Nash equilibrium in the economy occurs when firms in a competitive market choose strategies where no player can benefit by changing their own strategy while others keep theirs unchanged. An example is the pricing strategy among oligopolistic firms, such as airlines, where each airline sets ticket prices considering the pricing decisions of competitors. If one airline lowers prices, others may follow, leading to a stable pricing point where no airline gains by unilaterally changing its fare. In labor markets, Nash equilibrium can be observed when employers and workers set wages and effort levels expecting the other party's decisions. For instance, firms offer wages that maximize productivity without overpaying, while workers decide on effort based on expected wages. These strategic interactions stabilize at an equilibrium wage and effort level, reflecting mutual best responses in the labor economy.

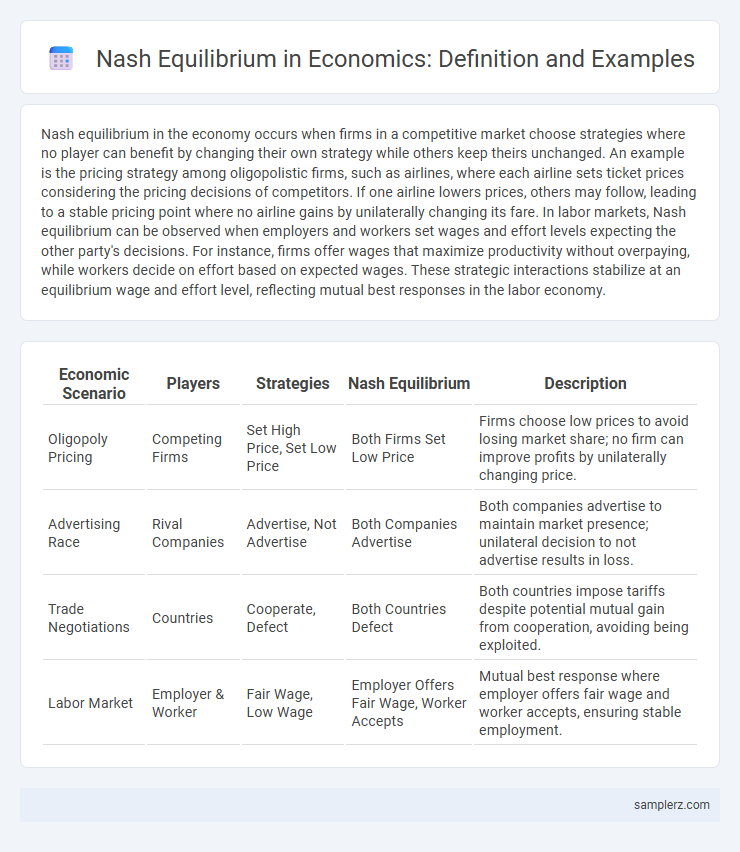

Table of Comparison

| Economic Scenario | Players | Strategies | Nash Equilibrium | Description |

|---|---|---|---|---|

| Oligopoly Pricing | Competing Firms | Set High Price, Set Low Price | Both Firms Set Low Price | Firms choose low prices to avoid losing market share; no firm can improve profits by unilaterally changing price. |

| Advertising Race | Rival Companies | Advertise, Not Advertise | Both Companies Advertise | Both companies advertise to maintain market presence; unilateral decision to not advertise results in loss. |

| Trade Negotiations | Countries | Cooperate, Defect | Both Countries Defect | Both countries impose tariffs despite potential mutual gain from cooperation, avoiding being exploited. |

| Labor Market | Employer & Worker | Fair Wage, Low Wage | Employer Offers Fair Wage, Worker Accepts | Mutual best response where employer offers fair wage and worker accepts, ensuring stable employment. |

Real-World Applications of Nash Equilibrium in Economy

Nash equilibrium is exemplified in oligopoly markets where firms set prices or outputs considering competitors' strategies, leading to stable pricing patterns despite the absence of collaboration. In auction design, such as spectrum auctions conducted by governments, bidders strategically place bids anticipating others' actions, resulting in efficient resource allocation. Furthermore, labor market negotiations often reflect Nash equilibrium as employers and employees settle on wages and conditions that neither party benefits from unilaterally changing.

