The Tobin tax is a proposed levy on foreign exchange transactions aimed at reducing currency speculation and stabilizing financial markets. This tax targets short-term currency trades, imposing a small percentage fee on each transaction to discourage excessive volatility. By generating government revenue, the Tobin tax can fund public goods or international development projects. One example of the Tobin tax concept was introduced by Sweden in the 1980s, where a tax on foreign currency trades was implemented but later abandoned due to reduced trading volume and market shifts. More recently, the European Union has discussed implementing a Financial Transaction Tax inspired by Tobin's idea to curb speculation and improve market stability. The Tobin tax remains a significant topic in economic policy debates regarding financial regulation and global market stability.

Table of Comparison

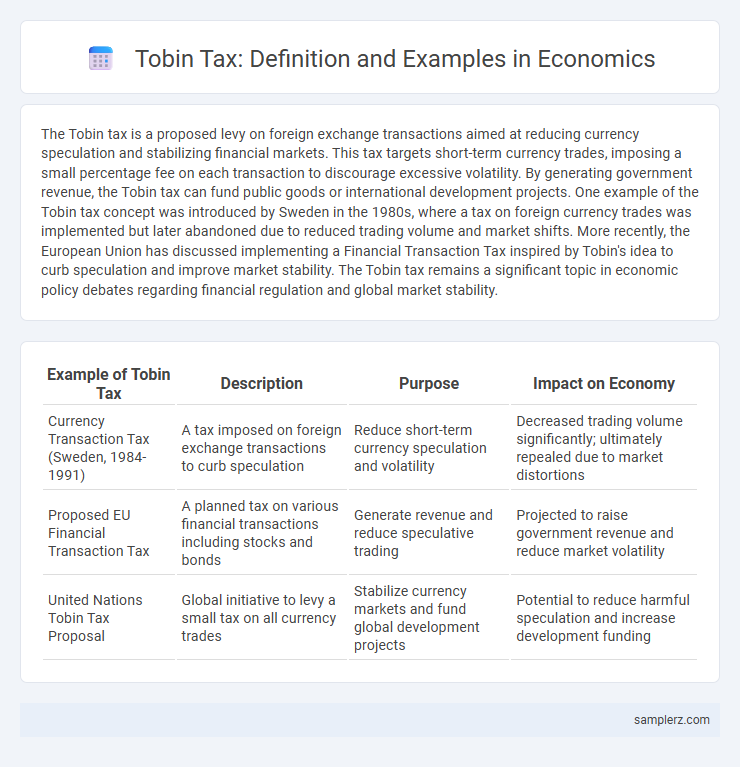

| Example of Tobin Tax | Description | Purpose | Impact on Economy |

|---|---|---|---|

| Currency Transaction Tax (Sweden, 1984-1991) | A tax imposed on foreign exchange transactions to curb speculation | Reduce short-term currency speculation and volatility | Decreased trading volume significantly; ultimately repealed due to market distortions |

| Proposed EU Financial Transaction Tax | A planned tax on various financial transactions including stocks and bonds | Generate revenue and reduce speculative trading | Projected to raise government revenue and reduce market volatility |

| United Nations Tobin Tax Proposal | Global initiative to levy a small tax on all currency trades | Stabilize currency markets and fund global development projects | Potential to reduce harmful speculation and increase development funding |

Introduction to Tobin Tax in Economic Policy

The Tobin tax is a proposed financial transaction tax aimed at curbing excessive currency speculation and stabilizing foreign exchange markets. Named after economist James Tobin, it targets short-term capital flows by imposing a small levy on currency conversions, reducing volatility and speculative attacks. Implementing the Tobin tax can enhance economic policy by promoting long-term investment and generating revenue for public goods.

Historical Background of Tobin Tax Implementation

The Tobin tax, proposed by economist James Tobin in 1972, was designed to curb excessive currency speculation and stabilize foreign exchange markets. Its initial implementation occurred in Sweden during the 1980s, where a financial transaction tax targeted currency trades but was later repealed due to capital flight concerns. Historical applications of the Tobin tax highlight the challenges of balancing market regulation and economic growth in the pursuit of global financial stability.

