Helicopter money refers to a monetary policy tool where central banks distribute cash directly to the public to stimulate economic activity during downturns. One prominent example occurred in Japan in 2020 when the government issued direct cash payments to households to combat deflation and boost consumer spending. This policy aimed to increase liquidity and encourage demand amidst sluggish economic growth and persistent deflationary pressures. Another example took place in the United States during the COVID-19 pandemic, with the issuance of stimulus checks under the CARES Act in 2020. The direct transfer of funds to individuals helped sustain consumer spending and stabilize financial markets amid massive job losses and economic uncertainty. These measures illustrate how helicopter money can serve as an unconventional approach to stimulate aggregate demand during severe economic crises.

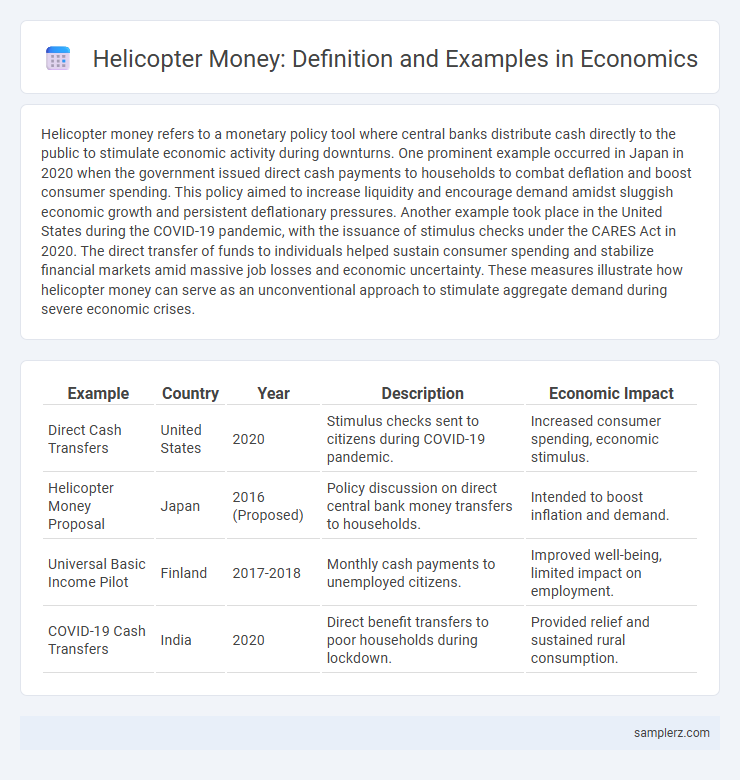

Table of Comparison

| Example | Country | Year | Description | Economic Impact |

|---|---|---|---|---|

| Direct Cash Transfers | United States | 2020 | Stimulus checks sent to citizens during COVID-19 pandemic. | Increased consumer spending, economic stimulus. |

| Helicopter Money Proposal | Japan | 2016 (Proposed) | Policy discussion on direct central bank money transfers to households. | Intended to boost inflation and demand. |

| Universal Basic Income Pilot | Finland | 2017-2018 | Monthly cash payments to unemployed citizens. | Improved well-being, limited impact on employment. |

| COVID-19 Cash Transfers | India | 2020 | Direct benefit transfers to poor households during lockdown. | Provided relief and sustained rural consumption. |

Understanding Helicopter Money: Definition and Mechanism

Helicopter money refers to a central bank or government distributing large sums of money directly to the public to stimulate economic activity without increasing debt. This unconventional monetary policy boosts consumer spending and inflation by increasing disposable income instantaneously. Notable examples include Japan's various stimulus measures and direct cash transfers proposed during the 2008 financial crisis and COVID-19 pandemic to counter deflation and recession risks.

