Capital flight in Argentina has been a persistent issue, particularly during periods of economic instability. One prominent example occurred in 2019 when investors moved billions of dollars out of the country amid fears of currency devaluation and tightening financial controls. Data from the Argentine Central Bank showed a substantial drop in foreign reserves as a result of these capital outflows. Another significant instance took place during the 2001 economic crisis, where capital flight contributed to a severe recession and banking collapse. Argentine households and businesses converted pesos into U.S. dollars, transferring funds abroad to protect their assets from inflation and government intervention. Economic reports indicate that the country lost approximately $50 billion to capital flight in the early 2000s, exacerbating fiscal imbalances and undermining economic recovery efforts.

Table of Comparison

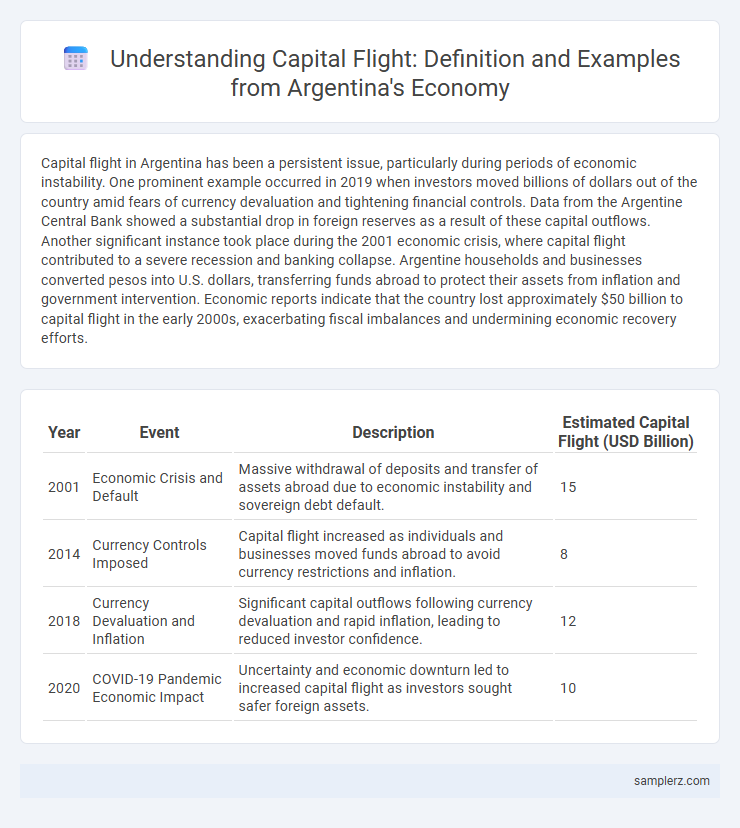

| Year | Event | Description | Estimated Capital Flight (USD Billion) |

|---|---|---|---|

| 2001 | Economic Crisis and Default | Massive withdrawal of deposits and transfer of assets abroad due to economic instability and sovereign debt default. | 15 |

| 2014 | Currency Controls Imposed | Capital flight increased as individuals and businesses moved funds abroad to avoid currency restrictions and inflation. | 8 |

| 2018 | Currency Devaluation and Inflation | Significant capital outflows following currency devaluation and rapid inflation, leading to reduced investor confidence. | 12 |

| 2020 | COVID-19 Pandemic Economic Impact | Uncertainty and economic downturn led to increased capital flight as investors sought safer foreign assets. | 10 |

Overview of Capital Flight in Argentina

Capital flight in Argentina has been characterized by massive investor withdrawals, with estimates exceeding $150 billion between 2011 and 2023, fueled by political instability, high inflation rates surpassing 100%, and restrictive currency controls. These capital outflows have severely impacted Argentina's foreign exchange reserves, reducing them to critical levels and exacerbating the country's debt challenges. The persistent loss of capital undermines economic growth prospects and increases vulnerability to external shocks.

