In the cryptocurrency economy, a bearwhale refers to a single investor or entity holding an enormous amount of a particular cryptocurrency who sells off large portions, triggering a sharp price decline. This sell-off causes panic among smaller investors, leading to widespread market fear and significant downward pressure on the asset's value. Bearwhales can manipulate market sentiment due to their substantial holdings, influencing price trends beyond typical supply and demand dynamics. Data indicates that bearwhales often exploit market volatility to maximize profits by timing their large-scale sales during periods of low liquidity. Such events have been observed in Bitcoin and Ethereum markets where large addresses liquidate significant holdings, causing prices to plunge rapidly. Understanding bearwhale activity is essential for traders and analysts looking to anticipate sudden market shifts in the cryptocurrency economy.

Table of Comparison

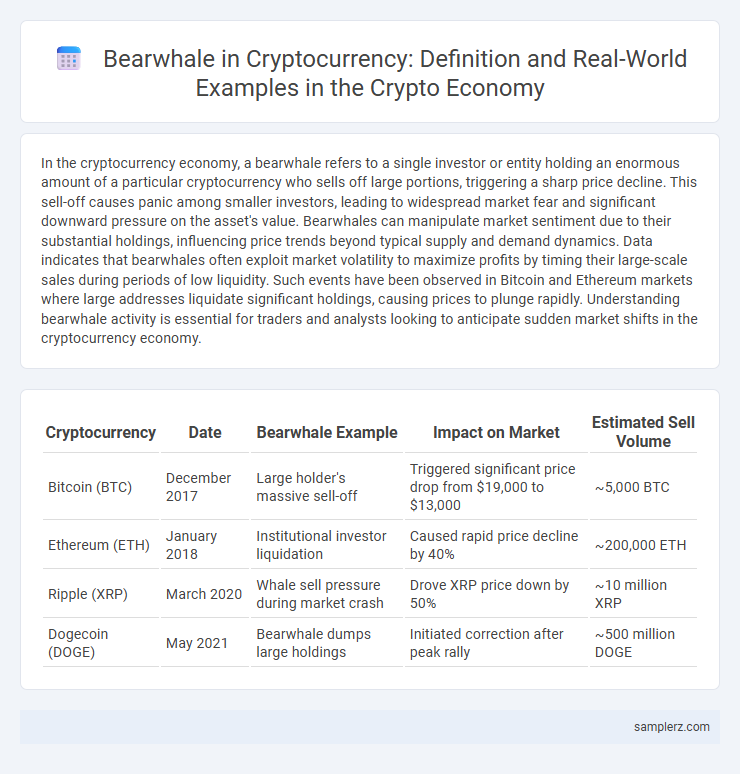

| Cryptocurrency | Date | Bearwhale Example | Impact on Market | Estimated Sell Volume |

|---|---|---|---|---|

| Bitcoin (BTC) | December 2017 | Large holder's massive sell-off | Triggered significant price drop from $19,000 to $13,000 | ~5,000 BTC |

| Ethereum (ETH) | January 2018 | Institutional investor liquidation | Caused rapid price decline by 40% | ~200,000 ETH |

| Ripple (XRP) | March 2020 | Whale sell pressure during market crash | Drove XRP price down by 50% | ~10 million XRP |

| Dogecoin (DOGE) | May 2021 | Bearwhale dumps large holdings | Initiated correction after peak rally | ~500 million DOGE |

Understanding the Bearwhale Phenomenon in Cryptocurrency Markets

A bearwhale in cryptocurrency markets refers to an entity or investor holding a significant amount of a digital asset who executes large sell orders, causing substantial price declines. This phenomenon disrupts market stability, triggers panic selling among retail investors, and can lead to prolonged bear trends in asset valuation. Understanding bearwhale behavior is crucial for traders aiming to anticipate market volatility and protect portfolio value.

Historic Bearwhale Events and Their Economic Impact

The 2017 Bitcoin bearwhale, who sold over 50,000 BTC during the peak market frenzy, drastically triggered a sharp price decline and market panic, revealing the vulnerability of cryptocurrency liquidity. Another historic bearwhale event occurred in 2021 when a single entity offloaded $1 billion worth of Ether, causing a ripple effect that disrupted DeFi protocols and led to significant short-term losses across exchanges. These bearwhale activities underscore the profound economic impact such large-scale sell-offs have on market volatility, investor confidence, and cryptocurrency valuation stability.

