The sunk cost fallacy occurs when project managers continue investing resources into a failing project due to previously incurred costs that cannot be recovered. For example, a company developing a software application may spend millions over two years, but despite poor user adoption and technical issues, the team persists because of the substantial investment already made. This behavior leads to inefficient allocation of capital and missed opportunities for more profitable ventures. In economic terms, rational decision-making requires ignoring sunk costs and focusing on future benefits and costs. Organizations facing sunk cost fallacy often exhibit escalation of commitment, where they commit additional funds without adequate evaluation of project viability. Data from business studies show that projects influenced by sunk cost bias are more likely to exceed budgets and underperform in returns, impacting overall economic productivity.

Table of Comparison

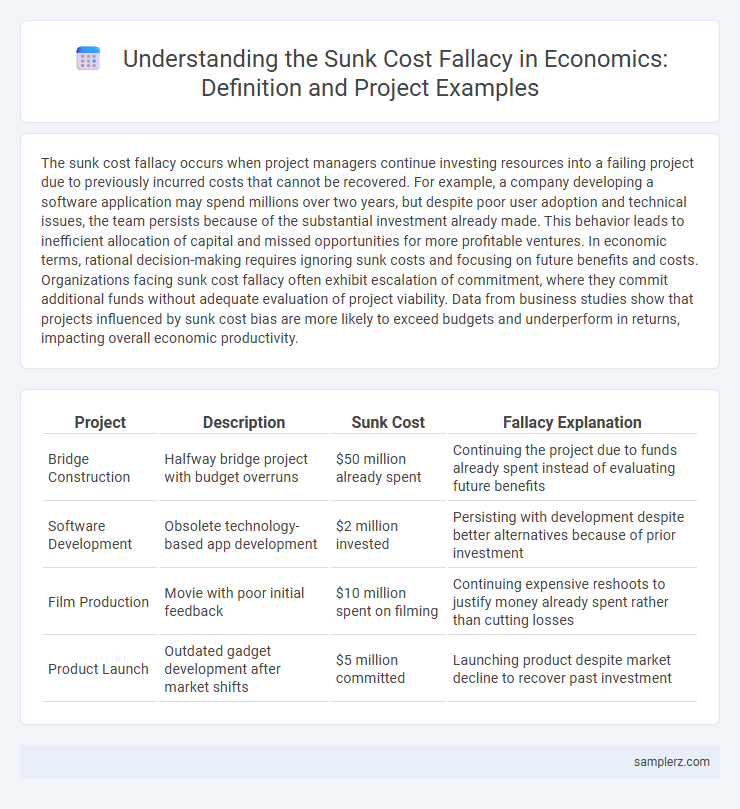

| Project | Description | Sunk Cost | Fallacy Explanation |

|---|---|---|---|

| Bridge Construction | Halfway bridge project with budget overruns | $50 million already spent | Continuing the project due to funds already spent instead of evaluating future benefits |

| Software Development | Obsolete technology-based app development | $2 million invested | Persisting with development despite better alternatives because of prior investment |

| Film Production | Movie with poor initial feedback | $10 million spent on filming | Continuing expensive reshoots to justify money already spent rather than cutting losses |

| Product Launch | Outdated gadget development after market shifts | $5 million committed | Launching product despite market decline to recover past investment |

Introduction to Sunk Cost Fallacy in Projects

Sunk cost fallacy in projects occurs when decision-makers continue investing time, money, or resources into a failing project due to previously incurred costs that cannot be recovered. For example, a company may persist with an over-budget software development project despite clear signs of inefficiency, driven by the significant funds already spent. Recognizing this fallacy is crucial for improving project management and avoiding further financial losses.

The Psychology Behind Sunk Cost Fallacy

Investors often continue funding failing projects due to the psychological need to justify previous investments, demonstrating the sunk cost fallacy. This cognitive bias triggers emotional attachment to irrecoverable costs, overshadowing rational decision-making about future returns. Behavioral economics highlights how loss aversion and commitment escalate resource allocation despite diminishing project viability.

Classic Examples of Sunk Cost Fallacy in Business Projects

Investing additional resources into a failing product development due to previous expenditures exemplifies the sunk cost fallacy in business projects. Firms often continue funding obsolete technology upgrades instead of pivoting to innovative solutions, driven by prior investments. This misallocation of capital underscores the importance of evaluating projects based on future returns rather than past costs.

Real-Life Case Studies: Sunk Cost Fallacy in Large-Scale Developments

The Sydney Opera House project exemplifies the sunk cost fallacy, where escalating expenses from initial underestimations led to continued investment despite mounting budget overruns, ultimately costing over 15 times the original estimate. Similarly, the Boston Big Dig incurred massive financial overruns exceeding $24 billion as decision-makers persisted with the project despite numerous technical and budgetary challenges. These instances highlight how psychological commitment to past expenditures drives inefficient allocation of resources in large-scale infrastructure developments.

IT and Tech Projects: Sunk Cost Traps

In IT and tech projects, the sunk cost fallacy often manifests when teams continue investing in outdated software development despite repeated failures and escalating budgets. Escalating commitments are driven by previously incurred expenses, overshadowing objective cost-benefit analysis and future project viability. This trap leads to inefficient resource allocation, project delays, and significant opportunity costs in fast-moving technology sectors.

Sunk Cost Fallacy in Public Infrastructure Investments

Public infrastructure projects often exemplify the sunk cost fallacy when governments continue funding costly developments despite diminishing returns or escalating problems. For instance, large-scale transportation initiatives may receive additional investments because of previously allocated budgets rather than objective cost-benefit analysis. This flawed decision-making can lead to inefficient resource allocation and increased public debt.

Government Policy and Sunk Cost Decisions

Government policy decisions often illustrate the sunk cost fallacy when authorities continue financing infrastructure projects despite escalating costs and diminishing benefits, driven by previous investments. Such persistence disregards opportunity costs and fails to reallocate resources efficiently, exacerbating budget deficits and economic inefficiencies. Recognizing sunk costs as irrecoverable promotes policy shifts toward outcome-based evaluations and prudent fiscal management.

Startups and the Risk of Sunk Cost Mentality

Startups often fall victim to the sunk cost fallacy by continuing to invest time and resources into failing projects due to prior expenditures. This mentality increases the risk of draining limited financial runway and losing valuable market opportunities. Recognizing when to pivot or abandon projects is critical for startup survival and long-term growth.

Financial Consequences of Sunk Cost Fallacy in Project Management

In project management, the sunk cost fallacy often leads to continued investment in failing projects despite mounting losses, exacerbating financial strain and resource wastage. Companies may pour additional funds into underperforming initiatives, ignoring that past expenditures cannot be recovered and diverting capital from more profitable opportunities. This misallocation of resources results in diminished return on investment and potential damage to overall financial stability.

Strategies to Prevent Sunk Cost Fallacy in Project Planning

Implementing clear project evaluation criteria before committing resources helps prevent the sunk cost fallacy by ensuring decisions are based on future benefits rather than past expenditures. Regularly reviewing project progress with objective metrics enables early identification of underperforming initiatives, allowing timely course corrections or project termination. Encouraging a culture of flexibility and openness to change reduces emotional attachment to sunk costs, promoting rational decision-making in project planning.

example of sunk cost fallacy in project Infographic

samplerz.com

samplerz.com