Stagflation occurs when an economy experiences stagnant growth, high unemployment, and rising inflation simultaneously. A notable example is the United States during the 1970s, when oil price shocks led to increased production costs and inflation rates soared above 10%. Despite inflation, the economy struggled with slow growth and unemployment rates climbing over 8%, creating a challenging environment for policymakers. This period demonstrated the difficulty of addressing multiple economic problems at once. Efforts to combat inflation through tight monetary policies often worsened unemployment and stagnation. The 1970s stagflation remains a significant case study in economic history for understanding the complex interaction between inflation, unemployment, and growth.

Table of Comparison

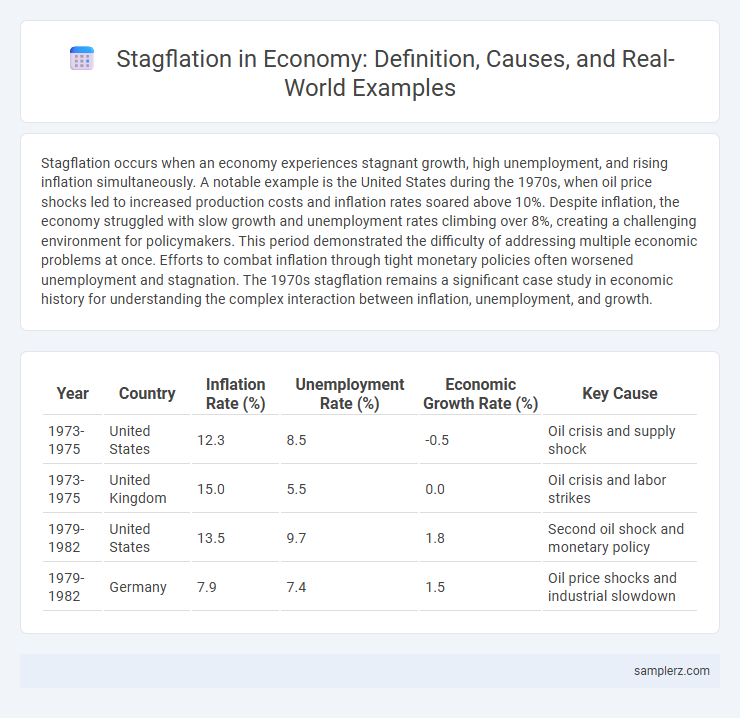

| Year | Country | Inflation Rate (%) | Unemployment Rate (%) | Economic Growth Rate (%) | Key Cause |

|---|---|---|---|---|---|

| 1973-1975 | United States | 12.3 | 8.5 | -0.5 | Oil crisis and supply shock |

| 1973-1975 | United Kingdom | 15.0 | 5.5 | 0.0 | Oil crisis and labor strikes |

| 1979-1982 | United States | 13.5 | 9.7 | 1.8 | Second oil shock and monetary policy |

| 1979-1982 | Germany | 7.9 | 7.4 | 1.5 | Oil price shocks and industrial slowdown |

Defining Stagflation: Key Characteristics

Stagflation is an economic condition characterized by stagnant economic growth, high unemployment rates, and persistent inflation occurring simultaneously. This anomaly challenges traditional economic theories, as inflation typically inversely correlates with unemployment according to the Phillips curve. Key features include rising consumer prices despite a contracting GDP, typically driven by supply shocks and ineffective monetary policies, as seen in the 1970s global oil crisis.

Historical Case Study: 1970s U.S. Stagflation

The 1970s U.S. stagflation presents a critical case of simultaneous high inflation and stagnant economic growth, driven largely by oil price shocks and monetary policy challenges. Inflation rates soared above 10%, while unemployment remained persistently high, reaching near 9% in 1975, defying the traditional Phillips Curve trade-off. This period underscores the complex dynamics between supply-side shocks and macroeconomic policy limitations in managing stagflation.

Stagflation in the United Kingdom: Lessons from the 1970s

The United Kingdom experienced severe stagflation during the 1970s, marked by simultaneous high inflation rates exceeding 20%, stagnant economic growth, and unemployment rising above 5%. Key factors included oil price shocks from OPEC, expansive fiscal policies, and labor market rigidities that fueled wage-price spirals. The UK's stagflation crisis highlighted the limitations of Keynesian policies and underscored the need for monetary restraint and structural reforms.

Japan’s Experience with Stagflation Pressures

Japan experienced stagflation during the 1970s due to oil price shocks that led to soaring inflation and stagnant economic growth. The rapid increase in energy costs severely impacted industrial output, resulting in rising unemployment and diminished consumer spending. These stagflation pressures in Japan highlighted the challenges of managing inflation without stifling economic expansion.

Recent Stagflation Risks in Emerging Markets

Recent stagflation risks in emerging markets have intensified due to surging commodity prices, persistent supply chain disruptions, and tightening monetary policies. Countries like Argentina, Turkey, and South Africa face rising inflation rates above 10% alongside stagnant or contracting GDP growth, straining fiscal stability. Structural vulnerabilities, including high external debt and currency depreciation, exacerbate inflationary pressures while limiting conventional policy responses.

Causes and Triggers of Stagflation in Modern Economies

Stagflation in modern economies is primarily caused by a combination of supply shocks, such as sudden increases in oil prices, and restrictive monetary policies that curtail economic growth while inflation rises. Key triggers include persistent cost-push inflation from higher production expenses and wage-price spirals, coupled with stagnant demand and rising unemployment. Central banks' responses to inflation without accommodating economic growth often exacerbate the stagflationary environment.

Economic Indicators Signaling Stagflation

Stagflation is characterized by rising inflation rates above 5%, elevated unemployment levels exceeding 7%, and stagnant or negative GDP growth, typically below 1%. Key economic indicators include a sharp increase in consumer price index (CPI), declining industrial production, and weak labor market performance. The 1970s U.S. economy exemplifies stagflation, with inflation peaking near 13.5%, unemployment rising to 9%, and GDP growth stagnating during the oil crisis period.

Policy Responses to Combat Stagflation

Central banks often respond to stagflation by tightening monetary policy to control inflation while risking higher unemployment. Fiscal measures may include targeted government spending and tax incentives aimed at boosting productive capacity without exacerbating price pressures. Structural reforms that enhance labor market flexibility and increase competition are essential to address the underlying supply-side constraints driving stagflation.

Impact of Stagflation on Global Trade and Investment

Stagflation, characterized by simultaneous high inflation and stagnant economic growth, severely disrupts global trade by increasing production costs and reducing consumer demand across countries. This economic condition leads to volatile currency markets and elevated risk premiums, deterring foreign direct investment and complicating supply chain management. Consequently, multinational corporations often delay expansion plans, causing long-term declines in global capital flows and trade volumes.

Future Outlook: Preventing Stagflation Recurrence

Proactive monetary policies targeting controlled inflation and sustainable growth are critical to preventing stagflation recurrence in future economies. Investing in technological innovation and workforce skill development enhances productivity, mitigating supply-side shocks that trigger stagflation. International coordination on energy prices and fiscal discipline supports economic stability and reduces stagflation risks.

example of stagflation in economy Infographic

samplerz.com

samplerz.com