The velocity of money is a critical economic indicator that measures the frequency at which a unit of currency circulates in the economy within a given time period. During hyperinflation, this velocity typically surges as consumers and businesses rush to spend money quickly before prices escalate further. In Zimbabwe's hyperinflation crisis in the late 2000s, the velocity of money skyrocketed, resulting in a dramatic increase in transactional frequency despite the collapsing purchasing power of the Zimbabwean dollar. Hyperinflation drives velocity of money because holding cash becomes costly; people prefer to exchange currency for goods or assets immediately. Data from Venezuela's hyperinflation period show velocity reached unprecedented levels as consumers lost faith in the bolivar. Economic entities such as retail stores and financial institutions experienced rapid turnover in currency, reflecting an unstable monetary environment where velocity acts as a barometer of confidence and economic health.

Table of Comparison

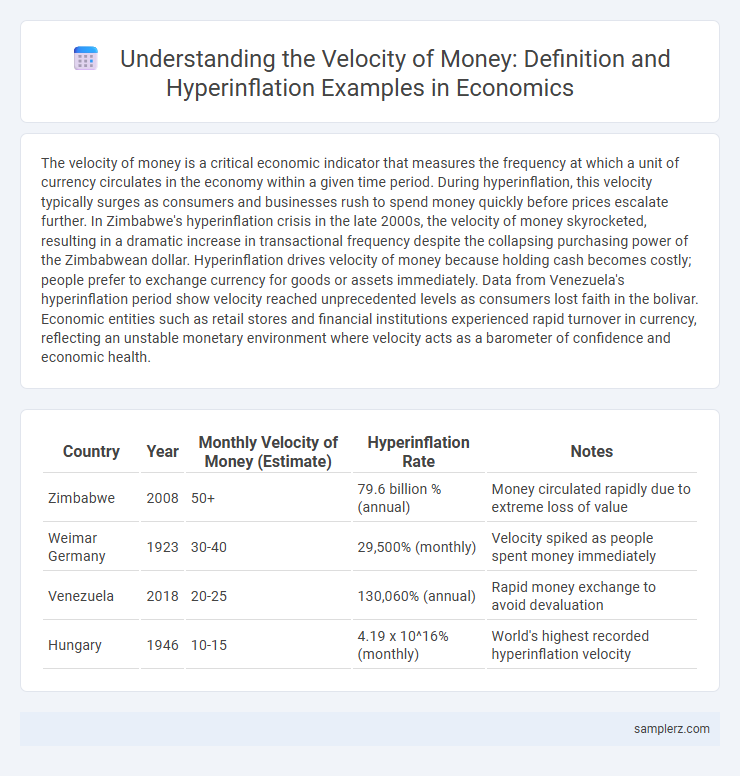

| Country | Year | Monthly Velocity of Money (Estimate) | Hyperinflation Rate | Notes |

|---|---|---|---|---|

| Zimbabwe | 2008 | 50+ | 79.6 billion % (annual) | Money circulated rapidly due to extreme loss of value |

| Weimar Germany | 1923 | 30-40 | 29,500% (monthly) | Velocity spiked as people spent money immediately |

| Venezuela | 2018 | 20-25 | 130,060% (annual) | Rapid money exchange to avoid devaluation |

| Hungary | 1946 | 10-15 | 4.19 x 10^16% (monthly) | World's highest recorded hyperinflation velocity |

Understanding Velocity of Money During Hyperinflation

During hyperinflation, the velocity of money accelerates rapidly as consumers and businesses rush to spend currency before it loses value, reflecting a sharp increase in money turnover. This phenomenon is exemplified by historical instances such as Zimbabwe in the late 2000s, where the velocity of money surged dramatically, worsening economic instability. Elevated velocity in hyperinflation signals a loss of confidence in the currency and challenges monetary policy effectiveness.

