Shadow price in resource economics refers to the estimated monetary value of a resource that is not directly priced in the market. For example, water used in agriculture may not have a clear market price, so its shadow price represents the opportunity cost of using that water for irrigation instead of other purposes. This value helps policymakers allocate scarce water resources efficiently and balance competing demands in resource management. Another example involves land used for conservation versus development. The shadow price of land in conservation reflects the ecological and social benefits foregone when the land is converted to commercial use. Shadow pricing of such resources provides critical data for decision-making by quantifying hidden costs and benefits, enabling more sustainable economic planning.

Table of Comparison

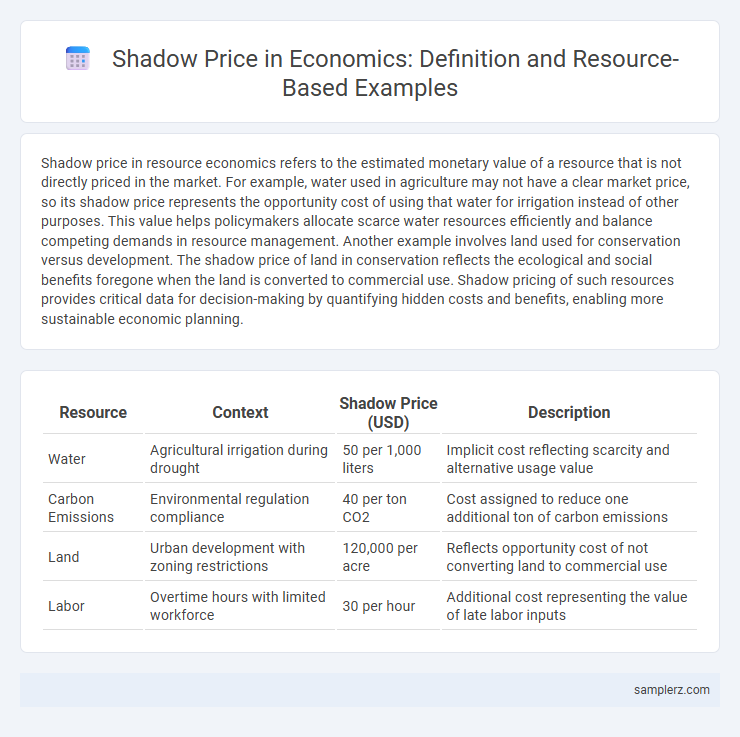

| Resource | Context | Shadow Price (USD) | Description |

|---|---|---|---|

| Water | Agricultural irrigation during drought | 50 per 1,000 liters | Implicit cost reflecting scarcity and alternative usage value |

| Carbon Emissions | Environmental regulation compliance | 40 per ton CO2 | Cost assigned to reduce one additional ton of carbon emissions |

| Land | Urban development with zoning restrictions | 120,000 per acre | Reflects opportunity cost of not converting land to commercial use |

| Labor | Overtime hours with limited workforce | 30 per hour | Additional cost representing the value of late labor inputs |

Understanding Shadow Price in Resource Allocation

Shadow price in resource allocation represents the implicit value of an additional unit of a scarce resource, often used in linear programming and economic optimization models. For example, in water resource management, the shadow price indicates the marginal benefit derived from one more unit of water in irrigation, guiding efficient distribution decisions. This concept helps policymakers allocate limited resources where they yield the highest economic return, enhancing overall productivity.

Shadow Price Application in Water Resource Management

Shadow price in water resource management measures the economic value of an additional unit of water, guiding efficient allocation and usage. For instance, in irrigation systems, shadow prices help determine optimal water distribution by reflecting the opportunity cost of limited water resources. Applying shadow price analysis supports policymaking decisions that balance agricultural productivity with sustainable water conservation.

Shadow Pricing for Limited Labor Resources

Shadow pricing for limited labor resources is applied in economic models to determine the implicit value of an additional hour of labor when labor supply is constrained. For instance, in a factory with a fixed number of skilled workers, the shadow price reflects the marginal benefit or cost saved by reallocating an hour of labor to a higher-value production task. This valuation helps firms optimize labor allocation, maximize output, and make informed decisions under labor scarcity conditions.

Determining Shadow Price in Agricultural Land Use

Shadow price in agricultural land use reflects the estimated economic value of land resources when market prices are unavailable or do not capture scarcity effects. It is determined by analyzing the opportunity cost of land conversion, such as comparing crop yields, input costs, and environmental impacts across different land uses. This valuation aids policymakers in optimizing land allocation to maximize social welfare and sustainable resource management.

Shadow Prices in Renewable Energy Resources

Shadow prices in renewable energy resources reflect the implicit cost of constraints in resource allocation, such as the opportunity cost of limited solar panel production capacity. For instance, in wind energy development, the shadow price can indicate the economic value of additional land availability for turbine installation, guiding investment decisions. These shadow prices help optimize the deployment of renewable assets by quantifying trade-offs in resource scarcity and policy limitations.

Transportation Network Optimization and Shadow Prices

Shadow prices in transportation network optimization quantify the marginal value of scarce resources, such as limited road capacity or vehicle availability, enabling cost-effective allocation decisions. For instance, during peak hours, the shadow price on a congested highway lane reflects the economic benefit of adding one more lane or improving traffic flow management. These values guide infrastructure investments and policy adjustments to maximize overall network efficiency and reduce travel costs.

Shadow Price Analysis in Manufacturing Inputs

Shadow price analysis in manufacturing inputs reveals the implicit cost of constrained resources, such as raw materials or machine hours, impacting production efficiency and profit margins. For example, if a factory operates at full capacity with limited steel availability, the shadow price indicates the additional profit gained per extra unit of steel, guiding optimal resource allocation. This analysis helps manufacturers prioritize scarce inputs and improve operational decision-making by quantifying the economic value of constraints.

Capital Resources and Shadow Price Implications

Shadow price in capital resources represents the implicit value of an additional unit of capital in constrained economic models, often reflecting the marginal benefit of investing extra funds. For example, in production optimization, a shadow price of $50 indicates that increasing capital by one unit could raise total profit by $50. This insight guides firms in resource allocation decisions, highlighting the economic trade-offs and opportunity costs associated with capital constraints.

Environmental Resource Valuation Using Shadow Prices

Shadow prices in environmental resource valuation quantify the implicit economic value of scarce natural assets, such as clean air, water, and biodiversity. For example, the shadow price of water in agriculture reflects the marginal value of water use, guiding efficient allocation and conservation in drought-prone regions. Incorporating shadow prices into policy-making supports sustainable resource management by internalizing externalities and promoting optimal investment in environmental protection.

Real-World Cases: Shadow Price in Public Resource Distribution

In water resource management, the shadow price reflects the marginal value of an additional unit of water in allocation decisions during scarcity. For instance, California's drought policies use shadow pricing to prioritize agricultural and urban water distribution, highlighting the economic cost of water constraints. This approach enables policymakers to optimize resource allocation by quantifying opportunity costs in environmental and public sectors.

example of shadow price in resource Infographic

samplerz.com

samplerz.com