Velocity in a monetary economy measures the frequency at which money changes hands within a specific period. It reflects the rate of economic activity by showing how often a unit of currency is used for transactions. A higher velocity indicates active spending and economic growth, while a lower velocity signals slower economic movement and potential stagnation. For example, if the money supply in an economy is $1 trillion and the nominal GDP is $5 trillion, the velocity of money is calculated as 5. This means each dollar is spent five times on average during the year. Central banks and policymakers analyze velocity to understand monetary circulation efficiency and to make decisions on interest rates and money supply adjustments.

Table of Comparison

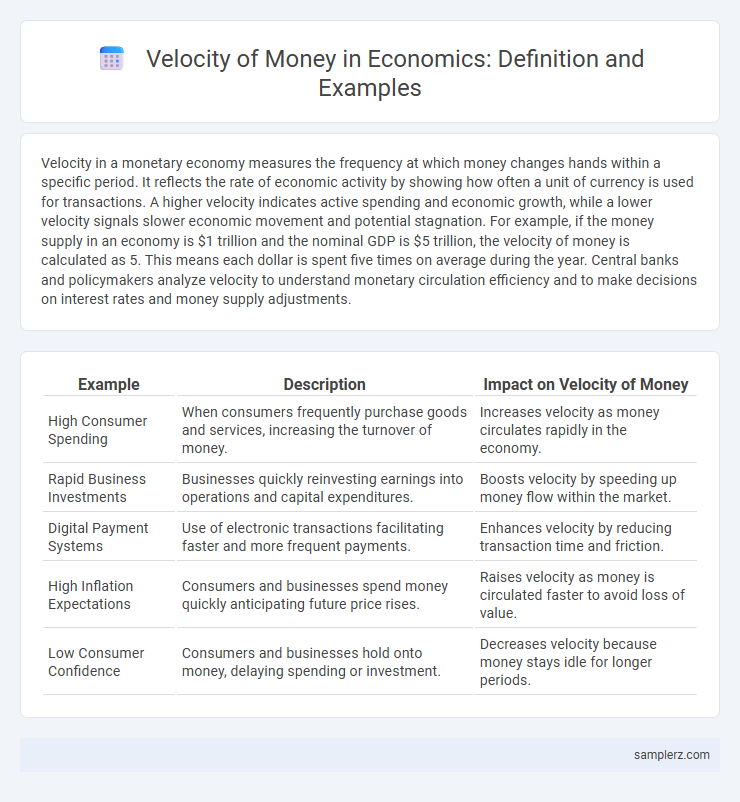

| Example | Description | Impact on Velocity of Money |

|---|---|---|

| High Consumer Spending | When consumers frequently purchase goods and services, increasing the turnover of money. | Increases velocity as money circulates rapidly in the economy. |

| Rapid Business Investments | Businesses quickly reinvesting earnings into operations and capital expenditures. | Boosts velocity by speeding up money flow within the market. |

| Digital Payment Systems | Use of electronic transactions facilitating faster and more frequent payments. | Enhances velocity by reducing transaction time and friction. |

| High Inflation Expectations | Consumers and businesses spend money quickly anticipating future price rises. | Raises velocity as money is circulated faster to avoid loss of value. |

| Low Consumer Confidence | Consumers and businesses hold onto money, delaying spending or investment. | Decreases velocity because money stays idle for longer periods. |

Understanding the Concept of Velocity in Monetary Economy

Velocity of money measures the frequency at which a unit of currency circulates within an economy over a specific period, reflecting overall economic activity. High velocity indicates rapid transactions and robust demand, while low velocity suggests sluggish spending and economic stagnation. Central banks monitor velocity to inform monetary policy decisions aimed at stabilizing inflation and promoting growth.

Measuring Money Velocity: Key Indicators

Money velocity in a monetary economy is measured by key indicators such as the ratio of nominal GDP to the money supply (M1 or M2). This metric captures how frequently a unit of currency circulates within an economy over a specified period, reflecting economic activity levels. High velocity indicates rapid spending and robust economic transactions, whereas low velocity suggests sluggish demand and potential economic stagnation.

Real-World Examples of Money Velocity

The velocity of money measures the frequency at which a unit of currency circulates within an economy, reflecting economic activity levels. In 2023, the United States experienced an average velocity of money around 1.5, indicating slower circulation compared to pre-pandemic years, largely due to increased savings and cautious consumer spending. Japan's economy, with a historically low money velocity near 1.0, exemplifies long-term structural factors like aging population and deflationary pressures that dampen money circulation.

Velocity of Money and Economic Growth

The velocity of money measures how frequently a unit of currency circulates in the economy over a specific period, directly influencing economic growth by affecting aggregate demand and investment levels. A higher velocity indicates increased transaction activity, boosting GDP and signaling robust economic performance, while a decline may reflect reduced consumer confidence and slower growth. Central banks monitor velocity closely alongside money supply to calibrate monetary policy aimed at sustaining stable inflation and accelerating economic expansion.

Case Study: High vs. Low Money Velocity

High money velocity indicates rapid circulation of currency within the economy, often seen during periods of strong consumer confidence and increased spending, as observed in the 1990s U.S. economy. Conversely, low money velocity reflects sluggish transaction activity and reduced spending, common during recessions like the 2008 financial crisis when consumers and businesses hoard cash. This comparison underscores how money velocity serves as a critical indicator of economic health and liquidity dynamics.

Influence of Consumer Spending on Money Velocity

Consumer spending significantly impacts the velocity of money by increasing the frequency at which currency circulates within the economy. High consumer confidence typically leads to greater expenditure on goods and services, accelerating money turnover and stimulating economic growth. Conversely, reduced spending slows money velocity, dampening economic activity and potentially leading to recessions.

Impact of Monetary Policy on Velocity Rates

Changes in interest rates set by central banks directly influence the velocity of money by affecting borrowing and spending behaviors. When monetary policy tightens, higher interest rates typically reduce consumer and business expenditures, slowing the rate at which money circulates in the economy. Conversely, expansionary policies with lower interest rates tend to increase transaction frequency, accelerating velocity and stimulating economic activity.

Velocity Changes During Economic Recessions

During economic recessions, the velocity of money typically decreases as consumers and businesses reduce spending and increase savings amidst uncertainty. This decline in velocity reflects slower circulation of money within the economy, leading to decreased demand and further contraction in economic activity. Central banks often respond by implementing monetary policies aimed at stimulating velocity to revive growth and stabilize prices.

Digital Payments and the Acceleration of Money Velocity

The rise of digital payments has significantly accelerated the velocity of money by enabling instantaneous transactions and reducing the need for cash holdings. Mobile wallets, online banking, and contactless payments facilitate rapid circulation of funds, enhancing economic activity and liquidity. Increased frequency of digital transactions promotes faster money flow, driving growth in consumer spending and business operations.

Strategies to Increase Velocity in Modern Economies

Increasing the velocity of money in modern economies relies on strategies such as enhancing digital payment systems that facilitate quicker transactions and promoting financial literacy to encourage frequent currency circulation. Governments and central banks implement policies like lowering interest rates and incentivizing consumer spending to boost transactional activity. Encouraging innovation in fintech, expanding e-commerce platforms, and reducing transaction costs also contribute significantly to accelerating money velocity.

example of velocity in monetary economy Infographic

samplerz.com

samplerz.com