Oligopoly Pricing: Nash Equilibrium in Competitive Markets

In oligopoly pricing, Nash equilibrium occurs when competing firms select prices where no single firm can improve profits by unilaterally changing its price, given the prices of others. This strategic interdependence stabilizes market prices despite limited competition, as seen in industries like airlines and telecommunications. The equilibrium ensures firms optimize pricing strategies without triggering aggressive price wars, maintaining market stability and predictable profit margins.

Nash Equilibrium in Auction Designs and Bidding Strategies

Nash equilibrium in auction designs occurs when bidders adopt strategies where no participant can gain by unilaterally changing their bid, given the bids of others. In first-price sealed-bid auctions, bidders shade their bids below their valuations to balance winning probability and profit, reaching an equilibrium where bid shading is optimal. In second-price (Vickrey) auctions, truth-telling emerges as a dominant bidding strategy, leading to a Nash equilibrium where bidders reveal their true valuations without benefit from strategic misrepresentation.

Cartel Behavior: Stability Through Nash Equilibrium

Cartel behavior in economics illustrates Nash equilibrium when firms in an oligopoly agree to set prices or output levels to maximize joint profits, understanding that deviation by any member leads to worse outcomes for all. Stability occurs because each firm's strategy is optimal given the strategies of others, preventing unilateral deviation. This equilibrium enforces cooperation without explicit contracts, explaining why cartels often maintain higher prices despite incentives to cheat.

Nash Equilibrium and Firm Location Decisions

Nash equilibrium in firm location decisions occurs when companies choose their positions in a market so that no firm can gain by unilaterally changing its location, balancing competitive advantages like access to customers and cost minimization. This equilibrium helps predict stable configurations in retail, manufacturing, and service industries, where firms strategically cluster or disperse to maximize profits without provoking competitors to relocate. Models such as Hotelling's linear city illustrate how Nash equilibrium informs optimal placement strategies, influencing urban economics and spatial competition.

Labor Market Negotiations Under Nash Equilibrium

In labor market negotiations under Nash equilibrium, both employers and labor unions choose strategies that maximize their payoffs given the other's actions, resulting in stable wage agreements and employment levels. For instance, firms set wage offers anticipating union responses, while unions decide on strike threats or acceptance, ensuring no party benefits by unilaterally changing their strategy. This equilibrium helps explain persistent wage contracts and labor disputes where mutual best responses define negotiation outcomes.

Public Goods Provision: Nash Equilibrium in Collective Action

In the provision of public goods, the Nash equilibrium occurs when each individual chooses their contribution level based on others' contributions, resulting in a stable but suboptimal outcome where free-riding persists. This equilibrium demonstrates how rational actors, aiming to maximize personal benefit, underinvest in collective goods like clean air or national defense. Economic models of public goods provision highlight the challenges of overcoming this equilibrium to achieve efficient resource allocation through mechanisms like taxes or subsidies.

Nash Equilibrium in International Trade Agreements

Nash Equilibrium in international trade agreements occurs when countries choose their trade policies, such as tariffs or quotas, taking into account the decisions of other nations, leading to a stable outcome where no country benefits from unilaterally changing its strategy. For instance, in a trade tariff game, if all participating countries adopt mutually low tariffs to maximize collective welfare, any country increasing tariffs unilaterally faces retaliation, resulting in lower gains. This strategic interaction exemplifies how Nash Equilibrium helps explain cooperation and conflict in global trade negotiations.

Currency Wars: Strategic Interactions and Nash Equilibrium

Currency wars illustrate Nash equilibrium as countries competitively devalue their currencies to boost exports without triggering retaliatory devaluations. Each country's optimal strategy depends on the others' actions, resulting in a stable outcome where no country benefits from unilaterally changing its currency policy. This strategic interaction exemplifies how mutual interdependence in exchange rate policies leads to equilibrium in international economic competition.

Nash Equilibrium in Financial Markets and Trading Strategies

Nash equilibrium in financial markets occurs when traders, anticipating each other's strategies, settle on a set of trading tactics that no one benefits from unilaterally changing, ensuring market stability. For example, competing firms consistently setting similar prices or hedge funds using correlated algorithmic strategies exemplify equilibrium where deviation reduces individual payoffs. This strategic balance minimizes arbitrage opportunities and shapes price formation, influencing liquidity and volatility in financial ecosystems.

example of Nash equilibrium in economy Infographic

samplerz.com

samplerz.com