A Pigovian tax on pollution targets the negative externalities caused by industrial emissions, aligning private costs with social costs. This tax imposes a financial charge on companies based on the quantity of pollutants they release, incentivizing reductions in harmful emissions. For instance, a carbon tax levied per ton of CO2 emitted encourages firms to adopt cleaner technologies and reduce their carbon footprint. Economists highlight the effectiveness of Pigovian taxes in correcting market failures by internalizing external costs. Data from regions implementing these taxes show measurable decreases in pollution levels and improvements in public health. The revenue generated can fund environmental initiatives or subsidize green innovation, creating a sustainable economic approach to pollution control.

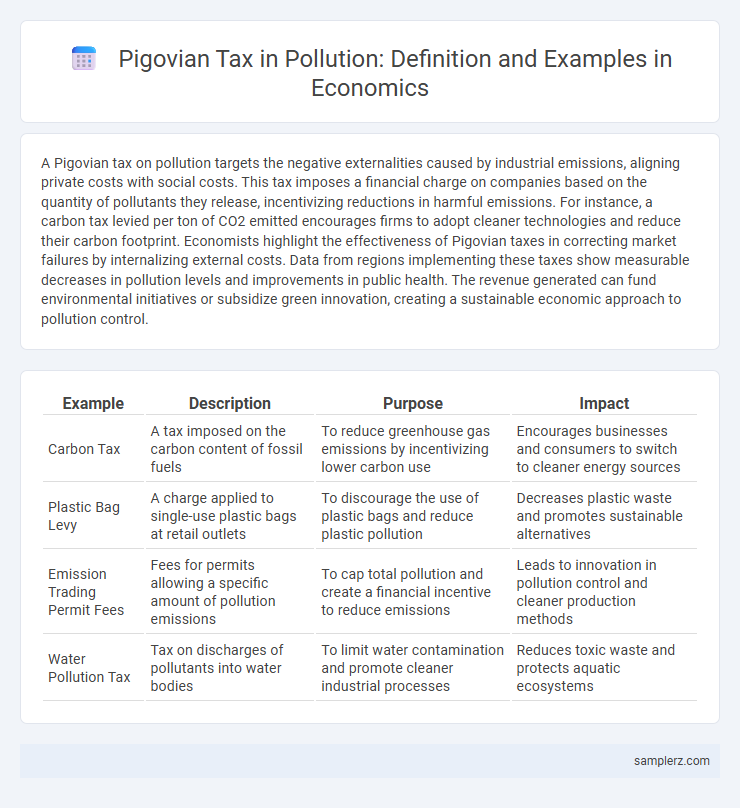

Table of Comparison

| Example | Description | Purpose | Impact |

|---|---|---|---|

| Carbon Tax | A tax imposed on the carbon content of fossil fuels | To reduce greenhouse gas emissions by incentivizing lower carbon use | Encourages businesses and consumers to switch to cleaner energy sources |

| Plastic Bag Levy | A charge applied to single-use plastic bags at retail outlets | To discourage the use of plastic bags and reduce plastic pollution | Decreases plastic waste and promotes sustainable alternatives |

| Emission Trading Permit Fees | Fees for permits allowing a specific amount of pollution emissions | To cap total pollution and create a financial incentive to reduce emissions | Leads to innovation in pollution control and cleaner production methods |

| Water Pollution Tax | Tax on discharges of pollutants into water bodies | To limit water contamination and promote cleaner industrial processes | Reduces toxic waste and protects aquatic ecosystems |

Introduction to Pigovian Taxes in Pollution Control

Pigovian taxes, named after economist Arthur Pigou, are levies imposed on activities that generate negative externalities, such as pollution. These taxes aim to internalize the external costs of pollution by charging firms or individuals based on the amount of pollutants they emit. By increasing the cost of polluting activities, Pigovian taxes provide economic incentives for reducing emissions and promoting cleaner technologies.

