Deadweight loss in taxation occurs when taxes lead to decreased economic activity, causing a loss of total welfare that neither the government nor taxpayers receive. For example, imposing a high sales tax on luxury goods may result in fewer purchases, reducing the quantity sold below the optimal market level. This decline in trade lowers consumer and producer surplus, illustrating how taxation can create inefficiencies in resource allocation. Capital gains tax also exemplifies deadweight loss by discouraging investment and asset sales. Investors may hold onto assets longer to avoid taxation, resulting in less frequent trades and reduced market liquidity. This behavior interferes with the efficient flow of capital, impairing economic growth and generating losses beyond just the tax revenue collected.

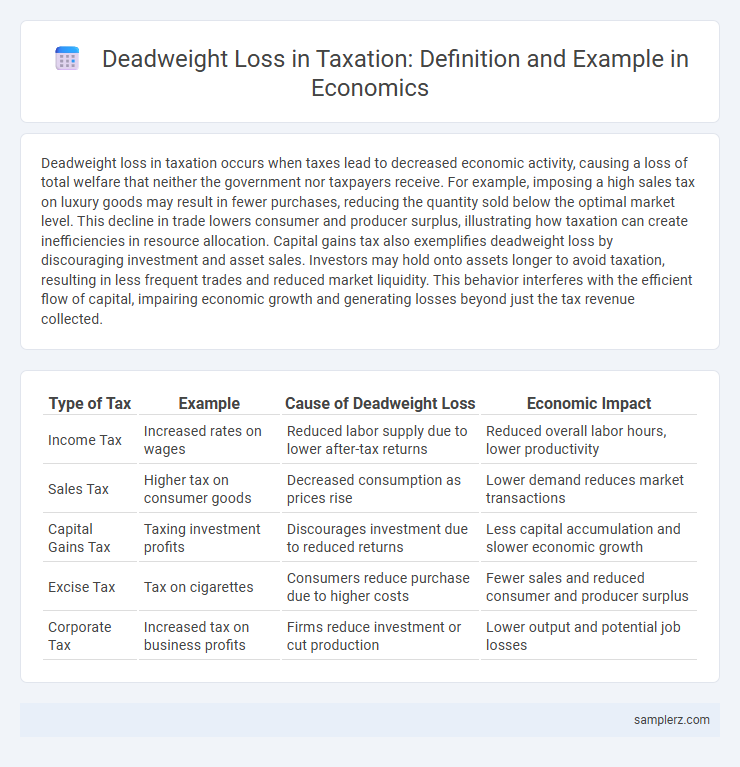

Table of Comparison

| Type of Tax | Example | Cause of Deadweight Loss | Economic Impact |

|---|---|---|---|

| Income Tax | Increased rates on wages | Reduced labor supply due to lower after-tax returns | Reduced overall labor hours, lower productivity |

| Sales Tax | Higher tax on consumer goods | Decreased consumption as prices rise | Lower demand reduces market transactions |

| Capital Gains Tax | Taxing investment profits | Discourages investment due to reduced returns | Less capital accumulation and slower economic growth |

| Excise Tax | Tax on cigarettes | Consumers reduce purchase due to higher costs | Fewer sales and reduced consumer and producer surplus |

| Corporate Tax | Increased tax on business profits | Firms reduce investment or cut production | Lower output and potential job losses |

Understanding Deadweight Loss in Taxation

Deadweight loss in taxation occurs when taxes create inefficiencies by reducing the quantity of goods or services traded below the market equilibrium, leading to lost economic welfare. For example, a high sales tax on fuel increases prices, causing consumers to buy less fuel and producers to sell less, shrinking total surplus. This reduction in mutually beneficial trades illustrates how tax rates above optimal levels can distort market behavior and reduce overall efficiency.

How Taxes Create Market Inefficiencies

Taxes impose a wedge between buyers' willingness to pay and sellers' willingness to accept, reducing the quantity traded below the efficient market equilibrium. This distortion leads to deadweight loss, where potential gains from trade are lost because taxes discourage mutually beneficial transactions. For example, a sales tax on goods increases prices for consumers while lowering net revenue for producers, causing underproduction and allocative inefficiency in the market.

Real-World Examples of Deadweight Loss from Sales Tax

Sales taxes on goods such as electronics often cause deadweight loss by reducing consumer purchases and decreasing overall market efficiency. In states with high sales tax rates, studies show significant drops in retail sales, reflecting a loss in consumer surplus and producer revenue. This distortion leads to fewer transactions than optimal, illustrating the economic inefficiency created by sales tax-induced deadweight loss.

The Deadweight Loss Effect of Income Taxation

Income taxation creates deadweight loss by reducing the incentive for individuals to work, as higher marginal tax rates decrease after-tax wages. This leads to a decline in labor supply, causing a loss of total economic surplus that neither benefits taxpayers nor the government. The resulting inefficiency distorts labor market behavior and reduces overall productivity in the economy.

Case Study: Deadweight Loss from Cigarette Taxes

Cigarette taxes create deadweight loss by reducing consumption below the socially optimal level, leading to lost consumer and producer surplus. For example, imposing a $2 per pack tax increases prices, causing smokers to buy fewer cigarettes and reducing overall market efficiency. Studies show that while cigarette taxes raise government revenue and discourage smoking, they also result in a welfare loss estimated between 20% and 40% of the tax revenue collected.

Corporate Taxes and Economic Inefficiency

Corporate taxes can create deadweight loss by discouraging investment and reducing the efficiency of capital allocation in the economy. When corporations face high tax rates, they may cut back on productive activities such as research and development or expansion, leading to lower overall economic outputs. This inefficiency results in lost potential gains that neither the government collects as revenue nor the businesses generate as profit, harming economic growth.

Deadweight Loss: Luxury Goods Taxation Explained

Taxation on luxury goods often leads to deadweight loss by reducing consumer and producer surplus without generating equivalent tax revenue. When higher taxes increase prices on items like high-end cars or designer apparel, demand decreases disproportionately, causing inefficiencies in market allocation. This results in lost economic welfare as buyers forgo purchases and sellers reduce output, highlighting the trade-off between tax revenue and market efficiency.

Illustrating Deadweight Loss Through VAT Implementation

The implementation of a Value Added Tax (VAT) often leads to deadweight loss by increasing the overall price of goods, which reduces consumer demand and producer supply compared to a no-tax scenario. For instance, if a VAT raises the price of electronics by 15%, some consumers may forgo purchases, resulting in lost sales and a decrease in total economic welfare. This inefficiency reflects the gap between potential gains from trade and actual market outcomes due to the taxation-induced distortion.

The Impact of Taxation on Consumer and Producer Surplus

Taxation creates deadweight loss by reducing both consumer and producer surplus, as higher prices decrease demand while lower returns discourage production. For example, a 10% tax on gasoline raises prices, leading consumers to buy less fuel, which shrinks consumer surplus and leaves producers with unsold inventory, reducing their producer surplus. This inefficiency results in a loss of total economic welfare, illustrating the negative impact of taxation on market equilibrium.

Policy Implications: Minimizing Deadweight Loss in Tax Systems

High marginal tax rates on labor income can create significant deadweight loss by discouraging work effort and reducing overall economic output. Implementing broad-based, low-rate consumption taxes minimizes market distortions and preserves incentives for productivity. Policymakers should prioritize tax designs that balance revenue generation with economic efficiency to sustain long-term growth.

example of deadweight loss in taxation Infographic

samplerz.com

samplerz.com