Real-World Examples of Tobin Tax Applications

Sweden implemented a Tobin tax in the 1980s targeting currency transactions to curb speculative trading and stabilize financial markets, though it was later abolished due to capital flight and decreased trading volumes. Brazil introduced a financial transaction tax inspired by the Tobin tax, which contributed to increased government revenues and moderated short-term currency volatility. More recently, the European Union has proposed a financial transaction tax aimed at cross-border securities trading to enhance market stability and generate fiscal resources.

Case Study: Tobin Tax in Sweden’s Financial Markets

Sweden implemented a Tobin tax on financial transactions in the 1980s, targeting currency trades to curb speculative trading and stabilize the market. The tax led to a significant decline in trading volume, with foreign exchange turnover dropping by more than 50%, and many transactions moving to offshore markets. The case demonstrated challenges in enforcing the Tobin tax globally, as traders shifted activities to untaxed jurisdictions, ultimately limiting its effectiveness in reducing market volatility.

Tobin Tax Adoption in the European Union

The European Union has explored the implementation of a Tobin tax as a financial transaction tax aimed at curbing currency speculation and generating public revenue. Several member states, including France, Germany, and Italy, have agreed on a partial adoption of the Tobin tax targeting stock and derivative transactions within the EU financial market. This move aligns with the EU's broader efforts to enhance financial stability and reduce market volatility by discouraging high-frequency speculative trading.

Impact of France’s Financial Transaction Tax

France's Financial Transaction Tax (FTT), implemented in 2012, targets the sale of shares in large French companies to curb speculative trading and generate public revenue. The tax has reduced high-frequency trading volumes and increased market stability, while raising significant funds for social and environmental programs. Critics argue it may reduce liquidity and increase costs for long-term investors, but overall, the FTT's impact highlights Tobin tax principles by promoting financial market regulation and economic equity.

Brazil’s Experience with Currency Transaction Taxes

Brazil implemented a currency transaction tax known as the IOF (Imposto sobre Operacoes Financeiras), which targets foreign exchange transactions to regulate capital flows and reduce speculative activities. This tax has proven effective in stabilizing Brazil's foreign exchange market by discouraging short-term currency speculation and mitigating excessive volatility. The Brazilian IOF serves as a practical example of Tobin tax principles, demonstrating how currency transaction taxes can enhance financial stability in emerging economies.

Effectiveness of Tobin Tax in Curbing Speculation

The Tobin tax, initially proposed by economist James Tobin in 1972, imposes a small levy on currency transactions aimed at reducing excessive short-term speculation. Empirical studies reveal mixed results; while the tax can decrease high-frequency trading and reduce currency volatility in some cases, it may also lower market liquidity and drive trading to less regulated markets. Overall, the effectiveness of the Tobin tax in curbing speculation depends on the tax rate, enforcement scope, and international coordination to prevent evasion.

Challenges and Criticisms of Tobin Tax Examples

The Tobin tax, aimed at curbing financial market volatility, faces challenges such as potential liquidity reduction and increased transaction costs that may hinder market efficiency. Critics argue its implementation can drive trading activity to unregulated markets, limiting enforcement and global coordination effectiveness. Empirical case studies, such as those in the European Union, highlight difficulties in balancing revenue generation with avoiding negative impacts on legitimate hedging and investment activities.

Future Prospects for Tobin Tax in Global Economy

The Tobin tax, a small levy on currency transactions, aims to reduce speculative trading and stabilize financial markets. Future prospects indicate increased adoption as global economies seek tools to curb volatility and generate revenue for sustainable development. Emerging digital currencies and growing international cooperation present opportunities to integrate the Tobin tax into modern financial frameworks.

example of Tobin tax in economy Infographic

samplerz.com

samplerz.com