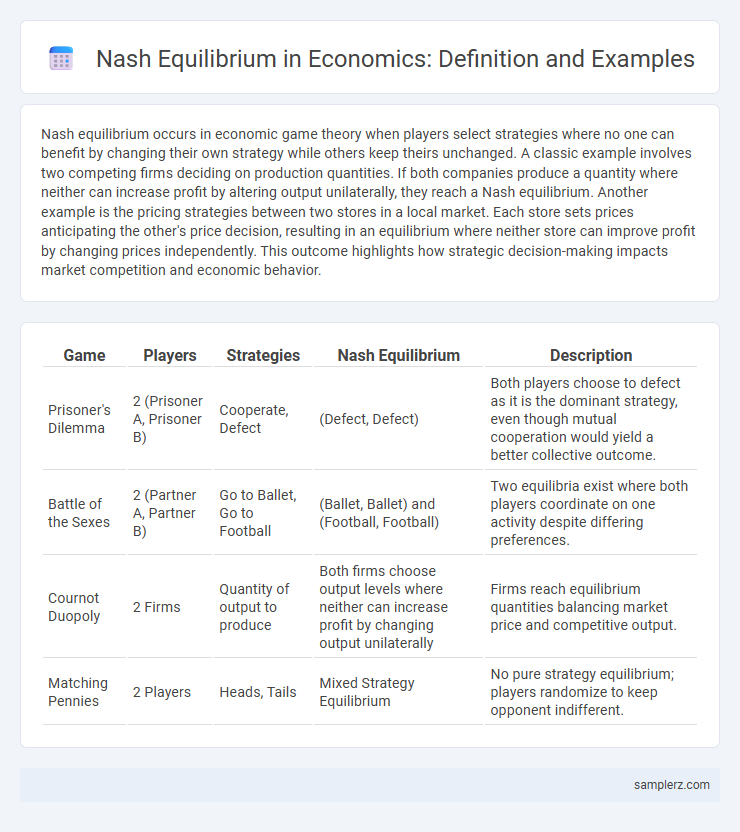

Nash equilibrium occurs in economic game theory when players select strategies where no one can benefit by changing their own strategy while others keep theirs unchanged. A classic example involves two competing firms deciding on production quantities. If both companies produce a quantity where neither can increase profit by altering output unilaterally, they reach a Nash equilibrium. Another example is the pricing strategies between two stores in a local market. Each store sets prices anticipating the other's price decision, resulting in an equilibrium where neither store can improve profit by changing prices independently. This outcome highlights how strategic decision-making impacts market competition and economic behavior.

Table of Comparison

| Game | Players | Strategies | Nash Equilibrium | Description |

|---|---|---|---|---|

| Prisoner's Dilemma | 2 (Prisoner A, Prisoner B) | Cooperate, Defect | (Defect, Defect) | Both players choose to defect as it is the dominant strategy, even though mutual cooperation would yield a better collective outcome. |

| Battle of the Sexes | 2 (Partner A, Partner B) | Go to Ballet, Go to Football | (Ballet, Ballet) and (Football, Football) | Two equilibria exist where both players coordinate on one activity despite differing preferences. |

| Cournot Duopoly | 2 Firms | Quantity of output to produce | Both firms choose output levels where neither can increase profit by changing output unilaterally | Firms reach equilibrium quantities balancing market price and competitive output. |

| Matching Pennies | 2 Players | Heads, Tails | Mixed Strategy Equilibrium | No pure strategy equilibrium; players randomize to keep opponent indifferent. |

Real-World Applications of Nash Equilibrium in Economics

In economic markets, the Nash equilibrium is exemplified by firms setting prices where no company can increase profits by independently changing its price, such as in oligopolistic competition among airlines. This strategic interaction stabilizes market outcomes, as seen in bidding wars for spectrum auctions where telecommunication companies balance bids to maximize gains without overpaying. Resource allocation in public goods scenarios also relies on Nash equilibrium, where individuals contribute optimally knowing others' contributions prevent underfunding or inefficiency.