Historical Instances of Argentine Capital Flight

Historical instances of Argentine capital flight peaked during the late 20th century, especially in the 1980s hyperinflation period when investors moved billions of dollars abroad to safeguard assets. The 2001 economic crisis triggered another massive capital outflow, estimated at over $30 billion, as domestic financial instability and government interventions eroded investor confidence. Persistent capital flight in Argentina has been driven by high inflation rates, currency controls, and political uncertainty, profoundly impacting the country's economic growth and foreign investment climate.

Causes of Capital Flight in Argentina

Capital flight in Argentina has been primarily driven by persistent inflation rates exceeding 50%, eroding real returns for investors and prompting them to seek safer currencies abroad. Government-imposed currency controls and restrictive regulations on foreign exchange transactions have further incentivized the movement of capital outside the country. Political and economic instability, including fiscal deficits and sovereign debt concerns, contribute significantly to the erosion of investor confidence and the acceleration of capital outflows.

Notable Episodes: 2001 Argentine Crisis

During the 2001 Argentine crisis, capital flight accelerated dramatically as investors and citizens moved approximately $20 billion out of the country in response to economic instability and debt default fears. The freeze on bank deposits, known as the "corralito," exacerbated the flight as trust in the banking system plummeted. This massive outflow of capital deepened the recession, leading to a GDP contraction of nearly 10% in 2002.

Government Policies and Capital Outflows

Government policies in Argentina, such as strict currency controls and high inflation rates, have triggered significant capital flight, as investors seek safer assets abroad. Between 2019 and 2023, capital outflows reached an estimated $20 billion, reflecting a loss of investor confidence and economic instability. These outflows exacerbate foreign exchange shortages, further weakening the Argentine peso and constraining economic growth.

Impact of Capital Flight on Argentina’s Economy

Capital flight in Argentina has significantly reduced foreign exchange reserves, destabilizing the national currency and increasing inflation rates. The outflow of capital has hampered investment in critical sectors such as infrastructure and manufacturing, leading to slower economic growth. This persistent capital flight has eroded investor confidence, resulting in higher borrowing costs and exacerbating the country's fiscal deficits.

Role of Foreign Currency Acquisition

Capital flight in Argentina has been significantly driven by the widespread acquisition of foreign currency, particularly the US dollar, as a means to hedge against inflation and peso devaluation. Restrictions on currency exchange and high inflation rates have incentivized businesses and individuals to convert pesos into stable foreign currencies, exacerbating the depletion of Argentina's foreign reserves. This persistent demand for foreign currency has weakened investor confidence and intensified economic instability, complicating fiscal recovery efforts.

Real Estate Investment Abroad by Argentines

Capital flight in Argentina is exemplified by significant real estate investments made by Argentines abroad, particularly in countries like Uruguay, Spain, and the United States. This trend reflects a lack of confidence in the domestic economy due to inflation, currency controls, and political instability. According to recent studies, Argentine investment in foreign property surged by over 30% in the last five years, signaling a strategic move to preserve wealth and hedge against economic uncertainty.

Banking Sector and Offshore Transactions

Capital flight in Argentina's banking sector has surged as depositors move billions of dollars offshore to evade currency controls and economic instability. Offshore transactions via jurisdictions like Uruguay and Panama facilitate the rapid outflow of capital, undermining domestic liquidity and weakening the peso. This persistent outflow exacerbates inflationary pressures and restricts credit availability within Argentina's financial system.

Anti-Capital Flight Measures and Their Effectiveness

Argentina implemented strict capital controls in 2011, limiting the purchase of foreign currency to curb capital flight amid economic instability. These measures included mandatory central bank approvals and increased taxes on dollar purchases, effectively reducing official dollar demand but encouraging a parallel black market. Despite temporary stabilization, capital flight persisted through informal channels, highlighting the limited long-term effectiveness of such controls in Argentina's volatile economic environment.

example of capital flight in Argentina Infographic

samplerz.com

samplerz.com