Forward guidance in monetary policy involves central banks communicating future policy intentions to influence market expectations and economic behavior. For example, the Federal Reserve may announce that it plans to keep interest rates near zero for an extended period to support economic recovery and encourage borrowing and investment. This forward guidance helps shape financial conditions by signaling confidence in sustained accommodative policy. Data shows that clear forward guidance can reduce market volatility and lower long-term interest rates. During the 2020 economic downturn, the European Central Bank used forward guidance by pledging to maintain low rates until inflation reached its target. Such communication strategies enhance transparency and guide investor decisions, playing a crucial role in stabilizing the economy.

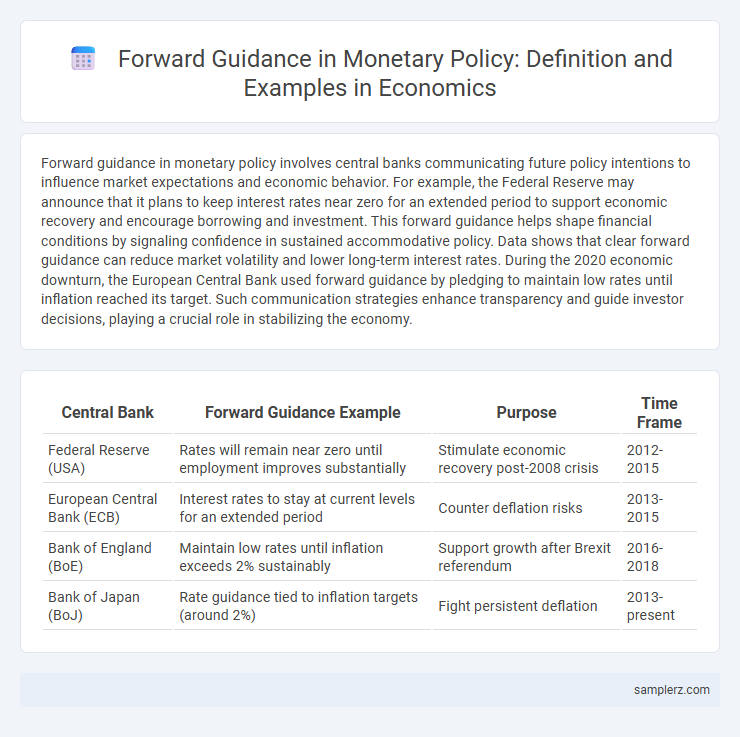

Table of Comparison

| Central Bank | Forward Guidance Example | Purpose | Time Frame |

|---|---|---|---|

| Federal Reserve (USA) | Rates will remain near zero until employment improves substantially | Stimulate economic recovery post-2008 crisis | 2012-2015 |

| European Central Bank (ECB) | Interest rates to stay at current levels for an extended period | Counter deflation risks | 2013-2015 |

| Bank of England (BoE) | Maintain low rates until inflation exceeds 2% sustainably | Support growth after Brexit referendum | 2016-2018 |

| Bank of Japan (BoJ) | Rate guidance tied to inflation targets (around 2%) | Fight persistent deflation | 2013-present |

Understanding Forward Guidance in Monetary Policy

Forward guidance in monetary policy involves central banks communicating future interest rate paths to influence market expectations and economic behavior. This tool helps stabilize inflation and foster economic growth by reducing uncertainty about future monetary conditions. The Federal Reserve's explicit signaling during the 2020 crisis exemplifies effective forward guidance, guiding investor decisions and supporting economic recovery.

Historic Examples of Forward Guidance by Central Banks

The Federal Reserve's use of forward guidance during the 2008 financial crisis provided explicit signals on keeping interest rates near zero until unemployment rates declined substantially, effectively shaping market expectations and stabilizing economic activity. The European Central Bank employed forward guidance in 2013 by communicating its intention to maintain low interest rates over an extended period to combat deflationary pressures in the Eurozone. The Bank of England's forward guidance in 2013 linked future interest rate decisions to specific labor market conditions, enhancing transparency and influencing bond yields and lending behavior.