Nash Equilibrium: Key Examples from Competitive Markets

In competitive markets, the Nash equilibrium occurs when firms choose strategies such that no player can benefit by unilaterally changing their output or pricing, exemplified by the Cournot duopoly model where two companies determine production levels to maximize profits. Another key example is the Bertrand competition, where firms simultaneously select prices, leading to equilibrium at marginal cost pricing, preventing any incentive to deviate. These scenarios demonstrate how strategic interdependence shapes outcomes in oligopolistic markets, sustaining equilibrium through mutual best responses.

Oligopoly Pricing Strategies: A Nash Equilibrium Perspective

In oligopoly pricing strategies, the Nash equilibrium occurs when firms set prices considering competitors' likely reactions, resulting in stable prices with no incentive for unilateral deviation. For example, in a duopoly, if both firms choose high prices anticipating mutual benefits and avoiding price wars, neither gains by changing prices alone. This equilibrium highlights strategic interdependence, where firms balance profit maximization and competitive behavior under market constraints.

The Prisoner's Dilemma: A Classic Economic Nash Equilibrium

The Prisoner's Dilemma exemplifies a classic Nash equilibrium in economics, where two individuals acting in their own self-interest fail to achieve the optimal collective outcome. Each prisoner independently chooses to betray the other, leading to a worse payoff than if both had cooperated. This scenario highlights the tension between individual rationality and collective benefit, demonstrating why cooperation is difficult to sustain in competitive economic environments.

Auction Designs and Nash Equilibrium Outcomes

In auction designs, the Nash equilibrium occurs when bidders submit strategies where no individual can improve their payoff by changing their bid, given others' bids. For instance, in a sealed-bid first-price auction, each bidder bids below their true valuation to balance winning probability and payment, resulting in equilibrium strategies. These outcomes ensure predictable revenue and strategic behavior, highlighting the interplay between auction format and bidder incentives in economic theory.

Cartel Behavior Explained with Nash Equilibrium

In cartel behavior, firms coordinate to maximize joint profits by restricting output or fixing prices, yet each member faces incentives to cheat for individual gain. Nash equilibrium occurs when no cartel member benefits from unilaterally deviating, stabilizing collusion despite temptation to undercut competitors. This strategic interdependence highlights how cartels sustain cooperation through mutual expectations of punishment or retaliation in repeated interactions.

Labor Markets and Wage Negotiation: Nash Equilibrium Scenarios

In labor markets, Nash equilibrium occurs when employers and workers choose wage and effort levels where neither party benefits from changing their strategy unilaterally, such as both agreeing to a wage that balances labor supply and demand. In wage negotiation, an equilibrium is reached when unions and firms settle on wage contracts maximizing mutual gains without incentives for deviation, reflecting strategic interdependence. These scenarios illustrate optimal outcomes under competitive labor conditions where rational agents stabilize wage offers and acceptance rates.

Public Goods Contribution: Nash Equilibrium in Action

In Public Goods Contribution games, the Nash equilibrium occurs when each individual contributes an amount where no one can increase their payoff by unilaterally changing their contribution. This equilibrium often leads to under-provision of the public good, as individuals weigh personal cost against shared benefits. The classic example is the "free rider problem," where individuals benefit from the public good without contributing, stabilizing a suboptimal contribution level.

International Trade Agreements and Nash Equilibrium

In international trade agreements, a Nash equilibrium occurs when countries choose their optimal trade policies, such as tariffs and quotas, assuming other countries' strategies are fixed, resulting in no incentive to unilaterally change their policies. This equilibrium often explains why states maintain mutually beneficial trade terms despite the temptation to impose protectionist measures. The World Trade Organization (WTO) frameworks exemplify Nash equilibria by promoting cooperative behavior that balances national interests and global economic stability.

Game Theory in Financial Markets: Nash Equilibrium Case Studies

In financial markets, Nash equilibrium occurs when traders select strategies where no participant can gain by unilaterally changing their decision, such as in bidding during an auction or choosing investment portfolios. A classic case study involves competing firms setting prices under incomplete information, where equilibrium prices reflect optimal responses to rivals' pricing strategies. This strategic behavior reduces the incentive for deviation, stabilizing market dynamics and informing risk management models.

example of Nash equilibrium in game Infographic

samplerz.com

samplerz.com