Adverse selection occurs in the market when buyers or sellers have asymmetric information, leading to inefficient outcomes. A classic example is the market for used cars, where sellers have more information about the vehicle's condition than buyers. This information gap causes buyers to assume higher risk, often resulting in lower prices and a prevalence of low-quality cars, known as "lemons." In the insurance market, adverse selection happens when individuals with higher health risks are more likely to purchase insurance, while healthier individuals opt-out. Insurance companies struggle to price policies accurately due to incomplete information about customers' health status. This imbalance can lead to increased premiums and reduced coverage availability, ultimately destabilizing the insurance market.

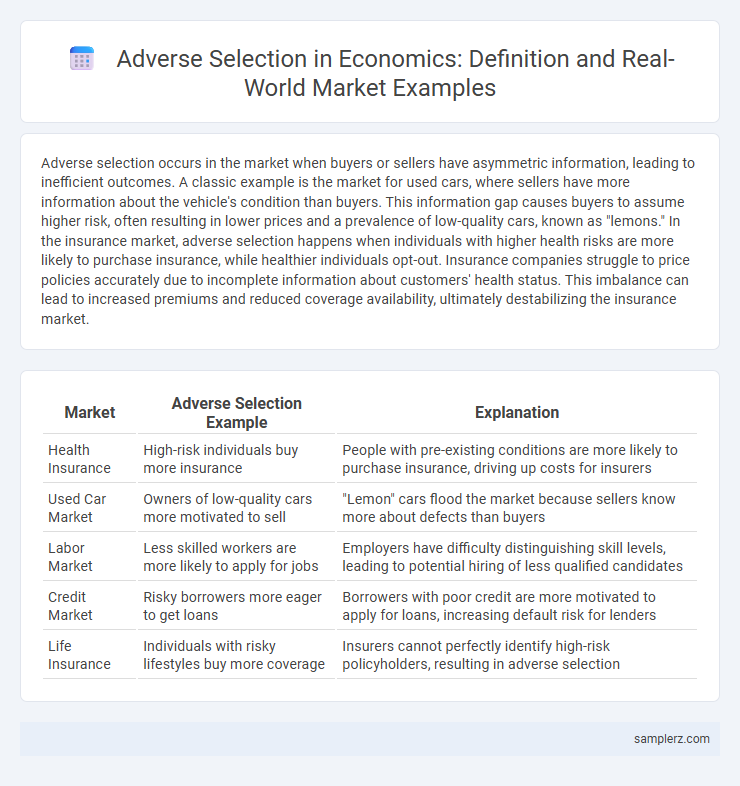

Table of Comparison

| Market | Adverse Selection Example | Explanation |

|---|---|---|

| Health Insurance | High-risk individuals buy more insurance | People with pre-existing conditions are more likely to purchase insurance, driving up costs for insurers |

| Used Car Market | Owners of low-quality cars more motivated to sell | "Lemon" cars flood the market because sellers know more about defects than buyers |

| Labor Market | Less skilled workers are more likely to apply for jobs | Employers have difficulty distinguishing skill levels, leading to potential hiring of less qualified candidates |

| Credit Market | Risky borrowers more eager to get loans | Borrowers with poor credit are more motivated to apply for loans, increasing default risk for lenders |

| Life Insurance | Individuals with risky lifestyles buy more coverage | Insurers cannot perfectly identify high-risk policyholders, resulting in adverse selection |

Understanding Adverse Selection in Economic Markets

Adverse selection occurs in economic markets when sellers or buyers possess asymmetric information that leads to the transaction of lower-quality goods or high-risk participants. A classic example is the used car market, where sellers know more about the vehicle's defects than buyers, causing the prevalence of "lemons" that drive down overall market prices. This information imbalance distorts market efficiency by discouraging honest sellers and reducing overall trust in transactions.

Classic Examples of Adverse Selection in Insurance

Adverse selection in insurance markets occurs when individuals with higher risks are more likely to purchase coverage, leading insurers to face disproportionate claims and financial losses. Classic examples include health insurance, where those with pre-existing medical conditions are more inclined to buy comprehensive plans, and life insurance, where individuals with poor health or risky lifestyles seek greater coverage. This asymmetry of information challenges insurers to set premiums accurately and design screening mechanisms to mitigate the adverse effects on the market.

Adverse Selection in the Used Car Market

Adverse selection in the used car market occurs when sellers have more information about vehicle quality than buyers, leading to a higher presence of low-quality "lemons." Buyers, unable to accurately assess car conditions, tend to offer lower prices that discourage sellers of high-quality vehicles from participating. This information asymmetry causes market inefficiency, reducing overall trust and transaction volumes.

Health Insurance and Adverse Selection Dynamics

Adverse selection in health insurance occurs when individuals with higher health risks are more likely to purchase comprehensive coverage, skewing the insurance pool towards higher claims and increased premiums. This dynamic leads insurers to raise prices, which can discourage healthier individuals from enrolling, exacerbating the imbalance further. The resulting market inefficiency reduces coverage availability and escalates costs for both insurers and insured parties.

Adverse Selection in Labor Markets

Adverse selection in labor markets occurs when employers cannot accurately distinguish between high-quality and low-quality candidates before hiring, leading to a pool of applicants with varying productivity levels. This information asymmetry causes employers to offer average wages, potentially driving away skilled workers who seek higher pay elsewhere. Consequently, firms may experience reduced overall workforce efficiency and increased hiring costs due to mismatches between employee capabilities and job requirements.

Real Estate Transactions: A Case of Adverse Selection

In real estate transactions, adverse selection occurs when sellers possess more information about property defects than buyers, leading to a market dominated by lower-quality homes. This information asymmetry drives down prices as buyers anticipate potential hidden issues, causing high-quality sellers to withdraw from the market. Consequently, adverse selection results in inefficient market outcomes and reduced overall transaction volumes in the housing sector.

Financial Markets and the Risk of Adverse Selection

In financial markets, adverse selection occurs when sellers possess more information about the riskiness of assets than buyers, leading to the prevalence of high-risk securities being traded. This information asymmetry increases the likelihood of market inefficiencies and can cause borrowing costs to rise, as lenders compensate for hidden risks. The 2008 financial crisis exemplified this risk, where complex mortgage-backed securities masked underlying loan quality, triggering widespread market distrust and liquidity shortages.

Adverse Selection in Credit Markets and Lending

Adverse selection in credit markets occurs when lenders cannot accurately assess the risk level of borrowers, leading to higher interest rates that drive away low-risk applicants and attract high-risk individuals. This information asymmetry results in a pool of borrowers with poorer credit quality, increasing the likelihood of loan defaults. Consequently, lenders may reduce credit availability, which restricts economic growth and financial inclusion.

Mitigating Adverse Selection: Screening and Signaling

In insurance markets, adverse selection arises when high-risk individuals disproportionately purchase coverage, leading to market inefficiencies. Effective screening methods include detailed questionnaires and medical examinations to identify applicant risk levels accurately. Signaling mechanisms, such as offering differentiated contracts or requiring upfront premiums, help credible low-risk individuals distinguish themselves, reducing information asymmetry and improving market outcomes.

Policy Solutions to Address Adverse Selection in Markets

Policy solutions to address adverse selection in markets include mandating comprehensive disclosure of information to reduce asymmetry between buyers and sellers. Implementing regulatory frameworks such as quality certification and standardized contracts helps signal product reliability and mitigate hidden information issues. Subsidizing screening mechanisms and fostering market institutions that facilitate transparency also play crucial roles in alleviating adverse selection challenges.

example of adverse selection in market Infographic

samplerz.com

samplerz.com