Deadweight loss in the economy occurs when market inefficiencies lead to a loss of total surplus, reducing overall welfare. One classic example is a tax imposed on a good, such as cigarettes, which causes the price to rise and demand to fall, resulting in fewer transactions and lost consumer and producer surplus. The reduction in trades means resources are not allocated optimally, generating a deadweight loss that harms economic efficiency. Another example is a monopoly setting prices above competitive levels, limiting output and causing higher prices for consumers. This market power reduces total surplus by decreasing consumer demand and producer gains compared to a competitive equilibrium. The loss in total welfare represents deadweight loss due to underproduction and misallocation of resources within the market.

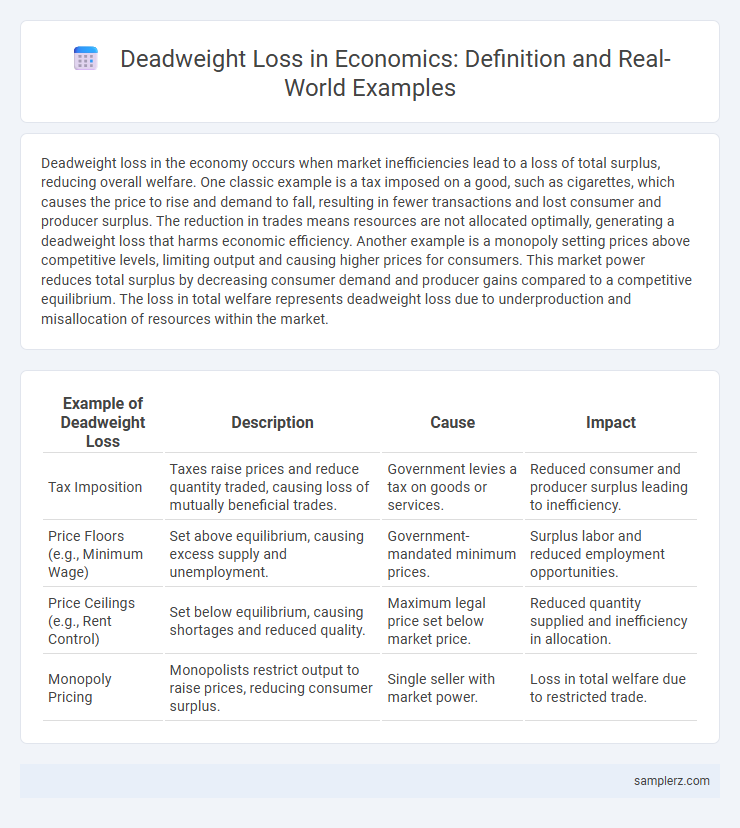

Table of Comparison

| Example of Deadweight Loss | Description | Cause | Impact |

|---|---|---|---|

| Tax Imposition | Taxes raise prices and reduce quantity traded, causing loss of mutually beneficial trades. | Government levies a tax on goods or services. | Reduced consumer and producer surplus leading to inefficiency. |

| Price Floors (e.g., Minimum Wage) | Set above equilibrium, causing excess supply and unemployment. | Government-mandated minimum prices. | Surplus labor and reduced employment opportunities. |

| Price Ceilings (e.g., Rent Control) | Set below equilibrium, causing shortages and reduced quality. | Maximum legal price set below market price. | Reduced quantity supplied and inefficiency in allocation. |

| Monopoly Pricing | Monopolists restrict output to raise prices, reducing consumer surplus. | Single seller with market power. | Loss in total welfare due to restricted trade. |

Real-World Examples of Deadweight Loss in Markets

Deadweight loss occurs in markets such as housing when rent controls lead to reduced supply and lower quality of available units, causing inefficiencies and unmet demand. In agriculture, subsidies distort production incentives, resulting in overproduction and wasted resources that reduce overall welfare. Trade tariffs also create deadweight loss by raising prices, decreasing consumer surplus, and limiting the variety of goods accessible in the market.

