Hot money refers to short-term capital flows that move quickly in and out of emerging markets seeking higher returns. An example of hot money is the surge of foreign portfolio investments in India during 2020-2021, driven by low global interest rates and the country's economic reforms. This influx boosted the stock markets and currency value but increased vulnerability to sudden capital flight. Another example occurred in Brazil between 2019 and 2020, when speculative capital chased high-yield government bonds amid rising interest rates. The rapid inflow caused financial market volatility and pressured the central bank to intervene. Hot money inflows support liquidity but can destabilize emerging market economies if confidence falters or global conditions shift abruptly.

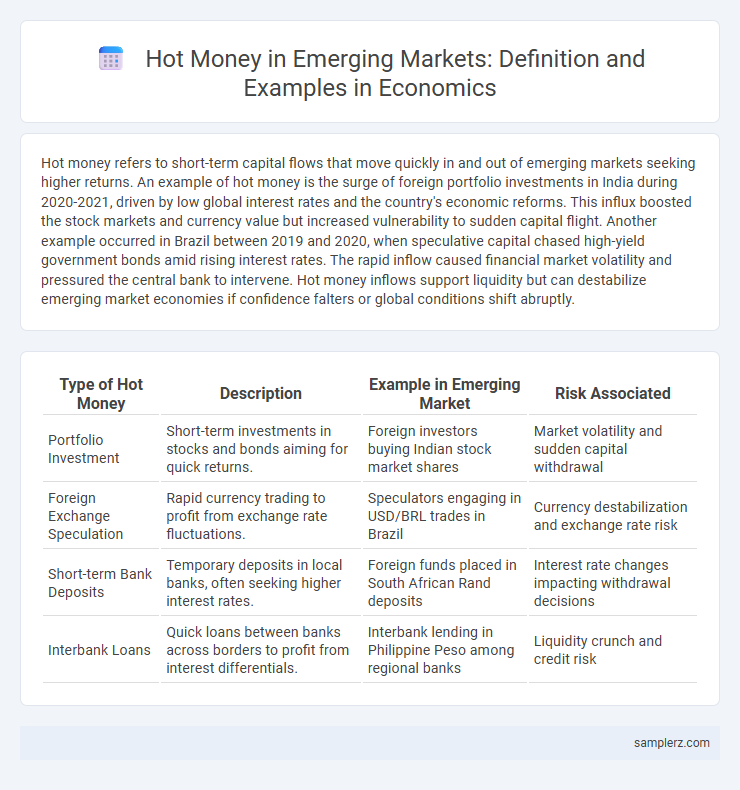

Table of Comparison

| Type of Hot Money | Description | Example in Emerging Market | Risk Associated |

|---|---|---|---|

| Portfolio Investment | Short-term investments in stocks and bonds aiming for quick returns. | Foreign investors buying Indian stock market shares | Market volatility and sudden capital withdrawal |

| Foreign Exchange Speculation | Rapid currency trading to profit from exchange rate fluctuations. | Speculators engaging in USD/BRL trades in Brazil | Currency destabilization and exchange rate risk |

| Short-term Bank Deposits | Temporary deposits in local banks, often seeking higher interest rates. | Foreign funds placed in South African Rand deposits | Interest rate changes impacting withdrawal decisions |

| Interbank Loans | Quick loans between banks across borders to profit from interest differentials. | Interbank lending in Philippine Peso among regional banks | Liquidity crunch and credit risk |

Introduction to Hot Money in Emerging Markets

Hot money refers to short-term capital flows that rapidly move across emerging markets seeking high returns, often driven by interest rate differentials and speculative opportunities. Countries like India and Brazil frequently experience large inflows and outflows of hot money, which can cause exchange rate volatility and financial instability. Managing these flows requires robust monetary policies and capital controls to mitigate risks associated with sudden reversals.

