Moral hazard in banking occurs when financial institutions take excessive risks because they believe they will be bailed out by the government or regulators if their actions lead to losses. An example is when banks engage in risky lending practices, such as approving subprime mortgages without proper credit checks, expecting that deposit insurance or emergency government support will cover potential defaults. This behavior distorts market discipline, as the bank's incentives are misaligned with the actual risk exposure. During the 2008 financial crisis, major banks exhibited moral hazard by heavily investing in mortgage-backed securities despite looming economic instability. The anticipation of government bailouts encouraged these institutions to prioritize short-term gains over long-term stability. Data shows that bailouts, including the Troubled Asset Relief Program (TARP), injected hundreds of billions of dollars into the banking sector, cushioning losses but also highlighting the consequences of moral hazard in financial markets.

Table of Comparison

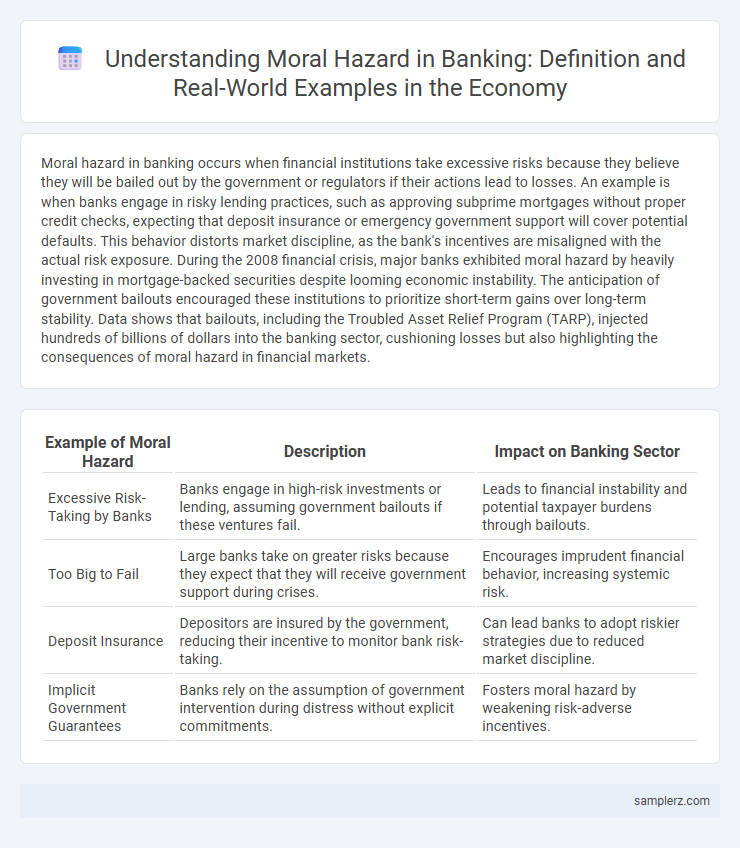

| Example of Moral Hazard | Description | Impact on Banking Sector |

|---|---|---|

| Excessive Risk-Taking by Banks | Banks engage in high-risk investments or lending, assuming government bailouts if these ventures fail. | Leads to financial instability and potential taxpayer burdens through bailouts. |

| Too Big to Fail | Large banks take on greater risks because they expect that they will receive government support during crises. | Encourages imprudent financial behavior, increasing systemic risk. |

| Deposit Insurance | Depositors are insured by the government, reducing their incentive to monitor bank risk-taking. | Can lead banks to adopt riskier strategies due to reduced market discipline. |

| Implicit Government Guarantees | Banks rely on the assumption of government intervention during distress without explicit commitments. | Fosters moral hazard by weakening risk-adverse incentives. |

Understanding Moral Hazard in the Banking Sector

Moral hazard in the banking sector arises when financial institutions engage in risky behavior, knowing they are protected by government bailouts or deposit insurance. This misalignment of incentives leads banks to prioritize short-term profits over long-term stability, increasing systemic risk within the economy. Regulatory frameworks like capital requirements and stress testing are essential to mitigate these dangers and promote prudent risk management.