The Federal Reserve’s Forward Guidance Strategies

The Federal Reserve's forward guidance strategies involve clear communication about the future path of interest rates and monetary policy to influence market expectations and economic behavior. By signaling plans for maintaining low rates until specific economic targets like inflation reaching 2% or unemployment falling below 4% are met, the Fed aims to stabilize markets and boost investment. This approach enhances policy transparency, reduces uncertainty, and supports the Fed's dual mandate of price stability and maximum employment.

European Central Bank’s Approach to Forward Guidance

The European Central Bank's forward guidance strategy emphasizes clear communication on future interest rate trajectories to influence market expectations and economic behavior. By signaling prolonged low interest rates and conditionality based on inflation targets, the ECB aims to stabilize inflation around its 2% goal while supporting economic growth. This approach enhances transparency and reduces uncertainty in financial markets, fostering more predictable monetary policy outcomes.

Bank of England: Case Studies in Forward Guidance

The Bank of England implemented forward guidance during the post-2008 financial crisis by signaling that interest rates would remain low until unemployment fell below a specific threshold, anchoring market expectations and stabilizing financial conditions. This policy approach aimed to enhance transparency and influence long-term interest rates despite the Bank Rate being at the effective lower bound. The case study highlights forward guidance's role in managing economic recovery by providing clear communication on future monetary policy paths.

The Impact of Forward Guidance During Financial Crises

Forward guidance during financial crises provides clear communication from central banks about future interest rate paths, reducing market uncertainty and stabilizing expectations. The Federal Reserve's implementation of forward guidance during the 2008 financial crisis helped lower long-term yields and boosted investor confidence, facilitating economic recovery. Studies show that transparent forward guidance enhances the effectiveness of monetary policy by anchoring inflation expectations and supporting credit flow in distressed markets.

Forward Guidance in Emerging Market Economies

Forward guidance in emerging market economies often involves clear communication from central banks about future interest rate paths to stabilize inflation expectations and attract foreign investment. For instance, the Reserve Bank of India uses forward guidance to signal its monetary policy stance, aiming to manage inflation while supporting growth in a volatile global environment. This strategy helps reduce market uncertainty and enhances the effectiveness of monetary policy transmission in economies susceptible to external shocks.

Lessons Learned from Forward Guidance Failures

Forward guidance in monetary policy faced setbacks when central banks underestimated inflation persistence, leading to credibility erosion and market confusion. The 2013 "taper tantrum" illustrated risks of premature signaling about asset purchase tapering, causing sharp bond yield spikes and financial instability. Clear communication, adaptive strategies, and realistic economic projections emerged as essential lessons to enhance forward guidance effectiveness.

Comparing State-Dependent vs. Calendar-Based Forward Guidance

State-dependent forward guidance adjusts interest rate projections based on economic indicators such as unemployment rates or inflation targets, providing conditional commitments to influence market expectations effectively. Calendar-based forward guidance, by contrast, commits to maintaining policy rates until a specific date, offering a fixed timeline that may lack responsiveness to evolving economic conditions. Empirical studies indicate that state-dependent guidance tends to enhance policy credibility and economic stability by allowing central banks to adapt to real-time data while calendar-based guidance can simplify communication but risks misalignment with actual economic dynamics.

Forward Guidance: Effectiveness and Economic Outcomes

Forward guidance by central banks influences market expectations by signaling the future path of interest rates, thereby reducing uncertainty and enhancing policy transparency. Empirical studies demonstrate that clear and credible forward guidance can lower long-term borrowing costs, stimulate investment, and support economic recovery during periods of economic downturn. The effectiveness of forward guidance depends on the central bank's credibility, communication clarity, and prevailing economic conditions.

example of forward guidance in monetary policy Infographic

samplerz.com

samplerz.com