A liquidity trap in monetary policy occurs when interest rates are near zero, and saving rates remain high, rendering conventional monetary tools ineffective in stimulating economic growth. Japan's experience during the 1990s and early 2000s serves as a prime example, where the Bank of Japan repeatedly pushed interest rates to near-zero levels but failed to boost demand or inflation. Despite aggressive monetary easing, the economy remained stagnant, highlighting the challenges central banks face in escaping liquidity traps. During the 2008 financial crisis, the United States also encountered conditions resembling a liquidity trap as the Federal Reserve lowered interest rates to near zero and initiated quantitative easing programs. Consumer spending and investment were subdued despite cheap borrowing costs, demonstrating the limits of monetary policy when confidence in the economy is low. These episodes underscore the importance of complementary fiscal policies to revive economic activity when liquidity traps inhibit traditional monetary stimulus.

Table of Comparison

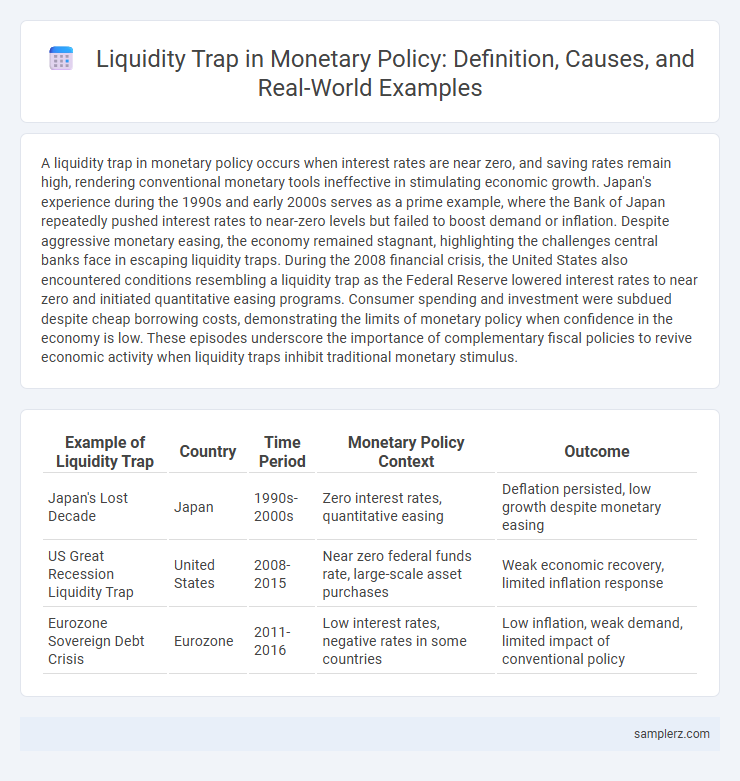

| Example of Liquidity Trap | Country | Time Period | Monetary Policy Context | Outcome |

|---|---|---|---|---|

| Japan's Lost Decade | Japan | 1990s-2000s | Zero interest rates, quantitative easing | Deflation persisted, low growth despite monetary easing |

| US Great Recession Liquidity Trap | United States | 2008-2015 | Near zero federal funds rate, large-scale asset purchases | Weak economic recovery, limited inflation response |

| Eurozone Sovereign Debt Crisis | Eurozone | 2011-2016 | Low interest rates, negative rates in some countries | Low inflation, weak demand, limited impact of conventional policy |

Understanding the Liquidity Trap in Modern Economies

A liquidity trap occurs when interest rates approach zero, and monetary policy becomes ineffective as people prefer holding cash over bonds, leading to stagnant economic growth despite central bank efforts. Japan in the 1990s experienced a prolonged liquidity trap where aggressive quantitative easing failed to stimulate consumption and investment effectively. Understanding this scenario helps policymakers recognize the limits of traditional monetary tools during periods of near-zero interest rates and deflationary pressures.

Historical Examples of Liquidity Traps in Monetary Policy

The Japanese economy during the 1990s and 2000s exemplifies a liquidity trap, where near-zero interest rates failed to stimulate spending or investment, leading to prolonged deflation and stagnant growth. The United States experienced a similar liquidity trap after the 2008 financial crisis, with the Federal Reserve lowering interest rates close to zero yet struggling to boost demand despite quantitative easing efforts. These historical examples illustrate the challenges central banks face in overcoming liquidity traps when conventional monetary policy loses effectiveness.

