Dutch disease occurs when a country's discovery of natural resources leads to a significant increase in revenue, causing currency appreciation and making other sectors less competitive. A classic example is the Netherlands in the 1960s after discovering large natural gas fields in the North Sea. The gas exports resulted in a stronger Dutch guilder, which reduced the competitiveness of Dutch manufacturing and agriculture industries. Another notable case is Nigeria, where oil exports dominate the economy and contribute to currency appreciation. This situation has hindered the development of the manufacturing sector and agricultural productivity. The overreliance on oil revenues makes the economy vulnerable to fluctuations in global oil prices, creating instability and slowing diversification efforts.

Table of Comparison

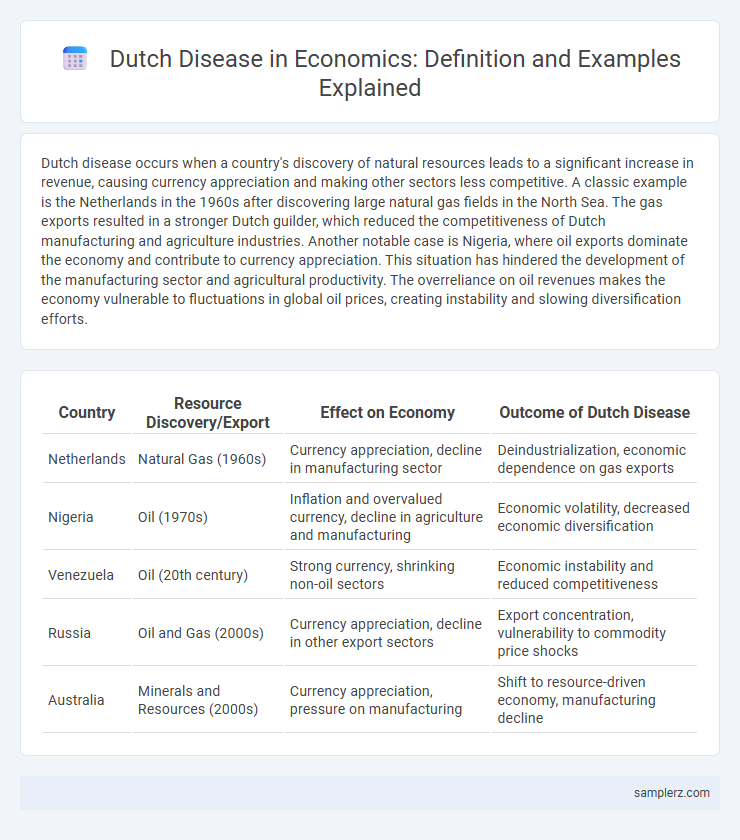

| Country | Resource Discovery/Export | Effect on Economy | Outcome of Dutch Disease |

|---|---|---|---|

| Netherlands | Natural Gas (1960s) | Currency appreciation, decline in manufacturing sector | Deindustrialization, economic dependence on gas exports |

| Nigeria | Oil (1970s) | Inflation and overvalued currency, decline in agriculture and manufacturing | Economic volatility, decreased economic diversification |

| Venezuela | Oil (20th century) | Strong currency, shrinking non-oil sectors | Economic instability and reduced competitiveness |

| Russia | Oil and Gas (2000s) | Currency appreciation, decline in other export sectors | Export concentration, vulnerability to commodity price shocks |

| Australia | Minerals and Resources (2000s) | Currency appreciation, pressure on manufacturing | Shift to resource-driven economy, manufacturing decline |

Introduction to Dutch Disease in the Economy

Dutch Disease refers to the negative economic consequences that occur when a country's rapid resource exports, like natural gas or oil, lead to currency appreciation, making other sectors such as manufacturing and agriculture less competitive internationally. This phenomenon was first identified in the Netherlands during the 1960s following large natural gas discoveries, which caused a decline in the manufacturing sector. The appreciation of the Dutch guilder resulted in higher import levels and a reduction in export diversification, negatively impacting long-term economic growth.

