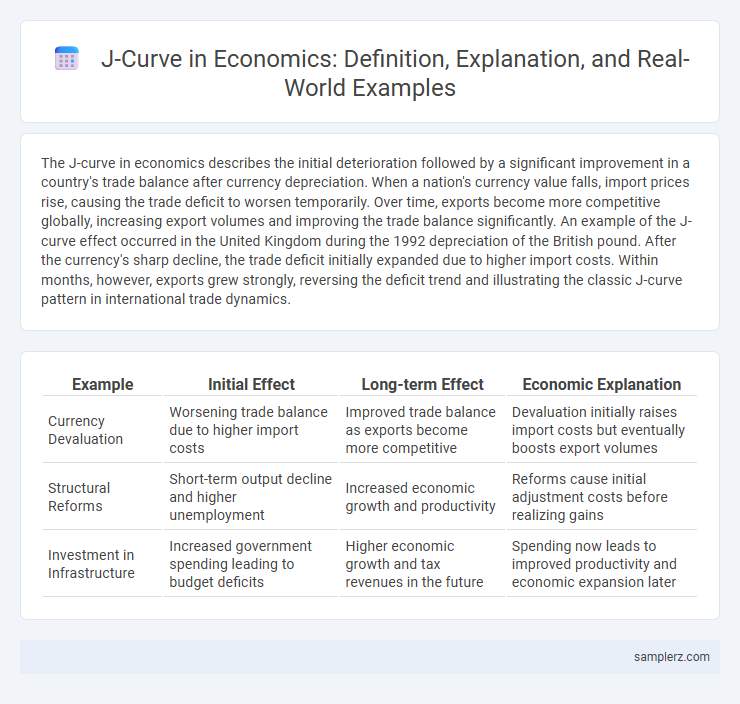

The J-curve in economics describes the initial deterioration followed by a significant improvement in a country's trade balance after currency depreciation. When a nation's currency value falls, import prices rise, causing the trade deficit to worsen temporarily. Over time, exports become more competitive globally, increasing export volumes and improving the trade balance significantly. An example of the J-curve effect occurred in the United Kingdom during the 1992 depreciation of the British pound. After the currency's sharp decline, the trade deficit initially expanded due to higher import costs. Within months, however, exports grew strongly, reversing the deficit trend and illustrating the classic J-curve pattern in international trade dynamics.

Table of Comparison

| Example | Initial Effect | Long-term Effect | Economic Explanation |

|---|---|---|---|

| Currency Devaluation | Worsening trade balance due to higher import costs | Improved trade balance as exports become more competitive | Devaluation initially raises import costs but eventually boosts export volumes |

| Structural Reforms | Short-term output decline and higher unemployment | Increased economic growth and productivity | Reforms cause initial adjustment costs before realizing gains |

| Investment in Infrastructure | Increased government spending leading to budget deficits | Higher economic growth and tax revenues in the future | Spending now leads to improved productivity and economic expansion later |

Understanding the J-Curve Concept in Economics

The J-curve in economics illustrates how a country's trade balance initially worsens following currency depreciation before improving as export volumes increase and import costs stabilize. This dynamic reflects short-term price effects combined with longer-term quantity adjustments in international trade. Understanding the J-curve helps policymakers anticipate the delayed benefits of monetary devaluation on trade deficits and economic recovery.

Historical Examples of the J-Curve Effect

The J-curve effect in economics is exemplified by the United Kingdom's experience after the 1949 devaluation of the British pound, where the trade balance initially worsened before improving significantly over time. Another historical instance occurred in Turkey during the 2001 currency crisis, where the lira depreciation caused a short-term trade deficit followed by a steady recovery and export growth. These cases illustrate how exchange rate adjustments can lead to an initial economic downturn before yielding positive trade outcomes.

The J-Curve in Currency Devaluation

The J-curve in currency devaluation illustrates how a country's trade balance initially worsens following a depreciation of its currency before improving over time. As the domestic currency weakens, import costs rise, causing a temporary trade deficit, but exports become cheaper and more competitive internationally, eventually boosting export volumes. This delayed positive effect reflects the time it takes for contracts to adjust and for demand elasticity to influence trade flows.

Trade Balance Adjustments: A J-Curve Perspective

Trade balance adjustments often exhibit a J-curve effect where a country's trade deficit initially worsens following a currency depreciation before gradually improving as export volumes increase and import demand decreases. This phenomenon is observable in emerging markets experiencing exchange rate shocks, where short-term contract rigidities and pricing inertia delay the positive impact of cheaper exports. Over time, improved trade competitiveness leads to a recovery of the trade balance, illustrating the dynamic response captured by the J-curve framework in international economics.

Real-World Case: UK’s Pound Sterling Devaluation

The UK's pound sterling devaluation in 1992 exemplifies the J-curve effect, where the initial depreciation led to a worsening trade balance due to higher import costs. Over time, export volumes increased as British goods became more competitively priced, improving the trade deficit and economic growth. This case highlights the delayed positive impact of currency devaluation on a country's balance of payments and overall economy.

Emerging Markets and the J-Curve Phenomenon

Emerging markets often experience the J-curve phenomenon when currency devaluation initially worsens their trade balance due to higher costs of imports and existing debt obligations. Over time, improved export competitiveness and increased foreign investment lead to a recovery and surplus in the trade balance, illustrating the characteristic upward curve. Countries like Turkey and Brazil have demonstrated this pattern, where short-term economic hardship transforms into long-term growth following currency adjustments.

Oil Price Shocks and J-Curve Dynamics

Oil price shocks often trigger J-curve dynamics in economies heavily reliant on petroleum imports, where initial trade deficits worsen due to higher import costs before improving as exchange rates adjust and export competitiveness increases. The short-term negative impact on the trade balance is followed by a gradual recovery as domestic industries adapt and global demand responds to new price levels. Historical episodes, such as the 1970s oil crises, exemplify this pattern, highlighting the delayed positive effects on economic performance despite immediate adverse shocks.

Policy Reforms and J-Curve Responses

Policy reforms such as currency devaluation often trigger a J-curve effect, where a country's trade balance initially worsens before improving as export competitiveness strengthens. This phenomenon occurs because import costs rise immediately while export volume and market adjustments take time to respond positively. Over time, the trade deficit decreases, reflecting the delayed benefits of policy-induced economic realignment.

Short-Term vs Long-Term Economic Effects of the J-Curve

The J-curve illustrates how a country's trade balance initially worsens following a currency depreciation due to higher import costs before improving as export volumes increase over time. In the short term, the price effect dominates, causing a deficit spike, while in the long term, the volume effect drives a trade balance recovery and economic growth. This dynamic emphasizes the temporal disparity between immediate negative impacts and delayed positive outcomes in exchange rate adjustments.

Implications of the J-Curve for Economic Policymaking

The J-Curve effect illustrates how a country's trade balance initially deteriorates after currency depreciation before improving, emphasizing the importance of timing in economic policy responses. Policymakers must anticipate short-term trade deficits and focus on structural reforms and export competitiveness to realize long-term gains. Understanding the J-Curve dynamic aids in designing interventions that balance immediate economic challenges with sustainable growth objectives.

example of J-curve in economy Infographic

samplerz.com

samplerz.com