The real business cycle (RBC) theory explains fluctuations in economic activity through changes in productivity shocks. A prominent example occurred during the early 2000s when technological advancements in information technology led to a significant positive productivity shock. This surge in productivity increased output and employment, demonstrating how innovation-driven shocks can stimulate economic growth under the RBC framework. Another example of a negative productivity shock is the 1970s oil crisis, which caused a substantial decline in production efficiency. The sharp increase in oil prices disrupted supply chains and raised costs for businesses, leading to reduced output and higher unemployment. This episode aligns with RBC models, where declines in productivity directly impact economic performance through variations in labor and capital utilization.

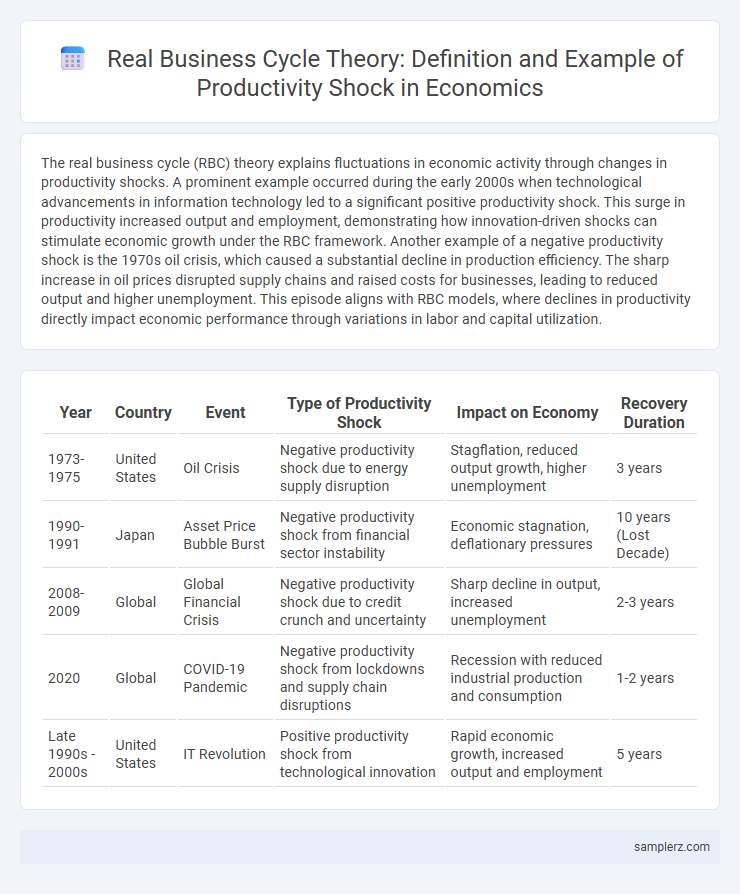

Table of Comparison

| Year | Country | Event | Type of Productivity Shock | Impact on Economy | Recovery Duration |

|---|---|---|---|---|---|

| 1973-1975 | United States | Oil Crisis | Negative productivity shock due to energy supply disruption | Stagflation, reduced output growth, higher unemployment | 3 years |

| 1990-1991 | Japan | Asset Price Bubble Burst | Negative productivity shock from financial sector instability | Economic stagnation, deflationary pressures | 10 years (Lost Decade) |

| 2008-2009 | Global | Global Financial Crisis | Negative productivity shock due to credit crunch and uncertainty | Sharp decline in output, increased unemployment | 2-3 years |

| 2020 | Global | COVID-19 Pandemic | Negative productivity shock from lockdowns and supply chain disruptions | Recession with reduced industrial production and consumption | 1-2 years |

| Late 1990s - 2000s | United States | IT Revolution | Positive productivity shock from technological innovation | Rapid economic growth, increased output and employment | 5 years |

Introduction to Real Business Cycles and Productivity Shocks

Real business cycles (RBC) illustrate how technology-driven productivity shocks cause fluctuations in economic output and employment. For instance, a sudden improvement in manufacturing technology can increase total factor productivity, leading to higher output and labor demand. This productivity shock prompts firms to invest more, fueling economic expansion without relying on monetary or fiscal interventions.

