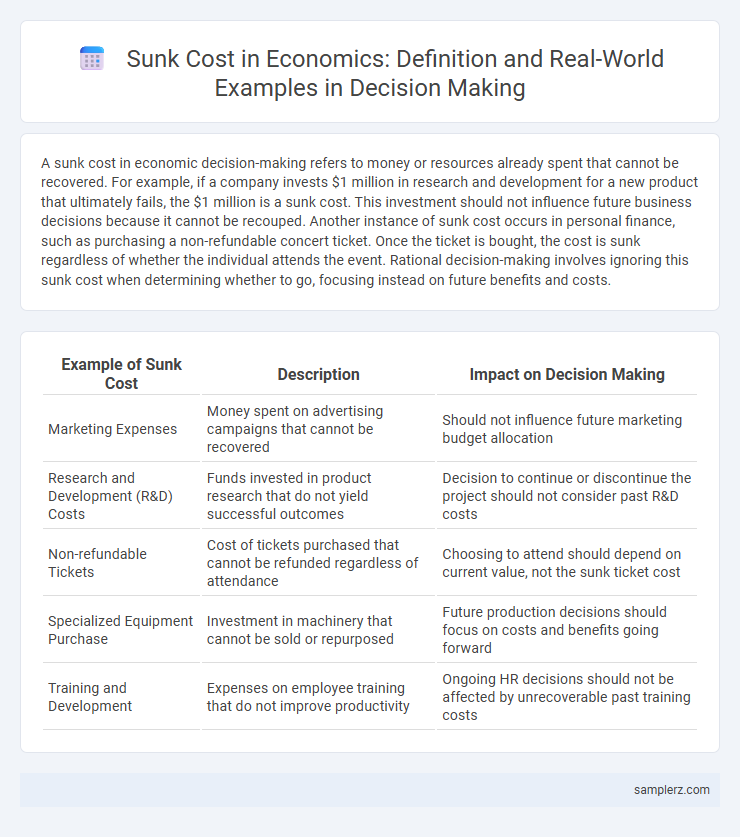

A sunk cost in economic decision-making refers to money or resources already spent that cannot be recovered. For example, if a company invests $1 million in research and development for a new product that ultimately fails, the $1 million is a sunk cost. This investment should not influence future business decisions because it cannot be recouped. Another instance of sunk cost occurs in personal finance, such as purchasing a non-refundable concert ticket. Once the ticket is bought, the cost is sunk regardless of whether the individual attends the event. Rational decision-making involves ignoring this sunk cost when determining whether to go, focusing instead on future benefits and costs.

Table of Comparison

| Example of Sunk Cost | Description | Impact on Decision Making |

|---|---|---|

| Marketing Expenses | Money spent on advertising campaigns that cannot be recovered | Should not influence future marketing budget allocation |

| Research and Development (R&D) Costs | Funds invested in product research that do not yield successful outcomes | Decision to continue or discontinue the project should not consider past R&D costs |

| Non-refundable Tickets | Cost of tickets purchased that cannot be refunded regardless of attendance | Choosing to attend should depend on current value, not the sunk ticket cost |

| Specialized Equipment Purchase | Investment in machinery that cannot be sold or repurposed | Future production decisions should focus on costs and benefits going forward |

| Training and Development | Expenses on employee training that do not improve productivity | Ongoing HR decisions should not be affected by unrecoverable past training costs |

Understanding Sunk Costs in Economic Decisions

Companies often face sunk costs such as non-refundable research and development expenses when deciding whether to continue a project. Ignoring these unrecoverable costs helps managers make rational economic decisions based on future benefits rather than past investments. Understanding sunk costs prevents the escalation of commitment and improves resource allocation efficiency.

Classic Examples of Sunk Cost Fallacy

Investing in a failing business project illustrates the classic sunk cost fallacy, where decision-makers continue funding due to prior expenses rather than future benefits. Another example includes continuing to repair an old car despite mounting repair costs exceeding its resale value. The fallacy leads to irrational commitments, ignoring that sunk costs cannot be recovered and should not influence ongoing decisions.

Sunk Cost in Business Investments

Sunk cost in business investments refers to expenses that have already been incurred and cannot be recovered, such as research and development expenditures or initial capital outlays on machinery. Firms must avoid considering these irrecoverable costs when making future investment decisions to prevent the sunk cost fallacy. Ignoring sunk costs ensures that businesses focus only on marginal costs and benefits, optimizing resource allocation and profitability.

Personal Finance and Sunk Cost Scenarios

Ignoring sunk costs is crucial in personal finance decisions, such as continuing to invest in a failing subscription or service simply because money has already been spent. For example, if someone purchases an expensive gym membership but rarely attends, the rational choice is to cancel and avoid future fees instead of feeling compelled to use it to justify past expenses. Recognizing sunk cost fallacy helps individuals avoid throwing good money after bad and make more economically sound decisions.

Sunk Costs in Government Projects

Sunk costs in government projects often manifest as large initial investments in infrastructure, such as highways or public transit systems, that remain unrecoverable despite changes in project viability or public needs. These costs create a bias towards continuing projects even when cost-benefit analyses suggest cancellation or modification would be more economical. Recognizing sunk costs prevents fiscal inefficiency and promotes more rational budget allocation in public sector decision-making.

Sunk Costs in the Entertainment Industry

Studios often face sunk costs when investing millions in pre-production for films that are later canceled, as these expenses cannot be recovered regardless of future decisions. Marketing campaigns funded for underperforming movies also represent sunk costs, influencing decisions about whether to continue promoting a project. Understanding sunk costs in the entertainment industry is crucial to avoid escalating losses by cutting investment in failing ventures.

Sunk Costs and Consumer Behavior

Sunk costs, such as non-refundable tickets or prepaid subscriptions, often influence consumer behavior by causing individuals to continue investing in a product or service despite diminishing returns. This phenomenon leads to the "escalation of commitment," where consumers irrationally justify further spending to recover past losses. Understanding sunk costs is crucial for making rational economic decisions, as ignoring these irrecoverable expenses can prevent inefficient resource allocation and reduce financial loss.

Real Estate and Sunk Cost Examples

Investors in real estate often face sunk costs such as non-refundable inspection fees and initial property renovations that cannot be recovered if a sale is abandoned. Ignoring these irrecoverable expenses helps buyers make decisions based on current market conditions rather than past investments. Understanding sunk cost examples in real estate prevents further financial losses from previous commitments.

Sunk Cost Implications in Startups

Startups frequently face sunk cost implications when invested resources in failed product development or marketing campaigns cannot be recovered, affecting future decision-making. Ignoring sunk costs, such as expenses on obsolete technology or discontinued services, is crucial to avoid escalating losses and allocate resources to more promising ventures. Effective recognition of sunk costs enhances strategic pivoting, allowing startups to focus on scalable opportunities rather than irrecoverable past expenditures.

Sunk Cost in Research and Development

Sunk costs in research and development (R&D) refer to prior investments in technology, prototypes, or experimental trials that cannot be recovered once spent. These costs impact strategic decisions, such as whether to continue funding a project despite diminishing prospects of commercial viability. Companies must avoid the sunk cost fallacy by evaluating R&D projects based on future returns rather than irrecoverable past expenditures.

example of sunk cost in decision Infographic

samplerz.com

samplerz.com