Kinked demand in an oligopoly occurs when a firm's demand curve has a distinct bend due to competitors' reactions to price changes. For example, if a leading smartphone manufacturer lowers its prices, rivals typically match the reduction to maintain market share, creating a relatively inelastic demand below the kink. Conversely, if the same firm raises prices, competitors often keep theirs stable, causing a more elastic demand above the kink. This pricing behavior results in a demand curve where firms face minimal incentive to change prices, stabilizing market dynamics in oligopolistic industries such as automotive or telecommunications. Data from the U.S. automobile market show firms like Ford and General Motors maintaining steady prices despite small cost fluctuations, consistent with the kinked demand model. The kinked demand theory explains price rigidity even amidst varying production costs or shifts in consumer preferences.

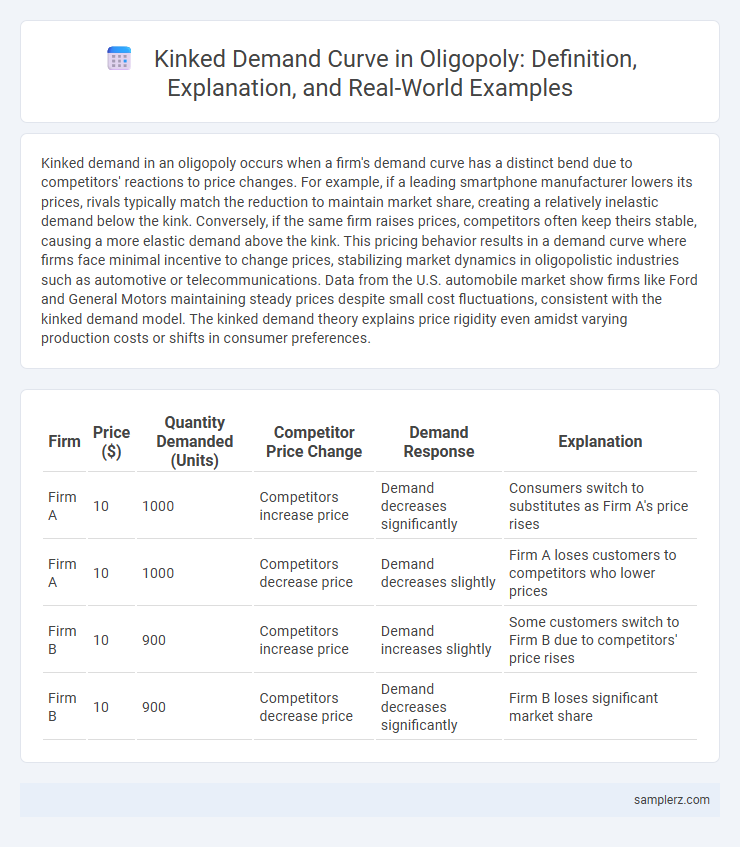

Table of Comparison

| Firm | Price ($) | Quantity Demanded (Units) | Competitor Price Change | Demand Response | Explanation |

|---|---|---|---|---|---|

| Firm A | 10 | 1000 | Competitors increase price | Demand decreases significantly | Consumers switch to substitutes as Firm A's price rises |

| Firm A | 10 | 1000 | Competitors decrease price | Demand decreases slightly | Firm A loses customers to competitors who lower prices |

| Firm B | 10 | 900 | Competitors increase price | Demand increases slightly | Some customers switch to Firm B due to competitors' price rises |

| Firm B | 10 | 900 | Competitors decrease price | Demand decreases significantly | Firm B loses significant market share |

Understanding the Kinked Demand Curve in Oligopoly

The kinked demand curve in oligopoly illustrates how firms face a dual-price sensitivity: demand is elastic above the current price due to rival firms not following price increases, and inelastic below the current price because competitors match price cuts. This results in a price rigidity where firms avoid changing prices to prevent losing market share or profit margins. Major industries like airlines and telecommunications often exhibit this kinked demand behavior, reinforcing the strategic interdependence characteristic of oligopolistic markets.

Classic Examples of Kinked Demand in Oligopolistic Markets

Classic examples of kinked demand in oligopolistic markets include the automobile industry and the airline sector, where firms face a demand curve that is more elastic for price increases and less elastic for price decreases. In such industries, companies hesitate to change prices due to the anticipated asymmetric reaction of competitors, resulting in price rigidity. This pricing behavior reinforces the kinked demand curve theory, where firms maintain stable prices despite fluctuations in costs or demand.

