Adverse selection in loans occurs when lenders face challenges in distinguishing between high-risk and low-risk borrowers. Borrowers with poor credit histories or unstable incomes are more likely to apply for loans, while reliable borrowers may avoid high-interest rates. This imbalance causes lenders to increase interest rates to compensate for the risk, potentially driving away creditworthy applicants. Financial institutions use data analytics and credit scoring models to mitigate adverse selection by accurately assessing borrower risk. Loan portfolios with high concentrations of subprime borrowers indicate a classic example of adverse selection. The phenomenon leads to higher default rates, negatively impacting the overall economy by limiting access to affordable credit and increasing financial instability.

Table of Comparison

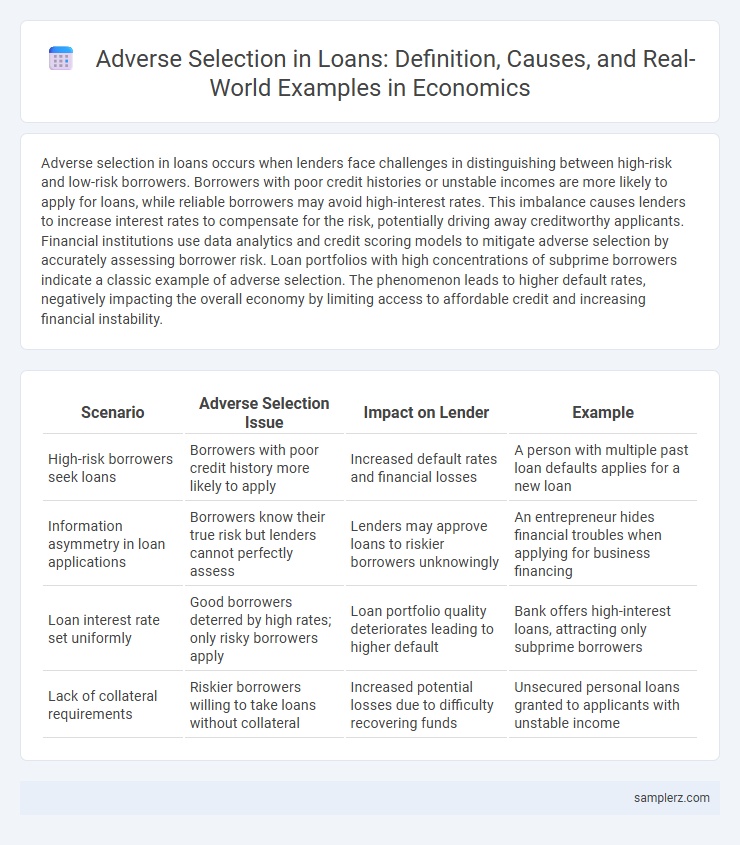

| Scenario | Adverse Selection Issue | Impact on Lender | Example |

|---|---|---|---|

| High-risk borrowers seek loans | Borrowers with poor credit history more likely to apply | Increased default rates and financial losses | A person with multiple past loan defaults applies for a new loan |

| Information asymmetry in loan applications | Borrowers know their true risk but lenders cannot perfectly assess | Lenders may approve loans to riskier borrowers unknowingly | An entrepreneur hides financial troubles when applying for business financing |

| Loan interest rate set uniformly | Good borrowers deterred by high rates; only risky borrowers apply | Loan portfolio quality deteriorates leading to higher default | Bank offers high-interest loans, attracting only subprime borrowers |

| Lack of collateral requirements | Riskier borrowers willing to take loans without collateral | Increased potential losses due to difficulty recovering funds | Unsecured personal loans granted to applicants with unstable income |

Understanding Adverse Selection in Loan Markets

Adverse selection in loan markets occurs when lenders cannot accurately assess the risk level of borrowers, leading high-risk individuals to seek loans more aggressively than low-risk borrowers. This information asymmetry causes lenders to potentially extend credit to applicants with a higher likelihood of default, increasing overall financial instability. Effective screening mechanisms and credit scoring models are essential tools for mitigating adverse selection and ensuring loan market efficiency.