Real-World Cases of Moral Hazard in Banks

The 2008 financial crisis exemplifies moral hazard in banking, where institutions like Lehman Brothers engaged in excessive risk-taking, assuming government bailouts would mitigate losses. Bear Stearns also faced moral hazard as it relied on short-term borrowing to fund risky assets, leading to its collapse and subsequent acquisition by JPMorgan Chase. These cases highlight how insufficiently regulated banks can exacerbate systemic risk through imprudent financial behavior driven by guaranteed safety nets.

Moral Hazard and the 2008 Financial Crisis

Moral hazard in banking was a key factor in the 2008 Financial Crisis, where financial institutions engaged in risky lending practices knowing they would be bailed out by the government. Banks issued subprime mortgages without proper risk assessment, driven by expectations of rescue if losses occurred. This behavior amplified systemic risk, leading to widespread financial instability and the collapse of major institutions like Lehman Brothers.

Bailouts: Encouraging Risky Behavior in Banking

Bailouts in banking create moral hazard by insulating financial institutions from the consequences of risky behavior, leading banks to engage in high-risk investments without fearing losses. The 2008 financial crisis highlighted how government interventions to rescue failing banks encouraged excessive risk-taking in the years before the collapse. This cycle undermines market discipline and increases systemic risk within the financial sector.

Subprime Lending as a Classic Moral Hazard Example

Subprime lending exemplifies moral hazard in banking by encouraging lenders to issue high-risk loans due to expectations of government bailouts or securitization. These risky loans often lead to higher default rates, causing significant financial instability and losses for taxpayers. The 2008 financial crisis highlighted the systemic risks posed by moral hazard in subprime mortgage markets.

Deposit Insurance and Its Role in Moral Hazard

Deposit insurance guarantees bank deposits up to a certain limit, encouraging customer confidence but also fostering moral hazard by reducing depositors' incentive to monitor banks' risk-taking behaviors. Banks may engage in riskier lending or investment practices, knowing that insured deposits shield their customers from losses, potentially leading to increased financial instability. This misalignment of risk and responsibility highlights the trade-off between protecting individual savers and promoting prudent banking practices.

Securitization Practices Leading to Moral Hazard

Securitization practices in banking often lead to moral hazard as lenders transfer loan risks to investors, reducing their incentive to thoroughly assess borrower creditworthiness. This detachment from default consequences encourages riskier lending behaviors, ultimately increasing systemic vulnerability. The 2008 financial crisis exemplified how securitized mortgage-backed securities propagated widespread defaults and financial instability.

Executive Compensation and Moral Hazard in Banks

Executive compensation structures in banks often incentivize excessive risk-taking, creating moral hazard by aligning managers' rewards with short-term profits rather than long-term stability. Large bonuses tied to risky investments encourage executives to prioritize personal gain over the bank's financial health and depositor security. This misalignment can lead to increased systemic risk, as observed during the 2008 financial crisis when irresponsible behaviors were fueled by such compensation schemes.

Regulatory Gaps Fueling Moral Hazard Risks

Regulatory gaps create significant vulnerabilities in banking by allowing institutions to engage in risky behaviors without sufficient oversight, exemplifying moral hazard. For instance, banks may increase leverage or invest in high-risk assets knowing that government bailouts are likely if their bets fail, as seen during the 2008 financial crisis. This regulatory inadequacy undermines market discipline and encourages reckless risk-taking, threatening financial stability.

Preventing Moral Hazard: Policy Solutions for Banks

Banks implement stricter capital requirements and leverage ratios to prevent moral hazard, ensuring financial institutions maintain sufficient buffers against risky behavior. Regulatory bodies enforce enhanced transparency and frequent stress testing to monitor banks' risk exposure and promote responsible lending practices. Deposit insurance schemes are carefully calibrated to protect consumers without encouraging reckless risk-taking by bank management.

example of moral hazard in banking Infographic

samplerz.com

samplerz.com