Price Rigidity: Real-World Kinked Demand Scenarios

In oligopolistic markets, price rigidity exemplifies the kinked demand curve where firms face a different elasticity for price increases versus price decreases. For example, in the airline industry, carriers often maintain stable ticket prices because raising prices leads to significant loss of customers to competitors, while lowering prices results in minimal market share gain, reinforcing rigid pricing. This strategic interdependence contributes to the persistence of stable prices despite fluctuations in costs or demand.

Case Study: Automobile Industry and Kinked Demand

The automobile industry exemplifies kinked demand in oligopoly where firms face a price rigidity due to asymmetric reactions from competitors: if a company raises prices, rivals may not follow, leading to loss of market share, while price cuts prompt immediate retaliation, causing price wars. Major players like Toyota, Ford, and Volkswagen maintain stable pricing strategies aligned with this kinked demand curve to avoid volatile profit margins. This behavior results in a price range where demand is inelastic above the current price and elastic below, reinforcing competition without aggressive price changes.

Kinked Demand in Telecom Oligopolies

Kinked demand in telecom oligopolies occurs when firms face a demand curve that is highly elastic for price increases but inelastic for price decreases, leading to price rigidity despite changes in costs. Major telecom companies like AT&T, Verizon, and T-Mobile maintain stable pricing strategies, fearing that raising prices will lose customers to competitors, while cutting prices will prompt retaliatory price drops, eroding profits. This kinked demand structure results in limited price competition and emphasizes non-price competition such as network quality and service innovation.

How Gasoline Markets Exhibit Kinked Demand Behavior

Gasoline markets in oligopolistic structures exhibit kinked demand behavior due to the rigid pricing strategies of major producers like ExxonMobil, Shell, and BP, who avoid price wars by maintaining stable prices. When one firm lowers prices, competitors quickly follow to protect market share, causing demand to be highly elastic below the current price but inelastic above it. This leads to a demand curve with a distinct kink, reflecting the asymmetric response of consumers and rivals to price changes in the gasoline industry.

The Role of Interdependence in Kinked Demand Curves

In oligopoly markets, the kinked demand curve illustrates firms' interdependence, where a price increase by one firm leads competitors to maintain prices, causing a significant loss in demand, while a price decrease prompts rivals to match cuts, resulting in only a small gain in demand. This interdependent behavior creates a kink at the current market price, making the demand curve more elastic above the kink and less elastic below it. The role of interdependence in kinked demand curves stabilizes prices within oligopolistic industries such as airlines and telecommunications, where firms are reluctant to change prices aggressively.

Airline Industry Pricing: An Illustration of Kinked Demand

In the airline industry, kinked demand is evident when carriers face a rigid fare structure, where lowering ticket prices leads to minimal gains in market share due to matched price cuts by competitors, while raising prices results in significant loss of customers. This pricing strategy creates a kink in the demand curve because airlines anticipate rival responses, causing price stability despite fluctuating costs. The oligopolistic nature of the industry, marked by a few dominant airlines, reinforces this kinked demand phenomenon as firms prioritize strategic interdependence over aggressive price competition.

Practical Implications of Kinked Demand for Oligopoly Firms

Kinked demand in oligopoly implies firms face a demand curve that is more elastic for price increases and less elastic for price decreases, leading to price rigidity in the market. This results in firms being reluctant to change prices, as raising prices may cause a significant loss of customers, while lowering prices may not substantially increase market share, impacting profit stability. Consequently, oligopoly firms often compete through non-price strategies such as advertising and product differentiation to maintain market position without triggering price wars.

Consumer Impact: Price Stability from Kinked Demand Curve

The kinked demand curve in an oligopoly leads to price stability, as firms are reluctant to change prices fearing loss of market share to rivals, resulting in minimal price fluctuations for consumers. Consumers benefit from predictable prices despite underlying cost changes, reducing uncertainty in purchasing decisions. This price rigidity often limits the intensity of price wars, fostering a stable market environment but potentially suppressing competitive discounts.

example of kinked demand in oligopoly Infographic

samplerz.com

samplerz.com