Classic Examples of Pigovian Taxes on Industrial Emissions

Classic examples of Pigovian taxes on industrial emissions include carbon taxes imposed on factories to reduce greenhouse gas emissions and sulfur dioxide taxes aimed at minimizing acid rain. These taxes internalize the external costs of pollution, encouraging firms to adopt cleaner technologies and reduce harmful environmental impact. Countries like Sweden and Canada have successfully implemented such taxes to curb emissions and promote sustainable industrial practices.

Implementation of Carbon Taxes Worldwide

Carbon taxes have been implemented in over 25 countries as a Pigovian tax to internalize the external costs of pollution by charging emitters per ton of CO2 released. Nations such as Sweden and Canada have set carbon tax rates exceeding $50 per metric ton, significantly lowering carbon emissions while generating revenue for renewable energy projects. These taxes effectively align market prices with environmental costs, incentivizing businesses and consumers to adopt cleaner technologies and reduce their carbon footprint.

Pigovian Tax on Plastic Pollution

Pigovian tax on plastic pollution imposes fees on producers and consumers based on the environmental costs of plastic waste, incentivizing reduced plastic use and promoting sustainable alternatives. This tax internalizes the externality by charging for the harmful effects of plastic pollution on ecosystems, marine life, and public health. Countries implementing such taxes report decreases in single-use plastic consumption and increased investment in recycling technologies.

The Role of Fuel Taxes in Reducing Air Pollution

Fuel taxes serve as a critical Pigovian tax by increasing the cost of gasoline and diesel, thereby discouraging excessive consumption and reducing air pollution from vehicle emissions. Studies show that higher fuel taxes lead to significant declines in carbon monoxide, nitrogen oxides, and particulate matter levels in urban areas. Implementing targeted fuel taxes aligns private costs with social costs, effectively internalizing the environmental externalities of fossil fuel use.

Success Stories: Sulfur Dioxide Tax in the US

The sulfur dioxide tax implemented under the US Acid Rain Program successfully reduced emissions by over 40% from 1990 levels, demonstrating the effectiveness of Pigovian taxes in addressing pollution externalities. Cap-and-trade mechanisms combined with the tax created economic incentives for power plants to innovate and adopt cleaner technologies, lowering overall compliance costs. This policy is a widely cited example of how market-based instruments can lead to significant environmental improvements while maintaining economic efficiency.

Water Pollution Levies: International Case Studies

Water pollution levies effectively address contamination by charging fees linked to pollutant discharge volumes in countries like Australia and Sweden. These Pigovian taxes incentivize industries to reduce wastewater pollutants, promoting sustainable water usage and environmental protection. Evidence from international case studies shows decreased pollutant levels and increased investment in cleaner technologies due to water pollution levies.

Pigovian Taxation on Hazardous Waste Disposal

Pigovian taxation on hazardous waste disposal imposes fees proportional to the environmental damage caused by improper waste management, incentivizing companies to reduce toxic waste production. This form of tax aligns private costs with social costs, encouraging firms to adopt cleaner technologies and improve waste treatment processes. Empirical studies show that regions implementing hazardous waste Pigovian taxes experience significant reductions in pollution levels and enhanced public health outcomes.

Challenges Facing Pigovian Taxes in Pollution Management

Pigovian taxes on pollution often face challenges such as accurately measuring the social cost of emissions and setting optimal tax rates to reflect environmental damage. Administrative difficulties arise due to monitoring compliance and enforcing tax payments across numerous polluters and sectors. Political resistance and economic concerns about competitiveness and job losses further complicate the implementation and acceptance of pollution taxes.

Future Trends in Pigovian Tax Policy for Environmental Protection

Emerging Pigovian tax policies increasingly target carbon emissions with variable rates tied to real-time pollution data, enhancing precision in environmental cost internalization. Advances in digital monitoring and blockchain technology facilitate transparent, efficient tax collection, ensuring firms are financially incentivized to adopt cleaner technologies. Future trends indicate integration with international carbon markets, promoting global cooperation and harmonization in environmental taxation strategies.

example of Pigovian tax in pollution Infographic

samplerz.com

samplerz.com