Velocity of money in the economy refers to the rate at which currency circulates and is exchanged in transactions within a specific period. High velocity indicates rapid spending and frequent exchange of money, often correlating with increased economic activity and robust demand for goods and services. For example, during periods of economic growth, consumers and businesses tend to spend money quickly, leading to a higher velocity of money. An example of velocity in the economy can be seen during a holiday shopping season when consumer spending accelerates sharply. Retailers experience increased sales volume as money changes hands rapidly, boosting economic output and encouraging production. Tracking the velocity of money helps economists assess the health and momentum of an economy by analyzing how fast money flows relative to the money supply.

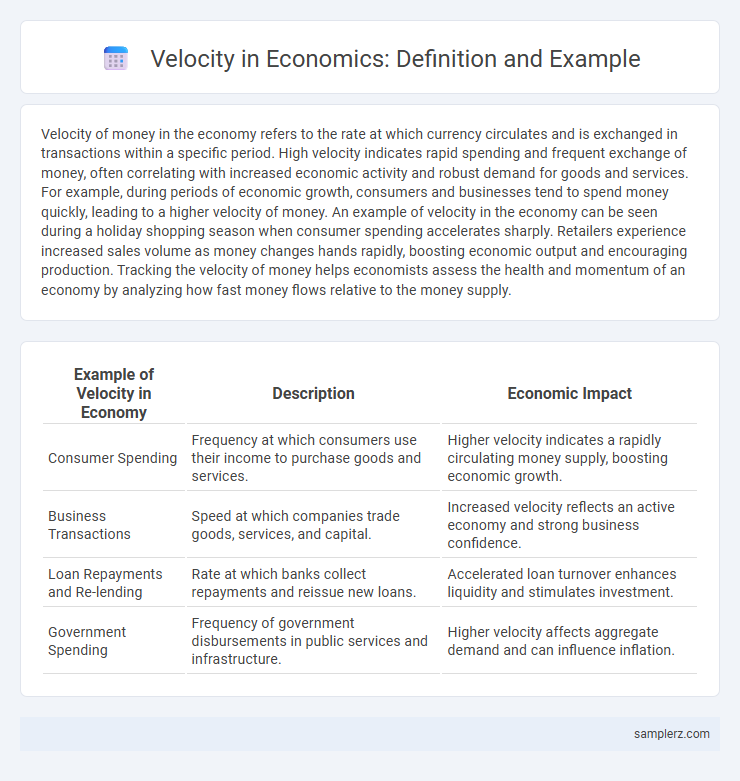

Table of Comparison

| Example of Velocity in Economy | Description | Economic Impact |

|---|---|---|

| Consumer Spending | Frequency at which consumers use their income to purchase goods and services. | Higher velocity indicates a rapidly circulating money supply, boosting economic growth. |

| Business Transactions | Speed at which companies trade goods, services, and capital. | Increased velocity reflects an active economy and strong business confidence. |

| Loan Repayments and Re-lending | Rate at which banks collect repayments and reissue new loans. | Accelerated loan turnover enhances liquidity and stimulates investment. |

| Government Spending | Frequency of government disbursements in public services and infrastructure. | Higher velocity affects aggregate demand and can influence inflation. |

Understanding the Concept of Economic Velocity

Economic velocity refers to the rate at which money circulates within an economy, measuring how quickly funds are spent and re-spent over a specific period. A high velocity indicates active economic transactions, commonly seen during periods of growth when consumer spending and investment surge. Conversely, a low velocity often signals economic stagnation or recession, reflecting reduced spending and slower money movement throughout markets.

Real-World Examples of Money Velocity

Money velocity in the economy reflects how quickly money circulates within a given period, with real-world examples including retail transactions during holiday seasons when consumer spending spikes. For instance, the rapid pace of electronic payments in developed countries like the United States demonstrates high velocity, as funds move swiftly through digital banking and e-commerce platforms. Conversely, during economic downturns such as the 2008 financial crisis, money velocity typically declines due to reduced consumer confidence and spending.

How Money Circulates: Case Studies

The velocity of money measures how frequently a unit of currency is used in transactions within a specific period, reflecting economic activity levels. In Japan during the 1990s, despite high money supply, velocity declined significantly due to deflation and consumer hoarding, slowing economic growth. Conversely, in the United States post-2008, quantitative easing increased money supply, but velocity remained low as banks and consumers were cautious, indicating subdued spending despite liquidity.

Velocity of Money in Developed Economies

Velocity of money in developed economies typically reflects the frequency at which a unit of currency circulates within the economy over a specific period, often measured annually. In countries like the United States and Germany, a higher velocity indicates robust consumer spending and investment activity, contributing to economic growth. Conversely, a declining velocity may signal decreased transaction frequency, often associated with economic uncertainty or increased saving rates.

Effects of Digital Payments on Transaction Speed

Digital payments significantly increase transaction speed by enabling instantaneous fund transfers and reducing processing times compared to traditional cash or check methods. This acceleration enhances the velocity of money, facilitating quicker circulation within the economy and stimulating economic activity. Faster transaction settlement also improves business cash flow and consumer convenience, driving overall economic efficiency.

Economic Booms and High Money Velocity: Historical Examples

Economic booms such as the Roaring Twenties in the United States and the post-World War II expansion exhibit high money velocity, reflecting rapid circulation of currency through consumer spending and investment. During these periods, increased confidence and demand drive faster transactions, amplifying GDP growth despite relatively stable money supply levels. Historical data shows velocity peaked alongside stock market surges and industrial production spikes, underscoring its role in economic dynamism.

Low Velocity During Recessions: Notable Cases

During recessions, the velocity of money significantly declines, reflecting reduced economic activity and slower circulation of currency. Notable examples include the 2008 global financial crisis, where velocity dropped sharply due to tightened credit and decreased consumer spending. The COVID-19 recession in 2020 also saw a pronounced fall in velocity as lockdowns and uncertainty led to increased savings and reduced transactions.

Central Bank Policies and Their Impact on Velocity

Central bank policies significantly influence the velocity of money by adjusting interest rates and altering reserve requirements, which impact consumer spending and lending behaviors. Quantitative easing programs inject liquidity into the economy, potentially increasing money circulation speed by encouraging borrowing and investment. Conversely, tightening monetary policy can reduce velocity as higher interest rates discourage borrowing and slow economic transactions.

Technological Innovations Driving Economic Velocity

Technological innovations accelerate economic velocity by streamlining production processes and enhancing communication efficiency, leading to faster transaction cycles and increased market responsiveness. The integration of AI-driven automation and blockchain technology reduces operational costs and secures real-time data exchange, significantly boosting the turnover rate of goods and services. This rapid flow of economic activities fosters higher GDP growth and amplifies overall economic productivity.

Comparing Money Velocity Across Different Countries

Money velocity measures how quickly money circulates within an economy, reflecting economic activity levels. For example, the United States typically exhibits a higher velocity of money compared to Japan, indicating more frequent transactions and stronger consumer spending. Differences in monetary policy, consumer confidence, and financial infrastructure largely explain this variation in money velocity across countries.

example of velocity in economy Infographic

samplerz.com

samplerz.com