Shadow banking refers to non-bank financial intermediaries that provide services similar to traditional banks but operate outside normal banking regulations. Examples include hedge funds, money market funds, and structured investment vehicles. These entities engage in credit intermediation by offering loans, credit, or liquidity without the same regulatory oversight as commercial banks. Data shows shadow banking plays a significant role in global finance, accounting for trillions of dollars in assets. For instance, in the United States, the shadow banking sector represents approximately $15 trillion in non-bank financial assets. This extensive network can influence credit markets and liquidity but poses risks due to limited transparency and regulatory safeguards.

Table of Comparison

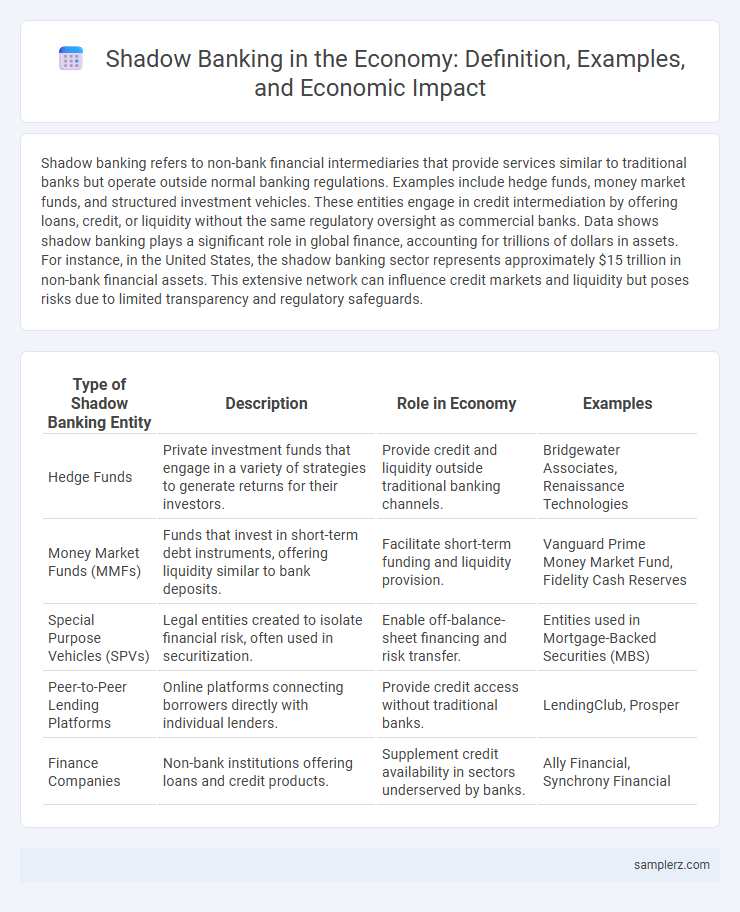

| Type of Shadow Banking Entity | Description | Role in Economy | Examples |

|---|---|---|---|

| Hedge Funds | Private investment funds that engage in a variety of strategies to generate returns for their investors. | Provide credit and liquidity outside traditional banking channels. | Bridgewater Associates, Renaissance Technologies |

| Money Market Funds (MMFs) | Funds that invest in short-term debt instruments, offering liquidity similar to bank deposits. | Facilitate short-term funding and liquidity provision. | Vanguard Prime Money Market Fund, Fidelity Cash Reserves |

| Special Purpose Vehicles (SPVs) | Legal entities created to isolate financial risk, often used in securitization. | Enable off-balance-sheet financing and risk transfer. | Entities used in Mortgage-Backed Securities (MBS) |

| Peer-to-Peer Lending Platforms | Online platforms connecting borrowers directly with individual lenders. | Provide credit access without traditional banks. | LendingClub, Prosper |

| Finance Companies | Non-bank institutions offering loans and credit products. | Supplement credit availability in sectors underserved by banks. | Ally Financial, Synchrony Financial |

Overview of Shadow Banking in the Modern Economy

Shadow banking in the modern economy encompasses non-bank financial intermediaries like hedge funds, money market funds, and peer-to-peer lending platforms that operate outside traditional regulatory frameworks. These entities facilitate credit creation and liquidity provision but pose systemic risks due to their opacity and leverage. Understanding shadow banking's role is crucial for monitoring financial stability and crafting effective regulatory policies.