Real-World Cases of Hyperinflation and Money Velocity

During Zimbabwe's hyperinflation peak in 2008, the velocity of money surged as prices doubled nearly every day, prompting consumers to spend cash immediately to avoid further loss of value. Similarly, in the Weimar Republic during the early 1920s, rapid price increases forced households and businesses to accelerate transactions, significantly increasing money velocity. These real-world cases demonstrate how hyperinflation disrupts normal economic behavior, causing money to circulate faster as a protective response to eroding purchasing power.

The Role of Velocity in Zimbabwe’s Hyperinflation Crisis

Zimbabwe's hyperinflation crisis saw the velocity of money skyrocket as consumers and businesses rushed to spend rapidly devaluing currency, exacerbating price increases. In 2008, the velocity of Zimbabwean dollars surged as inflation peaked at an estimated 79.6 billion percent, undermining economic stability. This extreme velocity intensified the collapse of purchasing power, highlighting the critical role that money movement plays in hyperinflation dynamics.

Venezuela: Surging Money Velocity and Economic Chaos

Venezuela's hyperinflation has caused the velocity of money to skyrocket, as citizens rapidly spend bolivares to evade devaluation. The accelerated circulation of cash exacerbates price instability, reflecting a collapsing trust in the currency. This surge disrupts economic planning, intensifies shortages, and deepens the country's financial crisis.

How High Velocity Fuels Price Spirals in Hyperinflation

In hyperinflation, the velocity of money skyrockets as consumers and businesses rapidly exchange currency to avoid holding devaluing cash, accelerating turnover rates in the economy. This high velocity intensifies demand for goods and services, causing prices to surge in a self-reinforcing spiral. Historical cases like Zimbabwe and Weimar Germany demonstrate how this relentless circulation fuels uncontrollable inflationary spirals.

Case Study: Germany’s Weimar Republic and Monetary Velocity

During the Weimar Republic's hyperinflation in the early 1920s, the velocity of money skyrocketed as citizens rapidly spent their currency to avoid its rapidly declining value. Prices doubled within days, and people often exchanged money immediately after receiving wages, reflecting an extraordinarily high monetary velocity. This case study highlights how hyperinflation causes the velocity of money to surge uncontrollably, exacerbating economic instability.

Household Behavior and Rapid Money Circulation in Hyperinflation

During hyperinflation, households tend to spend money immediately to avoid losing purchasing power, significantly accelerating the velocity of money. This rapid money circulation reflects a shift in consumer behavior where holding cash becomes costly, prompting quick transactions and continuous turnover of money supply. Such dynamics exacerbate inflationary pressures as increased spending fuels further price surges in the economy.

The Impact of Velocity on Savings and Investments During Crises

During hyperinflation, the velocity of money accelerates dramatically as consumers and businesses rush to spend rapidly depreciating currency, eroding the real value of savings. This heightened turnover diminishes the incentive to save, leading to reduced capital accumulation and stunted investment growth. The destabilization of financial markets caused by rapid money circulation disrupts long-term economic planning and undermines the foundations of sustainable economic recovery.

Government Policy Responses to Escalating Money Velocity

During hyperinflation, governments often implement contractionary monetary policies, such as raising interest rates and reducing money supply, to counteract escalating money velocity. Fiscal measures include tightening budget deficits and enhancing tax collection to stabilize currency demand. Central banks may also impose capital controls to limit rapid cash turnover and restore confidence in the monetary system.

Lessons Learned: Managing Velocity in Hyperinflationary Economies

During the Zimbabwe hyperinflation crisis of the late 2000s, the velocity of money skyrocketed as citizens rapidly spent devaluing currency, accelerating price increases and economic instability. Effective management lessons emphasize stabilizing currency value through sound monetary policies and restoring public confidence to reduce excessive money turnover. Controlling velocity alongside inflation is crucial to preventing the self-reinforcing cycle that deepens hyperinflationary damage.

example of velocity of money in hyperinflation Infographic

samplerz.com

samplerz.com