Japan’s Lost Decade: A Case Study in Liquidity Trap

Japan's Lost Decade, spanning the 1990s to early 2000s, exemplifies a liquidity trap where conventional monetary policy tools failed to stimulate economic growth despite near-zero interest rates. Persistent deflation and sluggish consumer spending rendered the Bank of Japan's aggressive interest rate cuts ineffective, trapping the economy in stagnation. Quantitative easing and unconventional policies were introduced but struggled to revive demand, highlighting the challenges of escaping a liquidity trap.

The 2008 Global Financial Crisis and Liquidity Trap Dynamics

During the 2008 Global Financial Crisis, central banks lowered interest rates to near zero in an attempt to stimulate economic activity, but the economy remained stagnant as borrowing and spending failed to increase, exemplifying a liquidity trap. Despite aggressive monetary easing and quantitative easing programs, liquidity continued to be hoarded rather than circulated, limiting the effectiveness of traditional monetary policy. This scenario highlighted the constraints of interest rate cuts in boosting demand during severe economic downturns and underscored the need for complementary fiscal measures.

Central Bank Responses to Liquidity Traps

Central banks facing liquidity traps often reduce nominal interest rates to near zero, yet the demand for money remains highly elastic, rendering traditional monetary policy ineffective. To counteract this, central banks deploy unconventional measures such as quantitative easing and forward guidance to stimulate economic activity and inflation expectations. These policies aim to increase the money supply and influence long-term interest rates, encouraging borrowing and investment despite the zero lower bound constraints.

The Limitations of Conventional Monetary Policy Tools

Central banks face a liquidity trap when nominal interest rates approach zero, rendering conventional monetary policy tools like rate cuts ineffective in stimulating economic growth. Despite efforts to increase money supply, businesses and consumers may hoard cash due to low confidence, causing demand to stagnate and inflation to remain low. This limitation highlights the need for alternative measures such as quantitative easing or fiscal stimulus to revive economic activity during deep recessions.

Quantitative Easing as a Solution to the Liquidity Trap

Quantitative easing (QE) is a monetary policy tool used to combat a liquidity trap when traditional interest rate cuts become ineffective. Central banks purchase long-term securities to inject money directly into the economy, increasing bank reserves and encouraging lending and investment. This approach helps stimulate economic growth by lowering long-term interest rates and boosting asset prices despite the liquidity trap's constraints.

Lessons Learned from Past Liquidity Trap Scenarios

Historical liquidity trap scenarios, such as Japan's Lost Decade and the 2008 global financial crisis, demonstrate that traditional monetary policy tools lose effectiveness when interest rates approach zero and demand remains stagnant. Central banks learned the importance of integrating unconventional measures--quantitative easing and forward guidance--to stimulate economic activity during these periods. These lessons emphasize the critical role of coordinated fiscal support alongside innovation in monetary policy to break out of prolonged liquidity traps.

Policy Implications for Avoiding Future Liquidity Traps

Central banks must deploy unconventional monetary tools such as quantitative easing and forward guidance to stimulate demand when traditional interest rate cuts become ineffective in a liquidity trap. Implementing fiscal policies that increase government spending can complement monetary interventions and enhance overall economic activity. Ensuring monetary policy flexibility and coordination with fiscal authorities reduces the risk of prolonged stagnation and deflation.

Comparing Global Liquidity Trap Experiences

Japan's prolonged liquidity trap during the 1990s and early 2000s contrasts with the United States' experience following the 2008 financial crisis, where near-zero interest rates failed to stimulate sufficient demand despite aggressive quantitative easing. Eurozone countries faced a unique liquidity trap scenario amid sovereign debt crises, with fragmented monetary transmission limiting the European Central Bank's effectiveness. Emerging markets like India have largely avoided deep liquidity traps due to higher inflation and interest rates, yet they remain vulnerable to capital flow reversals and tightening global financial conditions.

example of liquidity trap in monetary policy Infographic

samplerz.com

samplerz.com