Key Characteristics of Shadow Banking Systems

Shadow banking systems operate outside traditional regulatory frameworks, involving entities like hedge funds, money market funds, and special purpose vehicles (SPVs). These systems are characterized by high leverage, maturity transformation, and liquidity transformation, which amplify financial risks without the safety nets typical of regulated banks. Their lack of transparency and reliance on short-term funding make shadow banks vulnerable to sudden market shocks, impacting overall economic stability.

Major Shadow Banking Entities and Their Roles

Major shadow banking entities include hedge funds, private equity firms, and money market funds, which operate outside traditional banking regulations. These institutions provide financing through non-bank channels such as securitization, repurchase agreements, and credit intermediation. Their roles significantly impact liquidity and credit availability but pose systemic risks due to limited transparency and regulatory oversight.

Examples of Shadow Banking Practices Worldwide

Shadow banking practices worldwide include securitization of loans through special purpose vehicles (SPVs), peer-to-peer (P2P) lending platforms, and hedge funds engaging in credit intermediation outside traditional banking regulations. In China, wealth management products and trust companies play significant roles in shadow banking by channeling funds into real estate and local government financing. In the United States, money market funds and structured investment vehicles (SIVs) operate as shadow banks, providing liquidity and credit without deposit insurance or direct Federal Reserve oversight.

Impact of Shadow Banking on Economic Stability

Shadow banking, including entities like hedge funds and money market funds, operates outside traditional banking regulations and poses significant risks to economic stability. These institutions can amplify systemic risk due to high leverage and lack of transparency, leading to potential liquidity crises. The 2008 financial crisis exemplified how shadow banking activities can trigger widespread economic disruption and regulatory challenges.

Regulatory Challenges in Controlling Shadow Banks

Shadow banking entities, such as money market funds, hedge funds, and securitization vehicles, operate outside traditional banking regulations, creating significant regulatory challenges. These institutions engage in credit intermediation without direct oversight, increasing systemic risk and complicating efforts to monitor financial stability. Regulatory bodies struggle to implement effective controls due to the opaque nature of shadow banking activities and their interconnectedness with the formal banking system.

Case Studies: Shadow Banking in Developing Economies

In developing economies, shadow banking often manifests through informal lending networks and non-bank financial intermediaries that provide credit outside traditional banking regulations. For instance, in India, microfinance institutions act as crucial shadow banks by offering loans to underserved rural populations, bypassing formal banking requirements. Similarly, in China, wealth management products and trust companies have expanded shadow banking activities, fueling rapid credit growth but also raising concerns over financial stability.

Risks and Benefits of Shadow Banking Activities

Shadow banking, including entities like hedge funds and money market funds, provides crucial credit sources outside traditional banking, enhancing financial market liquidity and offering alternative financing options. However, shadow banking carries significant risks such as high leverage, lack of regulatory oversight, and potential for systemic instability during economic downturns. These activities can amplify credit cycles, increasing vulnerability to financial crises while fostering innovation and diversification in financial services.

Comparing Shadow Banking to Traditional Banking Models

Shadow banking involves financial intermediaries like hedge funds and money market funds that operate outside traditional banking regulations, providing credit through non-depository channels. Unlike traditional banks, shadow banks do not rely on customer deposits but often engage in securitization, repurchase agreements, and off-balance-sheet lending, increasing systemic risk. This sector's growth, exemplified by entities such as structured investment vehicles (SIVs), contributes to credit expansion but lacks the regulatory oversight typical of commercial banks, impacting financial stability.

Future Trends in Global Shadow Banking Operations

Future trends in global shadow banking operations indicate a significant rise in fintech-driven credit intermediation, leveraging blockchain and AI to enhance transaction transparency and efficiency. Emerging markets are witnessing rapid expansion in peer-to-peer lending platforms and digital asset management, challenging traditional banking frameworks. Regulatory bodies are increasingly adopting real-time monitoring systems and cross-border cooperation to mitigate systemic risks posed by these evolving shadow banking entities.

example of shadow banking in economy Infographic

samplerz.com

samplerz.com