approach to Open Market Transactions

The European Central Bank (ECB) employs open market operations primarily through its main refinancing operations, which involve weekly liquidity-providing reverse transactions with a maturity of one week. These transactions influence short-term interest rates and liquidity conditions in the eurozone, ensuring price stability aligns with the ECB's inflation target of close to but below 2%. By adjusting the volume and frequency of these operations, the ECB effectively manages monetary policy transmission and financial market stability.

Open Market Operations in Emerging Markets: Key Examples

Open market operations in emerging markets often involve central banks purchasing government securities to inject liquidity or selling them to absorb excess funds, directly impacting interest rates and currency stability. For instance, the Reserve Bank of India actively uses open market operations to manage inflation and support economic growth by adjusting liquidity levels. Similarly, Brazil's central bank conducts frequent open market operations to stabilize the real and influence inflation targeting, showcasing critical monetary policy tools in emerging economies.

Quantitative Easing as an Open Market Operation Tool

Quantitative easing (QE) is an open market operation tool used by central banks to stimulate the economy by purchasing longer-term securities, such as government bonds and mortgage-backed assets, from the open market. This infusion of liquidity lowers interest rates, increases money supply, and encourages lending and investment to spur economic growth. Major implementations of QE occurred after the 2008 financial crisis and during the COVID-19 pandemic to stabilize financial markets and support economic recovery.

How Open Market Operations Influence Interest Rates

Open Market Operations (OMO) involve the central bank buying or selling government securities to regulate the money supply and influence interest rates. When the central bank purchases securities, it increases the money supply, leading to lower interest rates by raising excess reserves in the banking system. Conversely, selling government securities reduces the money supply, resulting in higher interest rates as banks have fewer reserves to lend.

Comparative Analysis: Open Market Operations in Different Economies

The Federal Reserve's use of open market operations to buy Treasury securities contrasts with the European Central Bank's approach of purchasing a broader range of assets, including corporate bonds, to stimulate liquidity. In emerging markets like India, open market operations often focus on short-term government securities to manage liquidity and stabilize the currency. Comparatively, economies with advanced financial systems tend to implement these operations more flexibly, aiming to fine-tune interest rates and control inflation efficiently.

Lessons Learned from Historical Open Market Operations

Historical open market operations, such as the Federal Reserve's asset purchases during the 2008 financial crisis, demonstrated the effectiveness of buying government securities to inject liquidity and stabilize financial markets. Lessons learned include the importance of timely intervention and clear communication to manage market expectations and prevent excessive volatility. These operations highlighted how central banks can influence short-term interest rates and support economic recovery while balancing inflation risks.

example of open market operation in economy Infographic

samplerz.com

samplerz.com