Key Characteristics of Hot Money Flows

Hot money flows in emerging markets are highly liquid, short-term capital movements driven by speculative motives and rapid responses to interest rate differentials or political instability. These funds seek quick profits through currency arbitrage or asset appreciation but can quickly exit, causing volatility and sudden capital flight. Key characteristics include high sensitivity to market sentiment, low transaction costs, and a tendency to amplify economic fluctuations.

Notable Examples of Hot Money Movement in Asia

Notable examples of hot money movement in Asia include the rapid inflows into South Korea and Indonesia during the early 2010s, driven by speculative investments in stock and bond markets seeking higher yields. In 2013, Thailand experienced significant volatility when large volumes of hot money exited rapidly following unexpected shifts in U.S. Federal Reserve policy, causing sharp depreciation in the Thai baht. The Philippines also saw surges of short-term capital inflows in recent years, which affected currency appreciation and asset bubbles, reflecting typical characteristics of hot money dynamics in emerging markets.

Hot Money Influx during the 1997 Asian Financial Crisis

The 1997 Asian Financial Crisis saw a massive hot money influx into emerging markets like Thailand, Malaysia, and Indonesia, driven by speculative short-term investments seeking high returns. This rapid surge of volatile capital exacerbated currency overvaluation and asset bubbles, which collapsed when investors swiftly withdrew funds, triggering severe economic downturns. The crisis highlighted the risks of sudden capital flight associated with hot money and the vulnerabilities of emerging economies to external financial shocks.

Hot Money Flows in Latin America: Case of Brazil

Hot money flows in Latin America, particularly in Brazil, have surged due to high-interest rates and political stability attracting short-term foreign investments. These rapid inflows create volatility in the Brazilian real and inflate asset prices, impacting financial markets and economic stability. Monitoring central bank interventions and capital controls remains crucial to managing the risks associated with such speculative capital movements.

Impact of Hot Money on Local Currencies

In emerging markets, sudden inflows of hot money, such as speculative short-term investments in countries like Brazil and India, often lead to rapid currency appreciation, making exports less competitive. When these volatile capital flows reverse, local currencies can depreciate sharply, triggering inflation and destabilizing financial markets. Central banks frequently intervene by adjusting interest rates or using foreign exchange reserves to mitigate the disruptive impact on exchange rates and economic stability.

Policy Responses to Hot Money Surge

Emerging markets facing hot money surges often implement capital controls, including taxes on short-term inflows, to stabilize financial markets and reduce currency volatility. Central banks may also adjust interest rates or intervene directly in foreign exchange markets to manage liquidity and curb speculative attacks. These policy responses aim to maintain macroeconomic stability amid rapid and potentially destabilizing capital movements.

Risks and Volatility Linked to Hot Money

Hot money in emerging markets, such as rapid capital inflows into countries like Brazil and India, often leads to increased risks and volatility in exchange rates and asset prices. Sudden withdrawal of this speculative capital can trigger sharp currency depreciation, stock market crashes, and destabilize local financial systems. Policymakers face challenges managing inflation and maintaining economic stability amid these unpredictable capital movements.

Regulatory Measures to Control Hot Money

Regulatory measures to control hot money in emerging markets often include capital controls such as transaction taxes on short-term foreign investments and restrictions on the repatriation of profits. Central banks may impose higher reserve requirements or implement macroprudential policies to stabilize volatile capital flows and mitigate exchange rate pressures. Countries like India and Brazil have effectively used these tools to reduce speculative inflows and protect financial stability during periods of currency volatility.

Lessons Learned from Hot Money Episodes

Hot money inflows in emerging markets, such as the 1997 Asian Financial Crisis and the 2013 Taper Tantrum in India, highlight the risks of sudden capital reversals leading to currency depreciation, inflation spikes, and financial instability. These episodes emphasize the importance of building robust foreign exchange reserves, implementing flexible exchange rate regimes, and enhancing macroprudential measures to mitigate volatility. Policymakers learn that managing open capital accounts with prudent regulations can help cushion the adverse effects of speculative short-term capital movements.

example of hot money in emerging market Infographic

samplerz.com

samplerz.com