Classic Real-World Examples of Loan Adverse Selection

High-risk borrowers are more likely to apply for loans due to limited access to alternative financing, creating a classic example of adverse selection in the loan market. Banks face difficulty distinguishing between low-risk and high-risk clients, often resulting in higher default rates and increased interest rates for all borrowers. This information asymmetry leads to inefficient credit allocation and potential financial instability within lending institutions.

How Adverse Selection Impacts Loan Approval Processes

Adverse selection in loan approval processes occurs when borrowers with higher risk are more likely to apply for loans, making it difficult for lenders to distinguish between low-risk and high-risk applicants. This asymmetry of information leads to increased default rates and higher interest rates to compensate for potential losses. Consequently, banks implement stricter screening criteria and risk-based pricing models to mitigate the adverse effects on loan portfolios.

Borrower Risk and Information Asymmetry in Lending

Adverse selection in lending occurs when borrowers possess private information about their risk levels that lenders cannot accurately assess, leading to higher loan defaults. High-risk borrowers are more likely to seek loans, while lenders struggle to differentiate them from low-risk borrowers due to information asymmetry. This imbalance results in inefficiencies such as increased interest rates or credit rationing, undermining overall loan market stability.

Case Study: Subprime Mortgages and Adverse Selection

Subprime mortgages serve as a prime example of adverse selection in the loan market, where lenders unintentionally attract higher-risk borrowers due to information asymmetry. These borrowers typically have poorer credit histories, leading to increased default rates and financial instability within lending institutions. The 2008 financial crisis highlights how adverse selection in subprime lending amplified systemic risk and contributed to widespread economic downturn.

Consequences of Adverse Selection for Financial Institutions

Adverse selection in loan markets occurs when financial institutions are unable to distinguish between high-risk and low-risk borrowers, leading to an increased likelihood of lending to borrowers who may default. This results in higher default rates, increased loan losses, and reduced profitability for banks and credit unions. To mitigate these risks, institutions often raise interest rates or tighten lending standards, which can further exclude creditworthy borrowers and reduce overall lending activity.

The Role of Credit Scoring in Reducing Adverse Selection

Credit scoring models analyze borrowers' financial history and repayment behavior to accurately assess credit risk, thereby minimizing adverse selection in loan markets. By providing lenders with quantitative risk evaluations, credit scoring helps differentiate high-risk applicants from low-risk ones, reducing the likelihood of issuing loans to individuals with poor creditworthiness. This risk-based screening enhances loan portfolio quality and improves overall financial stability within banking institutions.

Policy Measures to Prevent Adverse Selection in Loans

Lenders implement stringent credit scoring systems and require comprehensive borrower documentation to mitigate adverse selection in loan markets. Policy measures such as mandatory disclosure of credit history and use of collateral help align borrower risk profiles with loan terms. Regulatory frameworks enforcing transparency and borrower verification reduce information asymmetry, enhancing overall loan market efficiency.

Adverse Selection in Peer-to-Peer Lending Platforms

Adverse selection in peer-to-peer lending platforms occurs when borrowers with higher credit risk are more likely to seek loans, while safer borrowers are underrepresented, leading to an imbalance in borrower quality. This phenomenon increases default rates and forces platforms to raise interest rates or tighten lending criteria, affecting overall market efficiency. Data from LendingClub indicates that loan grades correlated with borrower risk significantly influence default probabilities and platform profitability.

Lessons from Adverse Selection for Future Lending Practices

Adverse selection in loan markets highlights the risk lenders face when borrowers with higher default probabilities are more likely to seek loans, leading to inefficiencies and losses. Lessons from these scenarios emphasize the importance of enhanced credit screening, borrower monitoring, and risk-based pricing models to mitigate asymmetrical information. Implementing advanced data analytics and machine learning algorithms improves the identification of creditworthy applicants, fostering more sustainable lending practices.

example of adverse selection in loan Infographic

samplerz.com

samplerz.com