How Bearwhales Influence Cryptocurrency Price Dynamics

Bearwhales, entities holding massive amounts of cryptocurrency, significantly influence price dynamics by executing large sell-offs that trigger sharp price declines. Their market movements create heightened volatility as smaller investors react to the sudden drops, amplifying downward trends. The strategic timing and scale of bearwhale trades can lead to cascading effects across exchanges, impacting liquidity and price stability in the crypto market.

Notable Bearwhale Cases: Lessons from Bitcoin’s Early Days

Notable bearwhale cases in Bitcoin's early days include large holders who strategically sold off massive amounts during market downturns, causing significant price crashes and highlighting the volatility of early cryptocurrency markets. One example is the Mt. Gox CEO selling large Bitcoin reserves during 2013-2014, which contributed to sharp declines and loss of investor confidence. These events emphasize the impact that single entities with large holdings, or bearwhales, can have on liquidity, market sentiment, and price stability in cryptocurrency ecosystems.

Bearwhale Strategies: Tactics Used to Move the Market

Bearwhale strategies in cryptocurrency involve large holders executing massive sell-offs or buy-ins to manipulate market prices, often triggering cascades of stop-loss orders and amplified volatility. These tactics exploit the market's liquidity gaps and trader psychology, creating sharp price swings that benefit the bearwhale's position. Understanding patterns like whale sell walls, spoofing, and coordinated dumping is essential for traders aiming to anticipate and navigate these market movements effectively.

Bearwhale vs. Bullwhale: Economic Consequences Compared

Bearwhales, large holders who sell significant cryptocurrency quantities, trigger sharp market declines by flooding supply and causing panic selling, while bullwhales drive prices up through substantial buying pressure, creating investor optimism. The economic consequences of bearwhale actions include reduced liquidity, increased volatility, and erosion of market confidence, which can deter smaller investors and stifle innovation. In contrast, bullwhale activity often boosts market capitalization and trading volume, fostering economic growth but potentially creating overvaluation risks and speculative bubbles.

Regulatory Insights: Addressing Bearwhale Activity in Crypto

Bearwhale activity in cryptocurrency markets highlights significant risks of market manipulation and price volatility, prompting regulators to enhance surveillance and enforce stricter compliance measures. Regulatory bodies like the SEC and CFTC are developing frameworks to monitor large holders capable of influencing prices and mandating greater transparency from exchanges. Implementing these regulatory insights helps mitigate systemic threats posed by bearwhales, fostering a more stable and trustworthy crypto economy.

Bearwhales and Market Liquidity: Economic Implications

Bearwhales are large cryptocurrency holders whose massive sell-offs can drastically reduce market liquidity, triggering sharp price declines and increased volatility. These entities amplify market inefficiencies by creating supply gluts that overwhelm existing buy orders, leading to wider bid-ask spreads and diminished trading volumes. The presence of bearwhales challenges price stability and investor confidence, potentially causing cascading effects across related economic sectors reliant on cryptocurrency market performance.

Case Study: The 2014 Bitcoin Bearwhale Incident

The 2014 Bitcoin Bearwhale Incident involved a single trader who accumulated an enormous amount of Bitcoin, with estimates suggesting ownership of over 50,000 BTC, significantly influencing market dynamics. This bearwhale's large sell orders triggered substantial price drops, demonstrating the susceptibility of Bitcoin's market to manipulation by high-volume holders during its early stages. The event highlighted the importance of monitoring whale activities for risk assessment in cryptocurrency trading strategies.

Protecting the Economy: Mitigating Bearwhale Risks in Crypto

Bearwhales, large cryptocurrency holders capable of triggering market crashes, pose significant threats to economic stability within the crypto sector. Implementing regulatory frameworks and advanced monitoring tools helps identify unusual trading patterns, reducing the risk of bearwhale-induced volatility. Enhanced transparency and decentralized protocols further protect the economy by dispersing market influence among a broader range of participants.

example of bearwhale in cryptocurrency Infographic

samplerz.com

samplerz.com