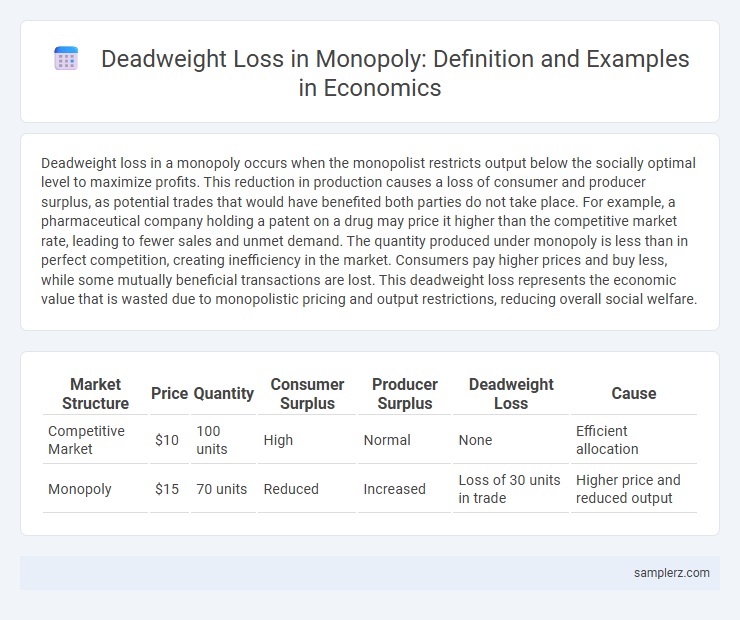

Deadweight loss in a monopoly occurs when the monopolist restricts output below the socially optimal level to maximize profits. This reduction in production causes a loss of consumer and producer surplus, as potential trades that would have benefited both parties do not take place. For example, a pharmaceutical company holding a patent on a drug may price it higher than the competitive market rate, leading to fewer sales and unmet demand. The quantity produced under monopoly is less than in perfect competition, creating inefficiency in the market. Consumers pay higher prices and buy less, while some mutually beneficial transactions are lost. This deadweight loss represents the economic value that is wasted due to monopolistic pricing and output restrictions, reducing overall social welfare.

Table of Comparison

| Market Structure | Price | Quantity | Consumer Surplus | Producer Surplus | Deadweight Loss | Cause |

|---|---|---|---|---|---|---|

| Competitive Market | $10 | 100 units | High | Normal | None | Efficient allocation |

| Monopoly | $15 | 70 units | Reduced | Increased | Loss of 30 units in trade | Higher price and reduced output |

Understanding Deadweight Loss in Monopoly Structures

Deadweight loss in monopoly occurs when the monopolist restricts output below the socially optimal level to maximize profits, resulting in lost consumer and producer surplus. This inefficiency arises because the price charged exceeds marginal cost, causing a reduction in consumer purchases and overall market welfare. An example is a patented drug manufacturer setting high prices, limiting access and creating deadweight loss in the pharmaceutical market.

Classic Examples of Monopoly-Induced Deadweight Loss

Monopoly-induced deadweight loss arises when a single firm restricts output below the socially optimal level to maximize profits, leading to allocative inefficiency. Classic examples include utility companies like electricity providers that set prices above marginal cost, causing consumers to reduce consumption and resulting in lost welfare. This inefficiency manifests as a loss of consumer surplus not offset by producer gains, creating a net loss to society.

Pharmaceutical Patents: A Case of Deadweight Loss

Pharmaceutical patents create a monopoly by granting exclusive rights to drug manufacturers, leading to higher prices and reduced output compared to competitive markets. This pricing power results in deadweight loss by limiting access to essential medications, reducing consumer surplus, and causing inefficiencies in resource allocation. Studies estimate that monopoly pricing under pharmaceutical patents can decrease overall social welfare by restricting the quantity of life-saving drugs supplied below optimal levels.

Utility Companies and Market Inefficiencies

Deadweight loss in monopoly arises when utility companies, such as electricity providers, restrict output below the socially optimal level to maximize profits, leading to higher prices and reduced consumer surplus. This market inefficiency results in allocative inefficiency, where the marginal cost of production is lower than the price charged, causing a loss in total welfare. The consequence is underconsumption of essential utilities, harming both consumers and overall economic efficiency.

Deadweight Loss from Internet Service Provider Monopolies

Internet service provider monopolies create deadweight loss by restricting output below competitive levels and charging higher prices, which reduces consumer surplus and overall economic efficiency. The lack of competition leads to under-provision of internet services, limiting access for price-sensitive consumers and causing a misallocation of resources. Studies show that these monopolistic practices can decrease total welfare significantly by creating gaps between consumer willingness to pay and monopolist pricing strategies.

Impact of Intellectual Property on Consumer Surplus

Monopolies driven by stringent intellectual property rights often reduce consumer surplus by limiting market competition and maintaining higher prices. The deadweight loss in this scenario arises as consumers face restricted access to innovative products, leading to decreased overall welfare and market inefficiency. Studies show that patent monopolies in pharmaceuticals can significantly elevate prices, severely diminishing consumer surplus and generating substantial deadweight loss.

Deadweight Loss in Cable Television Markets

Deadweight loss in cable television markets occurs when monopolistic providers restrict output to raise prices above competitive levels, leading to inefficient allocation of resources. Consumers face higher subscription fees and limited choices, reducing overall consumer surplus and market welfare. This inefficiency results in lost potential gains from trade that would benefit both producers and consumers in a more competitive environment.

The Role of Regulatory Capture in Monopoly Inefficiency

Regulatory capture occurs when monopolistic firms influence regulatory agencies to enact policies that protect their market dominance, leading to higher prices and reduced output. This manipulation results in deadweight loss by preventing competitive forces from lowering costs and improving product quality. Economic inefficiency manifests as consumers pay inflated prices while the overall welfare of society diminishes due to restricted market access and innovation.

Historical Cases: Standard Oil and Deadweight Loss

Standard Oil's monopoly in the late 19th century exemplified deadweight loss by restricting output to maximize profits, resulting in higher prices and reduced consumer surplus. The firm's dominance eliminated competition, causing inefficiencies and a loss of total welfare in the oil market. Government antitrust actions eventually dismantled Standard Oil, aiming to restore market balance and reduce deadweight loss.

Policy Solutions to Reduce Monopoly-Driven Deadweight Loss

Price regulation policies, such as imposing price ceilings, can effectively reduce monopoly-driven deadweight loss by forcing prices closer to competitive levels, increasing consumer surplus and overall welfare. Antitrust laws that prevent monopolistic mergers and promote market entry enhance competition, thereby minimizing inefficiencies caused by monopolies. Encouraging innovation and reducing barriers to entry through subsidies or deregulation also help in mitigating deadweight loss by fostering a more competitive marketplace.

example of deadweight loss in monopoly Infographic

samplerz.com

samplerz.com