The European Union Emissions Trading System (EU ETS) is a prominent example of a cap-and-trade program in the carbon market. It sets a limit on the total greenhouse gas emissions allowed from covered sectors, including power plants and manufacturing industries. Companies receive or buy emission allowances, which they can trade, promoting cost-effective emission reductions. California's Cap-and-Trade Program operates within the state's effort to lower carbon emissions and combat climate change. It covers major energy producers, industrial sources, and fuel distributors by capping total emissions and distributing allowances. Market participants trade permits to meet compliance obligations, incentivizing innovation in low-carbon technologies.

Table of Comparison

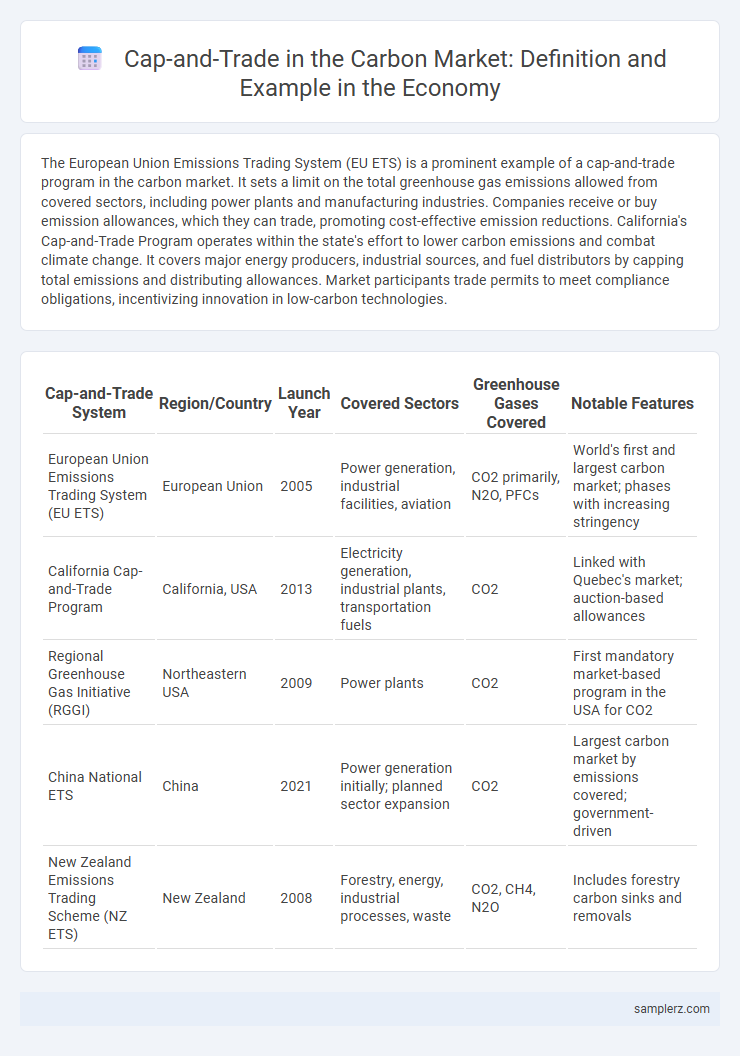

| Cap-and-Trade System | Region/Country | Launch Year | Covered Sectors | Greenhouse Gases Covered | Notable Features |

|---|---|---|---|---|---|

| European Union Emissions Trading System (EU ETS) | European Union | 2005 | Power generation, industrial facilities, aviation | CO2 primarily, N2O, PFCs | World's first and largest carbon market; phases with increasing stringency |

| California Cap-and-Trade Program | California, USA | 2013 | Electricity generation, industrial plants, transportation fuels | CO2 | Linked with Quebec's market; auction-based allowances |

| Regional Greenhouse Gas Initiative (RGGI) | Northeastern USA | 2009 | Power plants | CO2 | First mandatory market-based program in the USA for CO2 |

| China National ETS | China | 2021 | Power generation initially; planned sector expansion | CO2 | Largest carbon market by emissions covered; government-driven |

| New Zealand Emissions Trading Scheme (NZ ETS) | New Zealand | 2008 | Forestry, energy, industrial processes, waste | CO2, CH4, N2O | Includes forestry carbon sinks and removals |

Introduction to Cap-and-Trade Systems

Cap-and-trade systems set a maximum limit on carbon emissions and allocate or auction emission permits to companies, allowing them to trade these permits to meet regulatory requirements. The European Union Emissions Trading System (EU ETS) is the largest example, covering over 11,000 power stations and industrial plants across 31 countries. This market-based approach incentivizes firms to reduce emissions cost-effectively by monetizing their carbon savings.