Defining Productivity Shocks in Economic Terms

Productivity shocks are sudden, unexpected changes in the efficiency with which inputs such as labor and capital produce output, significantly impacting economic growth and business cycles. These shocks can be positive, like technological innovations, or negative, such as natural disasters disrupting production processes. Real business cycle theory uses productivity shocks to explain fluctuations in output, employment, and consumption by altering the economy's production function.

Historical Cases of Productivity Shocks Impacting Economies

The 1973 oil crisis exemplifies a real business cycle triggered by a negative productivity shock, where skyrocketing oil prices drastically reduced production efficiency across global economies. This supply-side disruption led to stagflation, characterized by simultaneous inflation and economic recession in many industrialized nations. Economists study such historical cases to understand the persistent effects of exogenous productivity shocks on output, employment, and long-term growth trajectories.

The 1970s Technological Change and Its Economic Ripple Effects

The 1970s experienced a significant productivity shock with the advent of new computer technologies and automation, fundamentally altering manufacturing processes. This technological change led to fluctuations in output and employment, reflecting real business cycle dynamics as firms adapted to increased efficiency and shifting labor demands. Consequently, the ripple effects included a reallocation of resources across industries and changes in wage structures, highlighting the interplay between technology and economic cycles.

Productivity Shock: The Dot-Com Boom and Bust

The Dot-Com Boom and Bust in the late 1990s and early 2000s exemplifies a real business cycle driven by a productivity shock, where rapid technological advancements in internet and computer technologies spurred significant productivity gains and economic expansion. This surge triggered increased investment and employment in the tech sector, boosting overall economic output. The subsequent bust, caused by overvaluation and reduced productivity growth, led to sharp contractions in investment and employment, demonstrating the cyclical impacts of productivity fluctuations on the economy.

Analyzing the 2008 Financial Crisis from an RBC Perspective

The 2008 Financial Crisis represents a critical example of a real business cycle triggered by a severe negative productivity shock, where disruptions in credit markets sharply reduced firms' ability to invest and produce. Empirical RBC models highlight declines in total factor productivity (TFP) during this period, resulting in significant output contraction and increased unemployment. This productivity shock, compounded by financial frictions, amplified the recession's depth and duration, illustrating the interplay between real economic fundamentals and cyclical fluctuations.

COVID-19 Pandemic as a Modern Productivity Shock Example

The COVID-19 pandemic triggered a significant negative productivity shock by disrupting global supply chains and reducing labor force participation due to health risks and lockdown measures. This sudden change led to a sharp decline in output and increased economic volatility, characteristic of real business cycle theory effects. Recovery phases have shown heterogeneous productivity rebounds across industries, reflecting varying adaptability to remote work and technological integration.

Agricultural Sector: Weather-Induced Real Business Cycles

Weather-induced real business cycles in the agricultural sector significantly impact productivity by causing fluctuations in crop yields and harvest timing. Droughts and excessive rainfall trigger supply shocks that reduce output and disrupt labor allocation, thereby affecting overall economic growth. These productivity variations highlight the sensitivity of agricultural economies to climatic conditions, emphasizing the need for adaptive strategies and risk management.

Oil Price Shocks and Their Real Business Cycle Implications

Oil price shocks represent a significant source of productivity shocks within real business cycle theory, causing fluctuations in production costs and output levels. Sharp increases in oil prices reduce overall productivity by raising input costs, leading to lower labor demand and decreased economic growth in oil-dependent industries. Empirical studies show that oil price shocks can induce recessions and prolonged adjustments in capital allocation, highlighting their critical role in business cycle dynamics.

Lessons Learned: Policy Responses to Productivity-Induced Fluctuations

Productivity shocks, such as the 2008 financial crisis triggered by a sudden decline in technological investment, demonstrate how rapid changes in productivity can cause significant economic fluctuations. Effective policy responses include implementing countercyclical fiscal measures, like increased government spending, and monetary policies aimed at stabilizing demand and promoting investment. These lessons emphasize the importance of timely government intervention to mitigate output volatility and support long-term economic growth during periods of productivity-induced shocks.

example of real business cycle in productivity shock Infographic

samplerz.com

samplerz.com