Deadweight Loss from Government Price Controls

Deadweight loss from government price controls occurs when price ceilings or floors disrupt the natural equilibrium between supply and demand, leading to inefficient market outcomes. For instance, rent control laws create shortages as landlords supply fewer rental units while demand exceeds supply, causing lost economic welfare for both consumers and producers. Likewise, minimum wage laws set above the equilibrium wage can result in unemployment, where the quantity of labor supplied exceeds labor demanded, generating inefficiencies and lost potential gains in the labor market.

Taxation and Its Impact on Economic Efficiency

Taxation often creates deadweight loss by reducing the total surplus in a market, as higher taxes discourage both consumption and production below the socially optimal level. For example, a sales tax increases the price buyers pay while lowering the net price sellers receive, leading to decreased quantity traded and lost economic efficiency. This inefficiency manifests as unrealized gains from trade, where potential benefits to consumers and producers are not captured due to the tax-induced market distortion.

Monopolies and Their Role in Creating Deadweight Loss

Monopolies create deadweight loss by restricting output below the socially optimal level, causing a loss in consumer surplus and inefficiency in resource allocation. The reduced quantity sold leads to higher prices than in competitive markets, limiting consumer access and overall market welfare. This inefficiency manifests as lost potential gains from trade, where neither producers nor consumers benefit.

Deadweight Loss from Subsidies in Various Sectors

Deadweight loss from subsidies occurs when government financial support leads to overproduction or inefficient allocation of resources, distorting market equilibrium. In agriculture, subsidies encourage excessive crop production, reducing prices artificially and causing resource misallocation. Similarly, energy sector subsidies for fossil fuels create deadweight loss by promoting higher consumption than socially optimal, hindering investment in cleaner alternatives and innovation.

Trade Barriers and the Persistence of Market Inefficiency

Trade barriers such as tariffs and quotas create deadweight loss by restricting market efficiency, leading to reduced trade volumes and higher prices for consumers. These barriers distort resource allocation, preventing goods from flowing to their most valued uses and causing persistent inefficiencies within the global economy. The resulting market distortions hinder competition, reduce consumer surplus, and slow economic growth.

Deadweight Loss in Rent Control Policies

Rent control policies often create deadweight loss by setting rent below the market equilibrium, leading to shortages as demand exceeds supply. Landlords reduce investments in property maintenance and new construction, diminishing overall housing quality and availability. The resulting mismatch between supply and demand decreases market efficiency, causing welfare losses for both consumers and producers.

Agricultural Price Floors and Surplus Generation

Agricultural price floors set above equilibrium prices cause surplus generation by incentivizing producers to supply more than consumers demand, leading to unsold crops and wasted resources. This inefficiency creates deadweight loss as market distortions prevent optimal allocation of goods, reducing overall economic welfare. Government interventions to purchase or store surpluses further amplify fiscal burdens and distort market signals in the agricultural sector.

Effects of Minimum Wage Laws on Labor Markets

Minimum wage laws can create a deadweight loss in labor markets by setting wages above the equilibrium price, leading to reduced employment opportunities for low-skilled workers. Employers may hire fewer workers or cut hours, resulting in inefficient allocation of labor and loss of potential economic surplus. This distortion decreases total employment and generates unemployment among vulnerable labor groups, demonstrating classic market inefficiency.

Externalities and the Deadweight Loss in Public Goods

Deadweight loss in the economy often arises from externalities where the social cost or benefit diverges from private costs or benefits, such as pollution from factories creating negative externalities that are not reflected in market prices. Public goods like national defense generate positive externalities, leading to under-provision when left to the private market due to free-rider problems, resulting in deadweight loss. Efficient allocation requires government intervention to internalize externalities and ensure optimal production and consumption levels.

example of deadweight loss in economy Infographic

samplerz.com

samplerz.com