Moral hazard in insurance occurs when insured individuals or entities take greater risks because they do not bear the full cost of those risks. For example, a homeowner with comprehensive fire insurance may be less vigilant about fire safety measures, knowing that damages will be covered by the insurer. This behavior increases the likelihood of claims, raising costs for insurance companies and impacting overall premiums. In the health insurance sector, moral hazard is evident when patients overuse medical services because insurance covers most expenses. A person with extensive health coverage might schedule unnecessary tests or treatments, inflating healthcare costs and straining resources. Insurers must adjust policies or premiums to manage this risk, affecting both providers and insured parties in the economy.

Table of Comparison

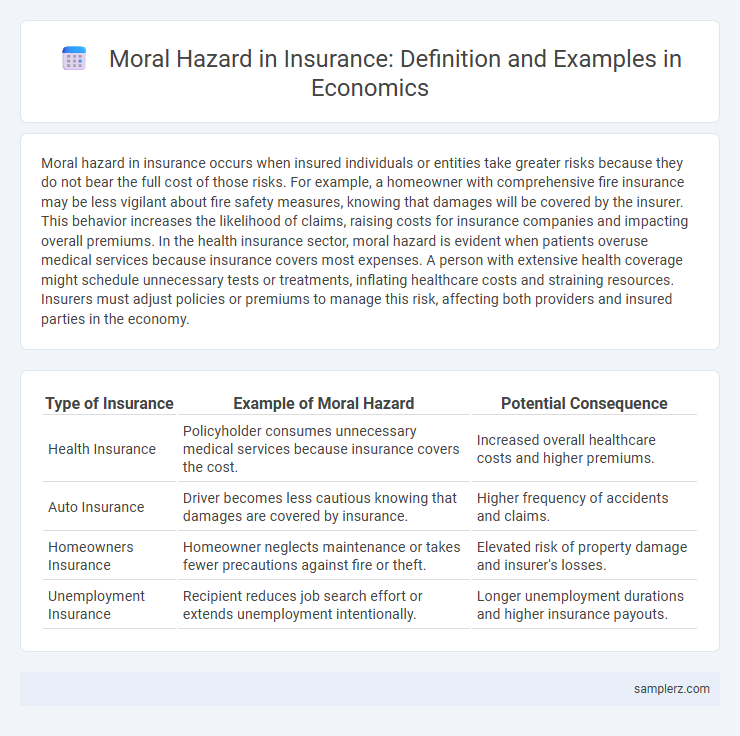

| Type of Insurance | Example of Moral Hazard | Potential Consequence |

|---|---|---|

| Health Insurance | Policyholder consumes unnecessary medical services because insurance covers the cost. | Increased overall healthcare costs and higher premiums. |

| Auto Insurance | Driver becomes less cautious knowing that damages are covered by insurance. | Higher frequency of accidents and claims. |

| Homeowners Insurance | Homeowner neglects maintenance or takes fewer precautions against fire or theft. | Elevated risk of property damage and insurer's losses. |

| Unemployment Insurance | Recipient reduces job search effort or extends unemployment intentionally. | Longer unemployment durations and higher insurance payouts. |

Understanding Moral Hazard in Insurance

Moral hazard in insurance occurs when policyholders engage in riskier behavior because they are protected from the financial consequences, such as a driver being less cautious after obtaining comprehensive car insurance. This phenomenon undermines the insurer's ability to accurately price risk, leading to higher premiums or potential market inefficiencies. Understanding moral hazard is crucial for designing contracts with deductibles, co-pays, or monitoring mechanisms to align incentives between insurers and insured parties.

Classic Examples of Moral Hazard in Health Insurance

Classic examples of moral hazard in health insurance include patients overusing medical services because they are shielded from costs by their insurance plans. Insured individuals may engage in riskier health behaviors, knowing that their expenses are partly covered by the insurer. This leads to increased healthcare spending and challenges in pricing premiums accurately.

Moral Hazard in Auto Insurance: Real-Life Scenarios

Moral hazard in auto insurance occurs when insured drivers engage in riskier behavior, such as texting while driving or neglecting vehicle maintenance, because they know their insurance will cover damages. For example, a policyholder might drive more aggressively or avoid installing safety features, leading to higher accident rates and increased claims. Insurers combat these risks by implementing measures like usage-based policies and premium adjustments based on driving behavior data.

Home Insurance and the Risk of Moral Hazard

Home insurance often faces moral hazard when policyholders engage in riskier behaviors, such as neglecting home maintenance or installing substandard security, knowing that damages will be covered. This increase in reckless actions raises the insurer's potential payouts, driving up premiums for all customers. Insurers combat this by implementing deductibles, coverage limits, and rigorous claim investigations to minimize fraudulent or negligent claims.

How Life Insurance Can Lead to Moral Hazard

Life insurance can lead to moral hazard when policyholders, aware their beneficiaries will receive financial support, might neglect health precautions or engage in riskier behaviors. This decreased incentive to avoid hazards arises because the insurance payout mitigates personal financial losses from adverse events. Insurers counteract this by implementing thorough underwriting processes and requiring medical examinations to assess policyholder risk accurately.

Moral Hazard in Crop and Agricultural Insurance

Moral hazard in crop and agricultural insurance arises when farmers, protected against losses, may engage in riskier behaviors such as neglecting crop maintenance or overusing inputs, expecting compensation for any damage. Insurance coverage can reduce the incentive to implement preventive measures, leading to higher overall claims and increased costs for insurers. This phenomenon challenges the sustainability and pricing of agricultural insurance products, requiring careful monitoring and risk management strategies.

The Role of Moral Hazard in Business Insurance

Moral hazard in business insurance occurs when companies engage in riskier behavior because they are protected by insurance coverage, leading to higher claims and increased premiums. For example, a manufacturing firm might neglect safety protocols, knowing that damages from accidents will be covered by its liability insurance. This distortion of risk incentives can result in inefficient resource allocation and elevated costs within the insurance market.

Impact of Moral Hazard on Insurance Premiums

Moral hazard in insurance occurs when policyholders engage in riskier behavior because they are protected from the consequences, leading to increased claim frequency and severity. This behavior drives insurers to raise premiums to cover higher expected costs and mitigate potential losses. As a result, moral hazard contributes to overall insurance market inefficiencies and can increase the cost of coverage for all policyholders.

Insurer Strategies to Mitigate Moral Hazard

Insurers implement deductibles, co-payments, and policy limits to reduce moral hazard by aligning the insured's financial responsibility with risk exposure. Risk-based pricing and thorough underwriting discourage fraudulent claims and ensure premium adequacy. Regular claims audits and loss prevention programs further incentivize policyholders to maintain prudent behavior, effectively minimizing the likelihood of moral hazard.

Policyholder Responsibilities to Prevent Moral Hazard

Policyholders must maintain transparency and honesty in disclosing relevant information to insurers, ensuring accurate risk assessments that prevent moral hazard. Implementing diligent risk control measures, such as regular maintenance and safety protocols, minimizes the likelihood of intentional or negligent claims. Insurers rely on these responsibilities to balance premiums and claims, fostering sustainable insurance markets and reducing fraudulent behavior.

example of moral hazard in insurance Infographic

samplerz.com

samplerz.com