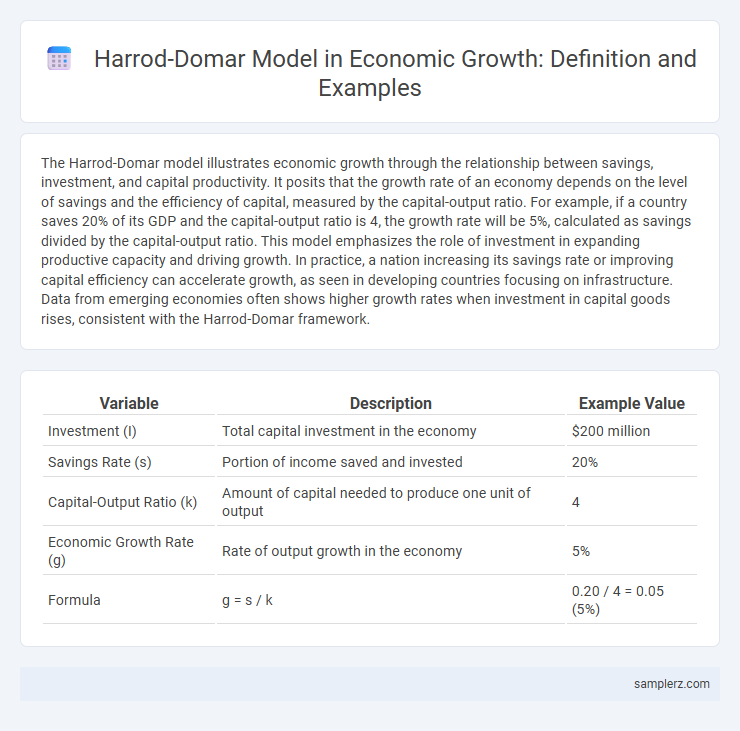

The Harrod-Domar model illustrates economic growth through the relationship between savings, investment, and capital productivity. It posits that the growth rate of an economy depends on the level of savings and the efficiency of capital, measured by the capital-output ratio. For example, if a country saves 20% of its GDP and the capital-output ratio is 4, the growth rate will be 5%, calculated as savings divided by the capital-output ratio. This model emphasizes the role of investment in expanding productive capacity and driving growth. In practice, a nation increasing its savings rate or improving capital efficiency can accelerate growth, as seen in developing countries focusing on infrastructure. Data from emerging economies often shows higher growth rates when investment in capital goods rises, consistent with the Harrod-Domar framework.

Table of Comparison

| Variable | Description | Example Value |

|---|---|---|

| Investment (I) | Total capital investment in the economy | $200 million |

| Savings Rate (s) | Portion of income saved and invested | 20% |

| Capital-Output Ratio (k) | Amount of capital needed to produce one unit of output | 4 |

| Economic Growth Rate (g) | Rate of output growth in the economy | 5% |

| Formula | g = s / k | 0.20 / 4 = 0.05 (5%) |

Introduction to the Harrod-Domar Growth Model

The Harrod-Domar Growth Model emphasizes the relationship between savings, investment, and economic growth, illustrating how increased capital accumulation drives output expansion. It quantifies the growth rate as the ratio of savings to the capital-output ratio, highlighting the need for sufficient savings to sustain steady growth. This model serves as a foundational framework in development economics to analyze how investment influences GDP growth and capital formation.

Key Assumptions of the Harrod-Domar Model

The Harrod-Domar model assumes a fixed capital-output ratio, indicating that output growth depends directly on investment levels and capital efficiency. It presumes a constant savings rate, where savings are entirely invested to fuel economic expansion. The model also relies on the notion of no technological change, emphasizing that growth is driven solely by capital accumulation without improvements in productivity.

Mathematical Representation of the Harrod-Domar Model

The Harrod-Domar model mathematically represents economic growth through the equation G = s/v, where G is the growth rate of GDP, s is the savings ratio, and v is the capital-output ratio. This formula demonstrates how higher savings lead to increased investment, which drives growth, while the capital-output ratio reflects the efficiency of capital in generating output. By emphasizing the critical role of investment and capital efficiency, the Harrod-Domar model provides a quantitative framework for understanding the dynamics of economic growth.

Role of Savings and Investment in Economic Growth

The Harrod-Domar model emphasizes that economic growth depends directly on the savings rate, as higher savings provide the funds necessary for investment in capital goods. Investment increases the capital stock, enhancing productive capacity and driving GDP growth, while insufficient savings limit investment and hinder economic expansion. This model highlights the critical role of maintaining a balanced savings-investment ratio to sustain steady economic development.

Example: Harrod-Domar Model Applied to Developing Economies

The Harrod-Domar model illustrates economic growth in developing economies by emphasizing the critical role of savings and investment rates in driving capital accumulation. For instance, when a country increases its savings rate from 10% to 15%, the model predicts a proportional rise in the economic growth rate, assuming technology and capital-output ratios remain constant. This framework highlights how insufficient savings can hinder growth, underscoring the need for policies that boost investment and improve capital efficiency in developing nations.

Harrod-Domar Model and Post-War European Recovery

The Harrod-Domar model emphasizes the role of savings and investment in driving economic growth, suggesting that higher investment rates lead to increased capital stock and output. Post-war European recovery exemplified this model as massive investments in infrastructure and industry, supported by the Marshall Plan, accelerated growth and reconstruction. This period demonstrated how enhanced capital formation can effectively boost economic stability and expansion in war-torn economies.

Case Study: India's Five-Year Plans and Harrod-Domar Framework

India's Five-Year Plans utilized the Harrod-Domar model by emphasizing capital investment to accelerate economic growth and address savings-investment gaps. The model's focus on the savings rate and capital-output ratio guided India's allocation of resources towards infrastructure and industrial sectors, driving higher GDP growth rates during key planning periods. Despite challenges, the integration of the Harrod-Domar framework helped shape policy measures that targeted balanced growth and structural transformation in India's economy.

Criticisms and Limitations of the Harrod-Domar Model

The Harrod-Domar model, which links economic growth to savings and investment rates, faces criticism for its unrealistic assumptions such as constant capital-output ratios and fixed savings rates that ignore technological progress and changes in productivity. Its inability to account for labor force dynamics and the flexibility of capital utilization limits its practical applicability in diverse economies. Furthermore, the model's prediction of inherently unstable growth paths contrasts with observed periods of stable economic growth, highlighting its theoretical constraints.

Comparative Analysis: Harrod-Domar vs. Solow Growth Model

The Harrod-Domar model emphasizes the role of savings and investment in driving economic growth, assuming a fixed capital-output ratio and highlighting potential instability in growth rates. In contrast, the Solow Growth Model incorporates technological progress and diminishing returns to capital, explaining long-term growth through exogenous technological improvements and steady-state equilibrium. Comparative analysis reveals that while Harrod-Domar stresses the importance of capital accumulation for growth, Solow provides a more comprehensive framework by integrating technology and labor, offering greater realism in analyzing sustained economic development.

Policy Implications of the Harrod-Domar Example

The Harrod-Domar model emphasizes that investment is crucial for economic growth, as it determines the capital accumulation necessary to increase output. Policymakers should focus on boosting savings rates and channeling funds efficiently into productive investments to sustain steady growth. Furthermore, addressing technological progress and capital efficiency ensures that increasing investment translates into higher growth rates rather than potential economic stagnation.

example of Harrod-Domar model in growth Infographic

samplerz.com

samplerz.com