Classic Examples of Dutch Disease Worldwide

Classic examples of Dutch disease include the Netherlands in the 1960s, when the discovery of natural gas led to a decline in manufacturing exports due to currency appreciation. Nigeria experienced Dutch disease after oil exports surged in the 1970s, causing a significant drop in agricultural output and industrial diversification. Similarly, Venezuela's heavy reliance on oil revenues during the late 20th century resulted in currency overvaluation and a weakened non-oil sector, illustrating typical symptoms of Dutch disease.

The Dutch Disease Phenomenon: Origins and Impact

The Dutch Disease phenomenon originates from the 1960s Netherlands when a natural gas discovery led to currency appreciation, making other export sectors less competitive. This economic imbalance caused a decline in manufacturing and agriculture, highlighting resource dependence risks. The resulting structural shifts exemplify how resource booms can undermine diversified economic growth.

Case Study: The Netherlands and the Discovery of Natural Gas

The Netherlands experienced Dutch disease after the 1959 discovery of vast natural gas fields in Groningen, leading to a resource boom that appreciated the Dutch guilder and harmed manufacturing competitiveness. This influx of revenue caused a shift in labor and capital toward the gas sector, resulting in deindustrialization and increased economic volatility. The case highlights how natural resource wealth can undermine diversified economic growth through exchange rate distortions and sectoral imbalances.

Nigerian Oil Boom and Dutch Disease Effects

The Nigerian Oil Boom in the 1970s triggered Dutch disease by causing a substantial appreciation of the naira, which harmed the competitiveness of Nigeria's manufacturing and agricultural sectors. The influx of oil revenues led to a resource movement effect, drawing labor and capital into the booming oil industry and away from other critical economic sectors. This economic imbalance resulted in a decline in non-oil exports, increased import dependency, and heightened vulnerability to oil price volatility.

Russia’s Natural Resources and Economic Shifts

Russia's heavy reliance on natural resource exports, particularly oil and gas, exemplifies Dutch disease by causing currency appreciation that undermines the competitiveness of other sectors like manufacturing and agriculture. The influx of foreign currency from resource exports has led to a decline in non-resource industries, resulting in economic shifts that increase vulnerability to global commodity price fluctuations. This resource dependence has constrained economic diversification, hindering sustainable growth and resilience in Russia's economy.

Australia’s Mining Boom: Signs of Dutch Disease

Australia's mining boom in the early 21st century triggered classic signs of Dutch Disease, marked by a surge in resource exports that caused currency appreciation and a decline in manufacturing competitiveness. The rapid growth in mining revenues led to higher income levels and government spending, driving up the Australian dollar and making non-mining sectors less competitive internationally. This economic shift resulted in job losses in manufacturing and a growing dependence on the volatile commodities market, highlighting the structural challenges associated with resource-driven growth.

The Impact of Dutch Disease on Developing Economies

The impact of Dutch Disease on developing economies manifests through the excessive reliance on natural resource exports, which triggers currency appreciation and undermines the competitiveness of other sectors like manufacturing and agriculture. Countries such as Nigeria and Venezuela have experienced deindustrialization and slowed economic diversification due to resource booms leading to volatile revenues and fiscal imbalances. This economic phenomenon often results in reduced long-term growth prospects and increased vulnerability to commodity price fluctuations.

Economic Policies to Counteract Dutch Disease

Economic policies to counteract Dutch disease often include establishing sovereign wealth funds to stabilize revenues from natural resource exports and investing in economic diversification to reduce dependence on the resource sector. Implementing monetary policies that control inflation and exchange rate appreciation can protect the competitiveness of tradable industries. Governments may also focus on strengthening institutional frameworks and promoting innovation to sustain long-term economic resilience.

Lessons Learned from Global Dutch Disease Cases

Global examples of Dutch disease, such as Nigeria's oil boom and Russia's gas exports, demonstrate the risks of over-reliance on natural resource sectors leading to currency appreciation and manufacturing decline. Effective policy responses include establishing sovereign wealth funds, diversifying the economy, and implementing fiscal rules to stabilize revenues. These strategies help mitigate inflationary pressures and preserve competitiveness in non-resource industries, highlighting key lessons for resource-rich economies.

example of Dutch disease in economy Infographic

samplerz.com

samplerz.com