Cost-push inflation occurs when rising production costs drive up overall prices in the economy. An example of cost-push inflation is an increase in crude oil prices, which raises transportation and manufacturing expenses for businesses. As companies pass these higher costs onto consumers, the general price level in the economy increases, contributing to inflation. Another instance of cost-push inflation is wage growth exceeding productivity gains, forcing firms to raise prices to cover higher labor costs. Supply chain disruptions can also limit the availability of raw materials, increasing input prices and pushing up final goods costs. These factors together highlight the critical role of rising production expenses in driving cost-push inflation scenarios.

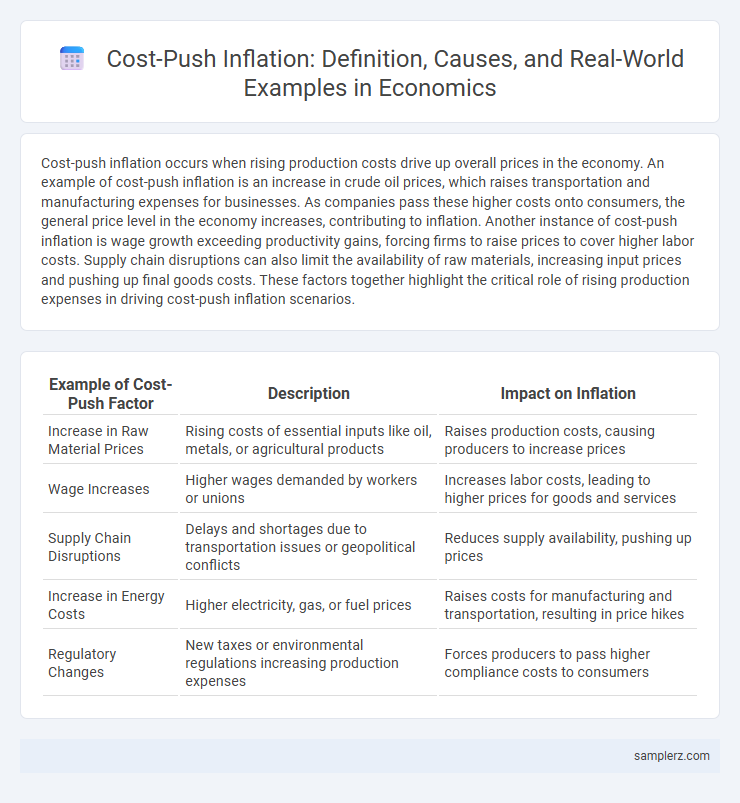

Table of Comparison

| Example of Cost-Push Factor | Description | Impact on Inflation |

|---|---|---|

| Increase in Raw Material Prices | Rising costs of essential inputs like oil, metals, or agricultural products | Raises production costs, causing producers to increase prices |

| Wage Increases | Higher wages demanded by workers or unions | Increases labor costs, leading to higher prices for goods and services |

| Supply Chain Disruptions | Delays and shortages due to transportation issues or geopolitical conflicts | Reduces supply availability, pushing up prices |

| Increase in Energy Costs | Higher electricity, gas, or fuel prices | Raises costs for manufacturing and transportation, resulting in price hikes |

| Regulatory Changes | New taxes or environmental regulations increasing production expenses | Forces producers to pass higher compliance costs to consumers |

Understanding Cost-Push Inflation: A Brief Overview

Rising raw material prices, such as increased oil and metal costs, often trigger cost-push inflation by raising production expenses for manufacturers. Wage hikes due to labor shortages also contribute to higher overall costs, forcing businesses to increase prices. These supply-side constraints reduce aggregate supply, leading to elevated price levels despite steady demand.

Key Drivers of Cost-Push Inflation in Modern Economies

Rising energy prices are a primary driver of cost-push inflation, increasing production costs across industries and leading to higher consumer prices. Labor market tightness, characterized by wage growth outpacing productivity, further intensifies inflationary pressures by elevating business expenses. Supply chain disruptions, such as shortages of raw materials and transportation bottlenecks, exacerbate cost increases, amplifying the overall inflationary trend in modern economies.

Wage Increases and Their Role in Cost-Push Inflation

Wage increases directly contribute to cost-push inflation by raising production expenses for businesses, which often pass these higher labor costs onto consumers through increased prices. When labor unions negotiate higher wages or minimum wage laws rise, companies face elevated operational costs, leading to a general upward pressure on the price level. This wage-driven cost escalation reduces profit margins unless offset by price hikes, thus fueling inflationary trends.

Raw Material Shortages Fueling Price Surges

Raw material shortages disrupt supply chains, driving manufacturing costs higher and fueling cost-push inflation across various industries. Key commodities like metals, oil, and agricultural products experience price surges, which producers pass on to consumers in the form of increased prices. These escalating input costs contribute significantly to sustained inflationary pressures in the economy.

Energy Prices as a Catalyst for Cost-Push Inflation

Rising energy prices serve as a primary catalyst for cost-push inflation by increasing production and transportation expenses across various industries. Higher costs for oil, natural gas, and electricity compel businesses to raise prices to maintain profit margins, directly feeding into overall inflationary pressures. This ripple effect slows economic growth as consumers face elevated prices for goods and services linked to energy inputs.

The Impact of Currency Depreciation on Production Costs

Currency depreciation increases the cost of imported raw materials and intermediate goods, leading to higher production expenses for businesses. This rise in input prices causes firms to pass on costs to consumers, driving cost-push inflation. Depreciation-induced inflation often results in a sustained increase in the general price level, reducing purchasing power and economic growth.

Government Regulations and Cost-Push Inflation

Government regulations can increase production costs by imposing stricter environmental standards, raising compliance expenses for businesses. These higher operational costs are often passed on to consumers, leading to cost-push inflation as the overall price level rises. Regulatory changes in industries like energy and manufacturing frequently contribute to sustained inflationary pressures by elevating input costs.

Case Study: The 1970s Oil Crisis and Global Inflation

The 1970s Oil Crisis serves as a prime example of cost-push inflation, where OPEC's oil embargo caused crude oil prices to quadruple, drastically increasing production costs across multiple industries. This surge in energy prices led to widespread price rises in goods and services worldwide, fueling stagflation marked by high inflation and stagnant economic growth. The crisis demonstrated how supply-side shocks in essential commodities can trigger prolonged inflationary periods, challenging traditional monetary policy responses.

Supply Chain Disruptions Leading to Higher Production Costs

Supply chain disruptions in key industries, such as semiconductor shortages and shipping delays, have significantly increased production costs, pushing manufacturers to raise prices. Rising expenses for raw materials and transportation contribute to cost-push inflation, reducing profit margins and increasing consumer prices. This supply-side shock ultimately slows economic growth by lowering demand through higher inflationary pressures.

Strategies to Mitigate Cost-Push Inflation Pressures

Rising raw material prices and increased labor costs intensify cost-push inflation, squeezing profit margins across industries. Implementing energy-efficient technologies and diversifying supply chains can reduce dependency on volatile inputs, helping stabilize production expenses. Governments may also introduce targeted subsidies or tax incentives to alleviate pressures on essential sectors and maintain competitive pricing.

example of cost-push in inflation Infographic

samplerz.com

samplerz.com