A liquidity trap occurs when interest rates are close to zero, and savings rates remain high despite monetary policy efforts to stimulate the economy. One prominent example is Japan's economic situation during the 1990s and early 2000s, where the Bank of Japan lowered interest rates to near zero but could not spur significant borrowing or investment. This environment led to stagnant growth and deflation, challenging policymakers' ability to revive economic activity. The United States also experienced a liquidity trap after the 2008 financial crisis, when the Federal Reserve reduced interest rates to nearly zero and implemented quantitative easing programs. Despite these efforts, consumer spending and business investments were slow to rebound, resulting in prolonged economic sluggishness. This scenario demonstrated the limits of conventional monetary tools in boosting demand when liquidity preference remains high.

Table of Comparison

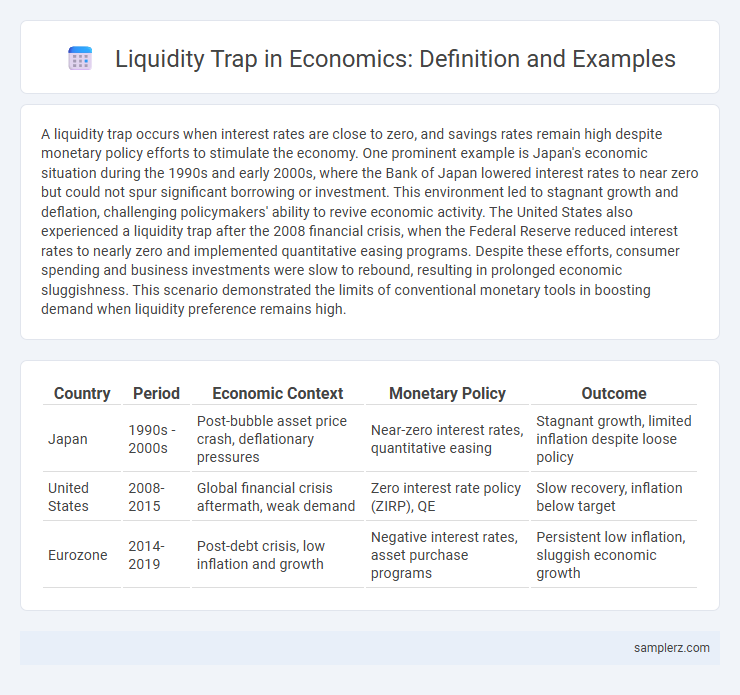

| Country | Period | Economic Context | Monetary Policy | Outcome |

|---|---|---|---|---|

| Japan | 1990s - 2000s | Post-bubble asset price crash, deflationary pressures | Near-zero interest rates, quantitative easing | Stagnant growth, limited inflation despite loose policy |

| United States | 2008-2015 | Global financial crisis aftermath, weak demand | Zero interest rate policy (ZIRP), QE | Slow recovery, inflation below target |

| Eurozone | 2014-2019 | Post-debt crisis, low inflation and growth | Negative interest rates, asset purchase programs | Persistent low inflation, sluggish economic growth |

Understanding the Liquidity Trap Phenomenon

A liquidity trap occurs when interest rates approach zero, and monetary policy loses its effectiveness as consumers and businesses hoard cash instead of investing or spending. Japan in the 1990s exemplifies this phenomenon, where despite near-zero interest rates, economic stagnation persisted due to lack of demand. This trap challenges central banks to find alternative strategies beyond traditional rate cuts to stimulate economic growth.

Historical Examples of Liquidity Traps

The Japanese economy during the 1990s and 2000s exemplifies a significant historical liquidity trap, where near-zero interest rates failed to stimulate consumer spending or investment, leading to prolonged deflation and economic stagnation. Another notable case occurred in the United States during the Great Depression, when despite the Federal Reserve lowering interest rates, monetary policy lost effectiveness as demand for liquidity surged and economic activity declined. These episodes highlight the challenges central banks face when conventional monetary tools become insufficient to revive growth in liquidity trap conditions.

The Japanese Economy: A Liquidity Trap Case Study

The Japanese economy experienced a notable liquidity trap during the 1990s when prolonged deflation and near-zero interest rates hindered monetary policy effectiveness. Despite aggressive money supply increases by the Bank of Japan, consumer spending and investment remained stagnant, showcasing the trap's grip. This period highlighted the challenge central banks face when nominal interest rates approach zero, limiting traditional stimulus tools.

The U.S. During the Great Depression: Early Evidence

During the Great Depression, the U.S. experienced a classic liquidity trap as interest rates approached zero but investment and consumption remained stagnant. Despite the Federal Reserve lowering rates, households and businesses hoarded cash instead of spending or borrowing, nullifying monetary stimulus effects. This period highlighted the limitations of conventional monetary policy in reviving economic activity during severe downturns.

The 2008 Global Financial Crisis and Liquidity Traps

The 2008 Global Financial Crisis exemplified a severe liquidity trap where central banks slashed interest rates close to zero, yet investment and consumption remained stagnant due to pervasive economic uncertainty and weakened demand. Despite aggressive monetary easing and quantitative easing programs, liquidity preferred to remain hoarded by banks and consumers, failing to stimulate economic growth effectively. This environment demonstrated how traditional monetary policy tools can become ineffective in overcoming liquidity traps, necessitating unconventional interventions to revive activity.

Eurozone Challenges: A Modern Liquidity Trap Scenario

The Eurozone faces a modern liquidity trap where ultra-low interest rates fail to stimulate investment or consumer spending, leading to stagnant economic growth despite expansive monetary policies. Persistent deflationary pressures and weak demand render traditional central bank measures ineffective, trapping the economy in a cycle of low inflation and sluggish output. This scenario complicates fiscal policy decisions and highlights the limits of monetary stimulus in addressing Eurozone structural challenges.

Central Bank Responses to Liquidity Traps

During a liquidity trap, central banks typically lower interest rates to near zero to encourage borrowing and spending, but this often fails to stimulate the economy due to persistent low demand. Quantitative easing becomes a primary tool, with central banks purchasing government securities to inject liquidity directly into the financial system and support asset prices. Forward guidance on prolonged low rates aims to influence expectations and confidence, attempting to revive economic activity despite the trap.

Consequences of a Prolonged Liquidity Trap

A prolonged liquidity trap leads to persistently low interest rates and ineffective monetary policy, stalling economic growth and increasing unemployment. Consumers and businesses hoard cash due to uncertain returns, reducing spending and investment, which exacerbates deflationary pressures. Extended periods in a liquidity trap can erode central banks' credibility, limiting their ability to stimulate the economy through traditional channels.

Policy Solutions for Escaping Liquidity Traps

When facing a liquidity trap, central banks can implement unconventional monetary policies such as quantitative easing to inject liquidity directly into the economy. Fiscal policy measures, including increased government spending and tax cuts, stimulate demand when interest rates are near zero and monetary policy becomes ineffective. Structural reforms aimed at boosting consumer confidence and investment can also help restore economic growth and escape prolonged periods of stagnant demand.

Lessons Learned from Liquidity Trap Examples

The liquidity trap experienced during Japan's Lost Decade demonstrated that near-zero interest rates can fail to stimulate borrowing and spending, highlighting the limits of conventional monetary policy. Lessons from the 2008 global financial crisis underscored the importance of coordinated fiscal stimulus alongside aggressive quantitative easing to revive demand. These cases reveal that central banks must innovate beyond interest rate adjustments, incorporating structural reforms and targeted government intervention to escape prolonged stagnation.

example of liquidity trap in economy Infographic

samplerz.com

samplerz.com