Crowding out occurs in an economy when increased government borrowing leads to higher interest rates, reducing private investment. For example, if a government issues a large amount of bonds to finance a fiscal deficit, banks and investors may prefer these safer government securities over financing private companies. This shift causes a reduction in available capital for businesses, slowing down economic growth. Another example involves a central bank raising interest rates to control inflation, which increases the cost of borrowing for both the public sector and private firms. As government debt service costs rise, firms may delay or cancel new investment projects due to higher loan expenses. This effect demonstrates how fiscal policy and monetary policy can interact to crowd out private enterprise activity.

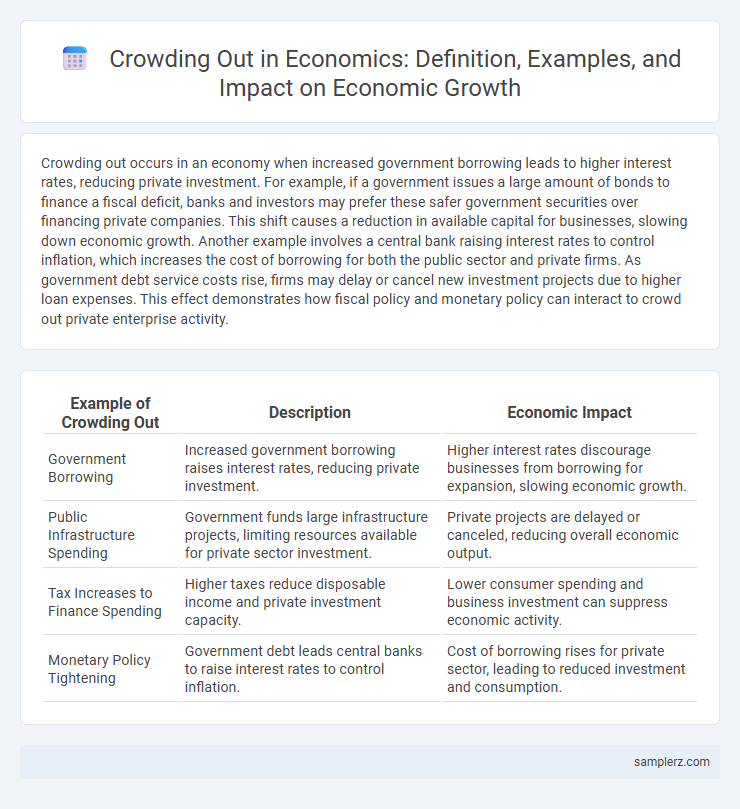

Table of Comparison

| Example of Crowding Out | Description | Economic Impact |

|---|---|---|

| Government Borrowing | Increased government borrowing raises interest rates, reducing private investment. | Higher interest rates discourage businesses from borrowing for expansion, slowing economic growth. |

| Public Infrastructure Spending | Government funds large infrastructure projects, limiting resources available for private sector investment. | Private projects are delayed or canceled, reducing overall economic output. |

| Tax Increases to Finance Spending | Higher taxes reduce disposable income and private investment capacity. | Lower consumer spending and business investment can suppress economic activity. |

| Monetary Policy Tightening | Government debt leads central banks to raise interest rates to control inflation. | Cost of borrowing rises for private sector, leading to reduced investment and consumption. |

Understanding Crowding Out in Economic Theory

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment spending and slowing economic growth. For example, when a government issues bonds to finance a large deficit, it competes with private firms for limited loanable funds, causing higher borrowing costs for businesses. This interaction highlights the trade-off between public spending and private sector activity in economic theory.

Real-World Examples of Crowding Out Effects

Government borrowing to finance large infrastructure projects often leads to higher interest rates, reducing private investment in sectors like manufacturing and technology. For instance, during the 1980s in the United States, increased federal deficits caused by defense spending contributed to significant crowding out in private capital markets. Emerging economies such as Brazil have also experienced crowding out when public debt issuance absorbs available credit, limiting funds for small and medium enterprises.

Government Borrowing and Private Investment Displacement

Government borrowing can lead to crowding out by increasing demand for available funds, which raises interest rates and reduces private investment. When public sector debt grows, businesses face higher borrowing costs, limiting their capacity to finance new projects and innovation. This displacement of private investment slows economic growth and reduces overall productivity gains.

The Impact of Expansionary Fiscal Policy on Private Sector

Expansionary fiscal policy, such as increased government borrowing to finance public projects, often leads to crowding out by raising interest rates, which reduces private sector investment. When the government competes for available credit in capital markets, higher demand pushes up borrowing costs, discouraging businesses from pursuing new ventures or capital expenditures. Empirical studies demonstrate that large-scale fiscal deficits correlate with decreased private investment, highlighting the trade-off between public spending and private sector growth.

Infrastructure Spending and Its Crowding Out Consequences

Government infrastructure spending often leads to crowding out by increasing demand for financial resources, which raises interest rates and reduces private investment. For example, when public funds are allocated to large-scale projects like highways and bridges, private companies may face higher borrowing costs and scale back their capital expenditures. This shift can slow down overall economic growth by limiting private sector expansion despite the boost from public infrastructure developments.

Crowding Out in Developing versus Developed Economies

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment; this effect is generally more pronounced in developing economies due to less efficient financial markets and limited access to external capital. In developed economies, deeper capital markets and higher investor confidence mitigate crowding out, allowing governments to finance deficits with less adverse impact on private sector investment. Empirical studies show that developing countries often experience a stronger negative correlation between public debt levels and private investment growth compared to developed nations.

Monetary Policy Responses to Crowding Out

Monetary policy responses to crowding out often involve lowering interest rates to encourage private investment despite increased government borrowing. Central banks may implement expansionary monetary policies, such as quantitative easing, to inject liquidity and counteract the reduced availability of funds for the private sector. These measures help mitigate the crowding-out effect by maintaining capital flow and supporting economic growth.

Empirical Case Studies: Crowding Out in the 2008 Financial Crisis

During the 2008 financial crisis, large-scale government borrowing to stabilize financial institutions led to measurable crowding out, where increased public debt caused higher interest rates that restricted private investment. Empirical studies indicate that U.S. Treasury issuance surged dramatically, resulting in capital displacement from private sectors and dampened business investment growth. Data reveal that this borrowing ultimately constrained economic recovery by limiting credit availability for smaller businesses, illustrating a clear case of crowding out during a major financial downturn.

Crowding Out’s Role in Interest Rate Fluctuations

Crowding out occurs when increased government borrowing leads to higher interest rates, reducing private investment by making credit more expensive. This phenomenon influences economic growth as businesses face higher financing costs, limiting expansion and innovation. Interest rate fluctuations driven by crowding out can dampen overall economic activity, especially during periods of substantial fiscal deficits.

Policy Measures to Mitigate Crowding Out Effects

Government bond issuance often leads to higher interest rates, reducing private investment due to crowding out. Implementing monetary policies such as lowering reserve requirements or engaging in quantitative easing can counteract these effects by increasing liquidity. Fiscal measures like targeted public spending on infrastructure may also stimulate private sector activity without significantly raising borrowing costs.

example of crowding out in economy Infographic

samplerz.com

samplerz.com