How Carbon Markets Operate

Carbon markets operate by setting a cap on total greenhouse gas emissions, issuing emission allowances equal to the cap, and enabling firms to trade these allowances to meet regulatory limits cost-effectively. Each allowance permits the holder to emit a specific amount of carbon dioxide or equivalent greenhouse gases, incentivizing companies to reduce emissions below their allocated quotas to sell surplus allowances. This market-driven approach promotes efficient emission reductions by aligning environmental goals with economic incentives, as seen in programs like the European Union Emissions Trading System (EU ETS).

Key Features of Cap-and-Trade Mechanisms

Cap-and-trade mechanisms set a firm limit on total carbon emissions, creating tradable permits that companies must hold to cover their emissions. This market-driven approach incentivizes emission reductions by allowing firms with lower abatement costs to sell excess allowances to higher-cost emitters. The key features include a fixed emissions cap, flexible trading of permits, and periodic allocation or auctioning of allowances to regulate the carbon market efficiently.

The European Union Emissions Trading System (EU ETS)

The European Union Emissions Trading System (EU ETS) stands as the largest and most advanced cap-and-trade carbon market globally, covering over 11,000 power stations and industrial plants across 31 countries. It sets a cap on total greenhouse gas emissions from these sectors and allows companies to buy and sell emission allowances, incentivizing reductions where they are most cost-effective. Since its launch in 2005, the EU ETS has contributed to a significant decrease in carbon emissions by progressively tightening the emissions cap each year.

California’s Cap-and-Trade Program

California's Cap-and-Trade Program sets a statewide limit on greenhouse gas emissions from major industries, allowing businesses to buy and sell emission allowances within the carbon market. This market-based approach incentivizes companies to reduce emissions efficiently while promoting investment in clean energy technologies. Since its implementation in 2013, the program has contributed to significant reductions in carbon pollution while generating revenue for environmental projects and sustainable infrastructure.

Regional Greenhouse Gas Initiative (RGGI) in the United States

The Regional Greenhouse Gas Initiative (RGGI) is a pioneering cap-and-trade program targeting carbon emissions from power plants in the Northeastern United States. By setting a regional cap on CO2 emissions and allowing regulated entities to buy and sell emission allowances, RGGI incentivizes cost-effective reductions while funding energy efficiency and renewable energy programs. This market-based approach has successfully lowered emissions by over 50% since its inception, proving the effectiveness of carbon trading mechanisms in driving economic and environmental benefits.

Success Stories from Cap-and-Trade Markets

The Regional Greenhouse Gas Initiative (RGGI) in the Northeastern United States serves as a leading example of cap-and-trade success, achieving a 47% reduction in CO2 emissions from power plants since its inception in 2009. The European Union Emissions Trading System (EU ETS) has similarly driven significant emission cuts and boosted investments in renewable energy, demonstrating robust market stability and environmental impact. These programs highlight how well-implemented cap-and-trade systems can effectively reduce greenhouse gases while supporting economic growth.

Economic Impacts of Carbon Cap-and-Trade

The Regional Greenhouse Gas Initiative (RGGI) in the Northeastern United States demonstrates significant economic benefits, generating over $2 billion in auction proceeds that states reinvest in energy efficiency and renewable energy projects. California's cap-and-trade program has successfully reduced carbon emissions by 15% while supporting job growth in clean energy sectors, contributing billions to the state economy. These programs incentivize innovation, create green jobs, and encourage investment in low-carbon technologies, fostering sustainable economic development.

Challenges and Criticisms of Cap-and-Trade Systems

Cap-and-trade systems in carbon markets face significant challenges such as market volatility, which can cause unpredictable carbon credit prices and undermine investment incentives. Critics highlight issues of carbon leakage, where businesses relocate emissions to regions without strict regulations, thus reducing the system's overall effectiveness. Enforcement difficulties and potential allocation of excessive free permits also raise concerns about the true environmental impact and fairness of these schemes.

Future Prospects for Global Carbon Trading

The future prospects for global carbon trading are promising as cap-and-trade systems expand beyond the European Union Emissions Trading System (EU ETS) to emerging markets in South America and Asia, including China's national carbon market, the largest in the world by volume. Advances in blockchain technology and real-time emissions tracking enhance transparency and efficiency, attracting more private sector investments and facilitating cross-border trade of carbon credits. Policy harmonization efforts, supported by international frameworks like the Paris Agreement, aim to standardize carbon pricing mechanisms, driving a more integrated and liquid global carbon market.

example of cap-and-trade in carbon market Infographic

samplerz.com

samplerz.com