Historical Examples of Helicopter Money Implementation

During the aftermath of the 2008 global financial crisis, Japan implemented helicopter money through direct cash transfers funded by its central bank to stimulate consumer spending and inflation. Zimbabwe also experimented with helicopter money in the late 2000s by distributing government bonds directly to citizens to combat hyperinflation and economic collapse. More recently, in response to the COVID-19 pandemic, several countries including the United States and Spain issued direct stimulus payments to households, reflecting modern applications of helicopter money aimed at boosting aggregate demand.

Helicopter Money vs. Quantitative Easing: Key Differences

Helicopter money involves direct cash transfers to households to stimulate spending and boost demand, contrasting with quantitative easing (QE), which focuses on central banks purchasing financial assets to lower interest rates and increase liquidity. Unlike QE, helicopter money does not create additional debt, making it a more direct fiscal policy tool aimed at increasing consumption. The key difference lies in helicopter money's immediate impact on consumer income, while QE primarily influences financial markets and bank lending.

Case Study: Japan’s Experiment with Helicopter Money

Japan's experiment with helicopter money involved the Bank of Japan directly financing government stimulus measures by distributing cash payments to households to boost consumer spending and counter deflationary pressures. The 2020 stimulus package included cash handouts totaling approximately $1 trillion, which aimed to increase liquidity and stimulate economic activity amid prolonged stagnation. Despite mixed results, this case provided valuable insights into the effectiveness of direct monetary transfers as a tool for macroeconomic policy.

The US COVID-19 Stimulus Checks as Helicopter Money

The US COVID-19 Stimulus Checks represent a prime example of helicopter money, directly injecting cash into households to boost consumer spending and stabilize the economy during the pandemic. These payments, authorized by the CARES Act and subsequent relief packages, provided millions of Americans with unconditional cash transfers totaling over $800 billion. Studies revealed that this direct fiscal stimulus helped reduce economic contraction and supported a faster recovery by increasing demand across various sectors.

Eurozone Discussions on Direct Cash Transfers

In the Eurozone, discussions on helicopter money have centered around direct cash transfers as a potential monetary policy tool to stimulate demand during economic downturns. The European Central Bank has debated issuing one-time payments directly to households to boost consumption and inflation without increasing public debt. This approach aims to complement traditional quantitative easing by targeting liquidity constraints faced by consumers across member states.

Impact of Helicopter Money on Consumer Spending

Helicopter money directly increases consumer spending by distributing funds or tax credits to households, boosting disposable income and encouraging immediate consumption. Empirical evidence from Japan's stimulus programs shows that such cash transfers lead to measurable increases in retail sales and durable goods purchases. The surge in consumer expenditure drives demand, stimulates economic growth, and can counteract deflationary pressures during economic downturns.

Risks and Challenges of Deploying Helicopter Money

Deploying helicopter money risks triggering uncontrollable inflation due to the sudden surge in money supply without corresponding increases in goods and services. Challenges include difficulties in calibrating the exact amount of money to distribute, which can lead to overspending or insufficient stimulus, undermining economic stability. There is also a risk of eroding central bank independence and undermining fiscal discipline, potentially causing long-term economic distortions.

Central Banks’ Perspectives on Direct Cash Distributions

Central banks view helicopter money as an unconventional monetary policy tool involving direct cash distributions to households to stimulate demand during economic downturns. The Bank of Japan and the European Central Bank have discussed or experimented with variations of helicopter money to counter low inflation and economic stagnation. Such measures bypass traditional financial intermediaries, aiming to boost consumption and inflation expectations more effectively than conventional quantitative easing.

Long-Term Economic Effects of Helicopter Money

Helicopter money, exemplified by direct cash transfers like Japan's stimulus payments, aims to rapidly boost consumer spending and inflation rates. Over the long term, sustained use of helicopter money can risk higher inflation expectations, potentially destabilizing price levels and reducing currency value. Economists caution that without corresponding productivity growth, such policies may lead to diminished fiscal discipline and increased public debt burdens.

example of helicopter money in economy Infographic

samplerz.com

samplerz.com